The HDB resale market received a boost in 1Q 2024 as the first group of private residential owners affected by the 15-month wait-out period began purchasing HDB properties after exiting the restriction.

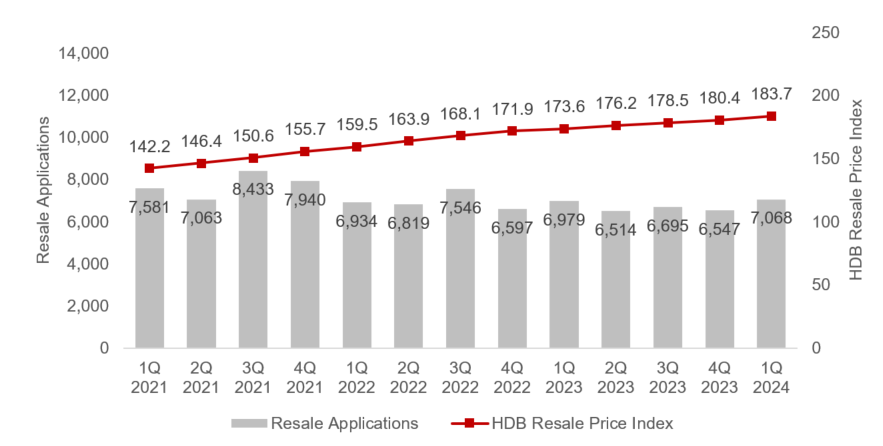

HDB Resale Price Index and Transaction Volume

The HDB Resale Price Index (RPI) reached 183.7 in 1Q 2024, growing by 1.8% quarter-on-quarter (q-o-q). This marked the 16th consecutive quarter of price growth and is the steepest q-o-q price growth seen since 4Q 2022 (2.3% q-o-q).

Chart 1: HDB Resale Price Index versus Resale Applications

Source: HDB, ERA Research and Market Intelligence

HDB transaction volume reached 7,068 units in 1Q 2024 reporting a 8.0% q-o-q and 1.3% y-o-y growth. The resale transaction volume is also the highest seen since 3Q 2022. HDB implemented a 15-month wait-out period for private residential owners who want to downgrade to HDB flats in September 2022. The 15-month wait-out period was introduced in Sept 2022 to help moderate demand for resale flats.

Despite the festivities in the 1Q 2024, the HDB resale market received a boost from the first group of private residential owners that have exited the 15-month wait-out period and begun purchasing HDB properties.

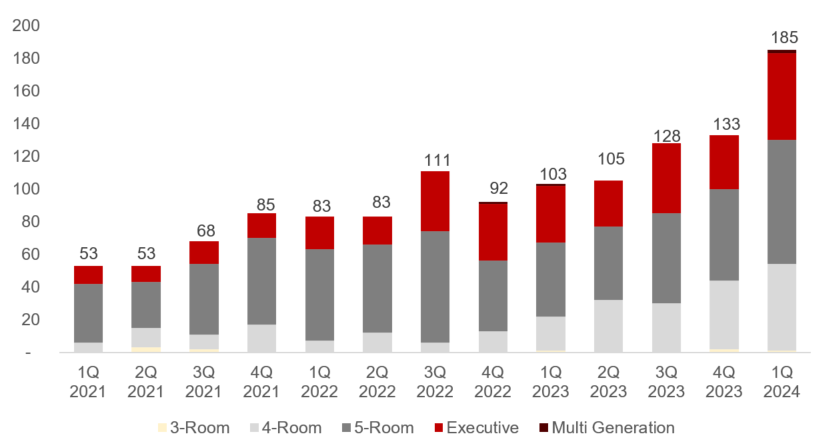

More HDB million-dollar flats transacted

A total of 185 million-dollar HDB flats were transacted in 1Q 2024, marking a 39.1% q-o-q growth. The higher number of million-dollar HDB flats can be largely attributed to private property owners who have recently exited their 15-month wait-out period and have recently purchased HDB resale flats.

Chart 2: HDB million-dollar flats by flat type

Source: data.gov.sg, HDB, ERA Research and Market Intelligence

Among the estates, Toa Payoh (26 units) saw the highest number of million-dollar flat transactions. This is followed by Kallang/Whampoa (22 units), and Bukit Merah (21 units). More than half of the HDB million-dollar flats are 15 years and below.

HDB launched 5,714 flats in Feb 2024 Build-To-Order and Sale of Balance Flats Exercises

Among which the 4,126 Build-To-Order (BTO) flats were offered across seven new BTO projects in Bedok, Choa Chu Kang, Hougang, Punggol, Queenstown, and Woodlands. Five out of the seven BTO projects, or over 80% of the BTO flats launched, have a waiting time of less than 3 and a half years. Another 1,588 Sale of Balance Flats (SBF) units, located across various estates were offered for sale.

Moreover, from 2024, there will only be one SBF exercise a year, in February. Those who are unsuccessful in their applications may and are unable to wait may look to the resale market instead. They may wait for the June and October 2024 BTO projects to be announced first before making a decision.

In June 2024, HDB will offer about 6,800 BTO flats in Jurong East, Kallang/Whampoa, Queenstown, Tampines, Woodlands, and Yishun. This will be the last batch of BTO flats that are unaffected by the upcoming reclassification framework.

Generally strong demand expected but resale flats in mature estates will see steeper price growth

ERA expected demand for HDB resale flats to hold firm, particularly for resale flats located in proximity to amenities and transport nodes. Existing resale flats, which are not affected by the more stringent resale conditions set for the upcoming Prime and Plus flats, will also be popular among buyers.

Even though the HDB resale market could see moderate price growth, mature estates could see steeper price growth in the short term. This is in anticipation of a moderate supply of resale units being offered for sale with the diminishing supply of MOP units. Additionally, the elevated interest rate situation and higher cost of replacement homes may have delayed some HDB owners’ upgrading plans. Supported by strong demand, resale homes in mature estate could see steeper price growth.

The June BTO exercise is expected to be well-received by prospective buyers, as it will be the last batch of BTO flats unaffected by the upcoming reclassification framework. Coupled with the June school holidays, this could lead to a slight dip in resale demand in the second quarter of 2024.

Barring any unforeseen circumstances, ERA estimates that the total resale transaction volume could reach between 26,000 and 27,000 units in 2024, with resale prices expected to rise by a more muted 3% to 5% range by the end of the year.