The tender for the Government Land Sale (GLS) parcel at Lakeside Drive closed today on 03 June 2025. It drew strong developer interest, with six bidders participating in a highly competitive round. CDL Polaris Properties Pte. Ltd. and CDL Polaris Commercial Pte. Ltd. emerged with the highest bid of $608 million ($1,132 psf ppr), edging out the next highest bidder by 10.4%.

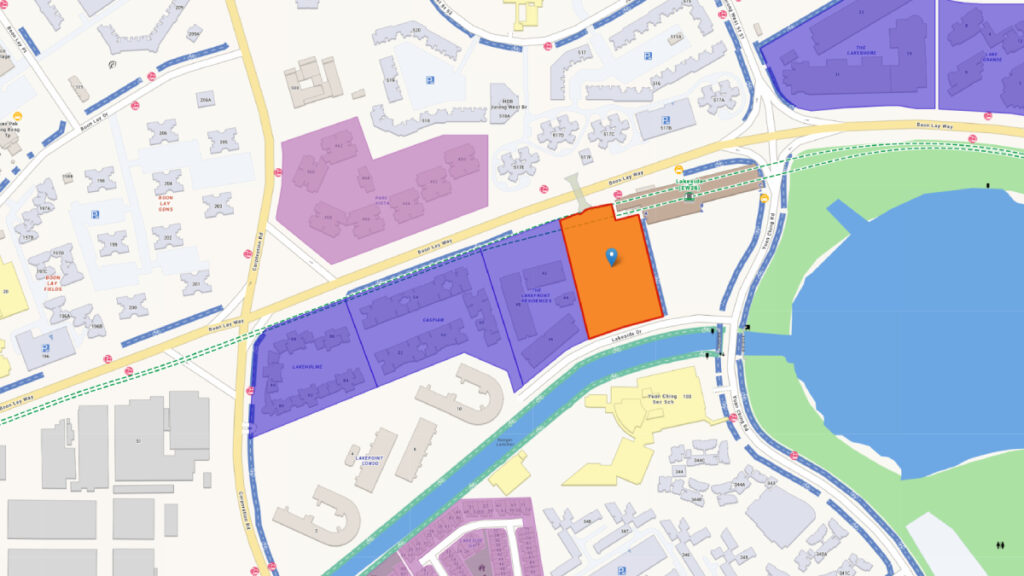

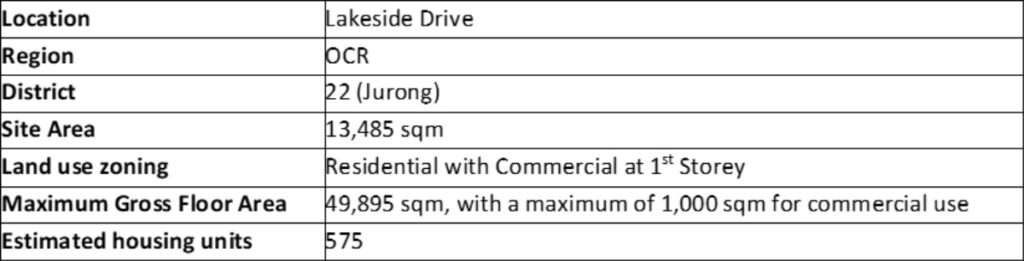

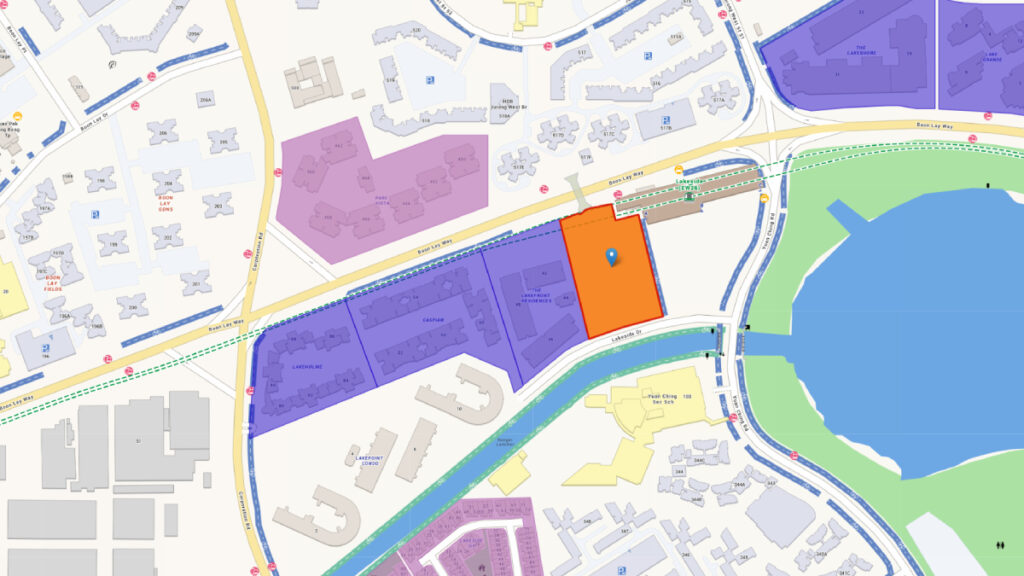

Table 1: Details of the GLS site

Locational Attributes

The site will include a maximum of 1,000 sqm of commercial space, which must include a supermarket of at least 700 sqm. This commercial space shall be held under a single strata lot.

Moreover, in line with Singapore’s vision for a car-lite society, sites located near MRT stations will be subjected to more stringent parking restrictions. As the site is located next to the Lakeside MRT station, the developer will have to provide car parking provision at the lower bound of LTA’s Range-based Parking Provision Standards (RPPS).

Neighbourhood amenities

In terms of shopping, dining and entertainment options, future residents can choose between visiting Jurong Point (near Boon Lay MRT) or Westgate and Jem (near Jurong East MRT). Depending on the nature of businesses taking root, ground-floor commercial units at the site’s own future development could provide some degree of retail convenience for to-be residents as well.

Nature lovers may also find the site’s location appealing due to its proximity to Jurong Lake Gardens. This urban green lung encompasses the recently-renovated Chinese and Japanese Gardens, on top of various cycling paths, play areas, and even an eclectic mix of F&B options.

As for educational opportunities, primary schools that could possibly fall within a 1km radius of the site include Lakeside Primary School, Shuqun Primary School, and Rulang Primary School. Just 13 minutes away from the site, the Canadian International School may prove appealing to expat families seeking premium education; this in turn raises the possibility of rental demand from foreigners who are keen on living nearby.

Connectivity

Nestled along Boon Lay Way in a condominium enclave, the Lakeside Drive site is just steps away from Lakeside MRT station. This closeness ensures ready access to key interchange stops on the East-West Line (EWL), allowing for easy transfers to the North-South Line and Circle Line via Jurong East station (two stops away) and Buona Vista station (five stops away) respectively.

The future Jurong Regional Line (JRL) will also be completed in phases between 2027 and 2029 to improve connectivity in the west. Upon its completion in 2027, Phase 1 of the Jurong Region Line will also see the transformation of the nearby Boon Lay MRT station (one stop away) into an interchange station, linking it to the EWL.

Jurong Lake District

Heading south-east on Boon Lay Way, future residents will find themselves at the Jurong Lake District (JLD), a residential and commercial precinct of the West. Pitched as Singapore’s largest mixed-use business district outside the city centre, the JLD is set to be largest commercial district outside of the city core and it is anticipated to provide some 100,000 new jobs and 20,000 new homes over the course of its development in the next two to three decades. This will bring jobs closer to home

URA previously released a white site spanning three separate land parcels totalling 6.5ha at JLD in its land tender exercise. However, this mega-site was not awarded previously owing to the consortium’s bid deemed too low. It is now on the GLS Reserve List and developers can still place a bid. These plots are projected to yield 146,000 sqm of office space, 1,700 residential units, and roughly 73,000 sqm of commercial real estate for retail, food and beverage, entertainment and other uses.

In the long run, strategic developments like the above could enhance the appeal of residential properties both within and around the JLD. Hence, as the JLD evolves into a thriving live-work-learn-play hub, forward-thinking property buyers may see value in its newfound CBD status.

Price and Market Trends

Low demand from residents in nearby HDB towns due to lower resale prices

HDB upgraders from Jurong East and neighbouring towns of Jurong West and Bukit Batok are unlikely to make up the bulk of homebuyers. In 1Q 2025, the 4-room median transacted prices at these towns are $530,000, $538,000 and $595,000 respectively. In addition, there are few landed estates whereby landed owners could look to right-size to a non-landed home.

However, owners of older condominiums near Lakeside Drive such as Lakeholmz, Caspian and Lakefront Residences may consider moving to a newer development in the same locale. Those who want a fresh 99-year lease, a familiar environment and nearer an MRT station may consider this project in future. While the quantum of a similar sized new home is higher, households where the children have moved out can consider right-sizing to a smaller home with lower maintenance costs.

Demand could come from external towns

There is strong demand for homes in the OCR that are located near MRT stations and amenities. Buyers today value convenience and are willing to pay a premium for such homes. Even at new benchmark prices, such projects have performed well.

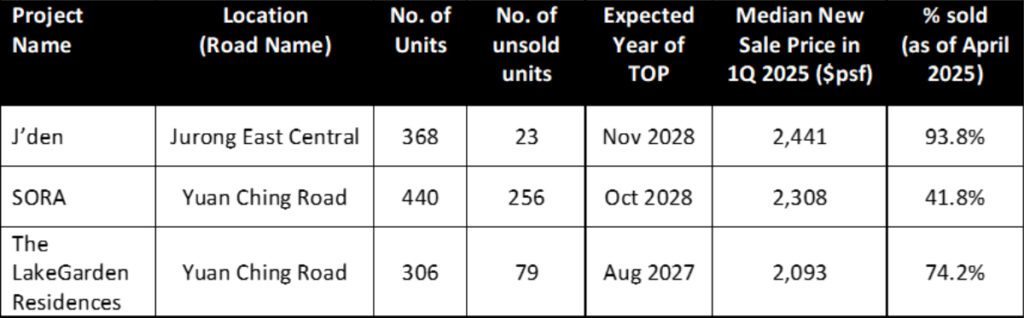

Table 2: OCR new launches located near MRT stations

We could see HDB upgraders from flats in Clementi, where there were 29 million-dollar flats transacted from January to April 2025. Clementi Station is just four MRT stops away from Lakeside Station.

Moreover, landed homeowners living in Clementi or Bukit Batok may also consider right-sizing to this Lakeside Drive project if they are looking for a new home in the west that is easily accessible by MRT.

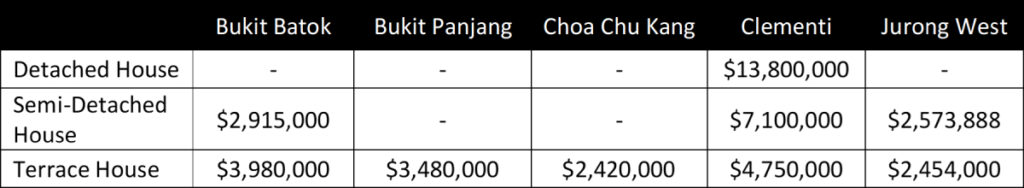

Table 3: Median Landed Home Prices in the West

Landed right-sizers would still have a sizeable surplus from their sales proceeds even after purchasing a new replacement home at Lakeside Drive. This could prove useful to unlock monies either for building a retirement nest egg, supporting their children’s housing aspirations or other lifestyle needs.

Comparable new launches

While recent District 22 launches such as J’den, SORA, and The LakeGarden Residences offer potential alternatives for the Lakeside Drive site, their distance from the vicinity of Lakeside Drive prevents direct parallels from being drawn. For instance, J’den is located within the heart of the JLD in Jurong East. In contrast, SORA and The LakeGarden Residences are located along Yuan Ching Road, significantly further away from an MRT station and a more remote part of Jurong Lake.

Table 4: Comparable new launches with available stock in District 22

Nonetheless, the sales trajectories of these developments warrant scrutiny. Within D22, The LakeGarden Residences has already surpassed the 75% sellout mark, while SORA is nearing this milestone as of early-April this year.

Hence, by the time of Lakeside Drive’s project launch, it is possible that these regional projects may have limited competing stock left. Should such a scenario emerge, this could prove beneficial for Lakeside Drive’s future development, both in terms of market positioning and unit mix availability.

Further adding to the site’s appeal is the fact that the Lakeside Drive parcel marks the first GLS site launched for sale in the Jurong West planning area since 2014’s Jurong West Street 41 (now Lake Grande. While there are new homes launched around Jurong Lake Gardens, they are still relatively further away from the MRT station. Hence, there may still be pent-up demand for new homes near Lakeside MRT Station, although prices will likely be higher.

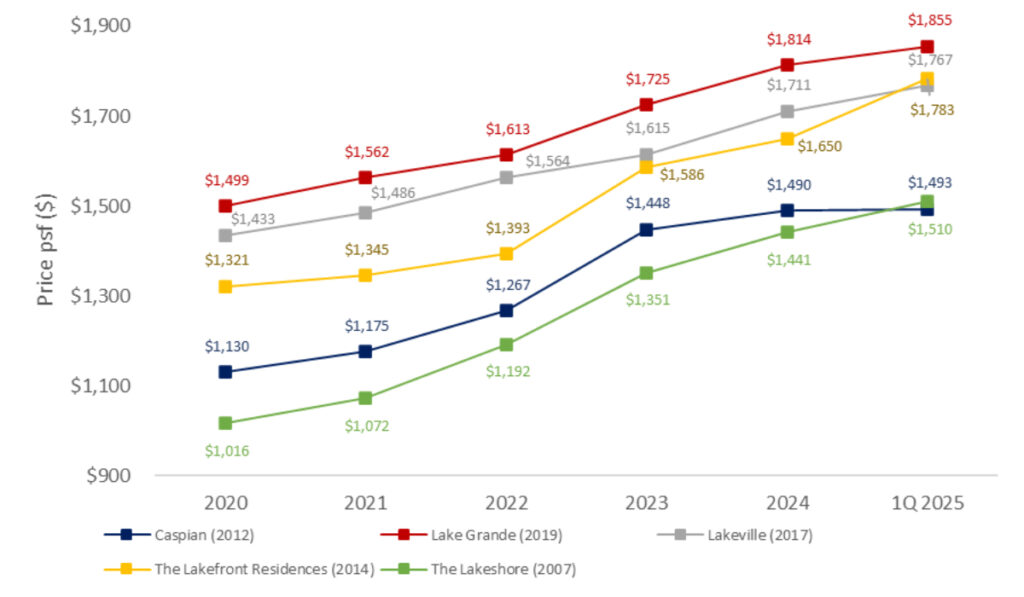

On a street level, neighbouring built developments sharing the same condominium enclave as Lakeside Drive have demonstrated strong price performance. Resale unit price data ($psf) from 2020 through 1Q 2025 reveals consistent growth across all nearby completed projects.

Chart 1: Median price psf for private condo developments near Lakeside Drive

Therefore, as per this price trend analysis, there is sufficient grounds to believe that the future development sited on the Lakeside Drive GLS site could also benefit from this demonstrated appreciation in time to come.

Conclusion

Despite challenges faced by global markets, Singapore’s residential market maintains a largely positive outlook for the foreseeable future. Over the years, Singapore has built a name for itself as a reputable wealth hub in the region, with local real estate being perceived as a quality asset offering stable rental yield for investors.

While some may argue that the high-profile money laundering case in 2023 has exposed vulnerabilities in Singapore’s financial oversight, the swift response by the Government reaffirms its strong stance and commitment to a zero-tolerance policy against the masking of illicit gains.

Separately, Singapore is experiencing a significant wave of wealth transfer. This is largely fuelled by an affluent middle class whose wealth base has been solidified by the rapid appreciation of their housing assets. With Singapore’s aging population, an acceleration in wealth transfer is to be expected. However, while this influx of capital will empower future generations financially, it could also widen the existing societal wealth gap.

With Singaporeans’ strong belief in real estate investment, much of the anticipated acceleration in wealth transfer will likely benefit this market. We already see this as older homeowners right-size to unlock housing equity for liquidity, and younger buyers receive parental support for property purchases. Accordingly, this influx of capital will sustain long-term demand and price appreciation across Singapore’s residential market.

At the same time, while ongoing trade tensions and potential recession risks pose threats to job security, the government’s sustained push for job creation and its support for reskilling initiatives have strengthened economic resilience and enhanced workforce adaptability. So long as employment rate remains healthy, it is likely to sustain housing demand in Singapore.

Against the backdrop of these market trends, the location of Lakeside Drive could prove to be a compelling opportunity for developers and homebuyers alike. This is considering the limited new launch options near MRT stations in the West. Moreover, buyers could be drawn to the future Jurong Lake District, which is slated to be the largest mixed-use district outside the city centre.

Additionally, the six bids for the site reflect a better-than-expected developer response, especially considering the calibrated interest shown for previous sites, excluding Bayshore. The future project at Lakeside Drive could also set new benchmark pricing for the Lakeside area, surpassing those of The LakeGarden Residences and Sora. Both projects were launched in 2024, and have achieved median prices of $2,134 psf and $2,216 psf as of present.

Due to Lakeside Drive coming under the harmonisation rule, as well as its proximity to Lakeside MRT station, launch prices could start from approximately $2,400 psf.