In 1H 2025, demand for luxury ($5 million and above) and ultra-luxury ($10 million and above) non-landed homes held resilient despite the heightened economic uncertainty.

This sustained interest reflects the strong holding power of these individuals, who typically purchase such properties not for speculation (i.e. flipping upon its completion), but for their own stay. They are drawn to these luxury homes by their lifestyle appeal and large living spaces. Freehold properties, in particular, are highly sought after by those focused on legacy planning, long-term capital preservation and a hedge against short-term volatility.

The luxury home segment had seen its glory days before being impacted by the increase in Additional Buyer’s Stamp Duty (ABSD) since 2023 and the high-profile money laundering cases. But more importantly, more buyers are seeking flight-to-safety opportunities in Singapore, given its reputation as an investor’s safe haven.

Separately, some sellers may have gradually adjusted their price expectations in response to softer market sentiment, partly influenced by mounting economic headwinds. As the economic uncertainty deepens, we may see so more motivated sellers to emerge, and buyers may be on the waiting on the sideline for favourable deals.

Singapore’s Safe Haven Appeal More Pronounced amid heighten uncertainty

Singapore’s position as a global financial hub, underpinned by a strong legal framework, continues to bolster its attractiveness amid economic uncertainty.

Even though Singapore is exposed to an open economy, its stable political landscape, and strong Singapore dollar enhances its appeal as a safe have in the region. Investors, both local and foreign, may have a flight-to-safety mindset. In times of economic uncertainties, these buyers have turned to safe-haven assets such as real estate for wealth preservation, in addition to finding a home. The relatively transparent property market, with reliable and accessible information and data has empowered investors to make informed decisions.

As a result, Singapore’s property market, has remained resilient and attractive, even in volatile global conditions, reinforcing its position as a preferred destination for long-term real estate investment.

Singapore is also distinct from other global cities, with its comprehensive infrastructure, from shopping malls and office spaces to its extensive public transport network and renowned education system. Its location and culture appeal to Asian buyers, and its status as a leading financial hub and English-speaking environment draw interest from Western investors alike. This continues to attract the well-heeled looking to settle down in Singapore.

Volume

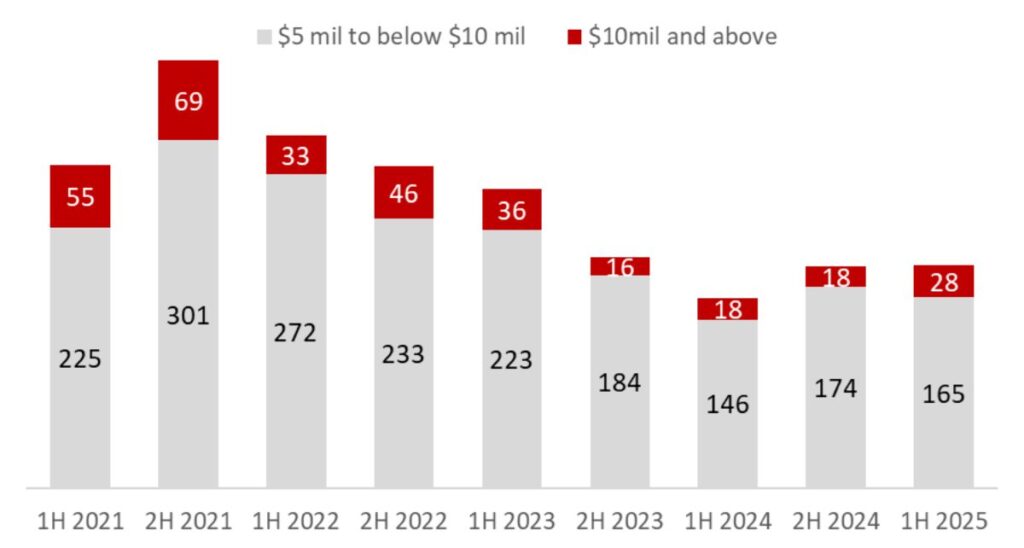

Based on URA caveats as of 17 June 2025, we have seen a total of 193 luxury non-landed homes, which includes 28 ultra-luxury non-landed homes in 1H 2025.

Of the 193 luxury non-landed home transactions, 56.5% of buyers are Singaporean buyers, while Singapore Permanent Residents (SPRs) and foreign buyers account for 35.8% and 7.8% of transactions respectively.

Chart 1: Number of luxury and ultra-luxury home transactions

Ultra-luxury Non-landed Homes

In 1H 2025 alone, there are 28 ultra luxury homes transacted till date, the highest recorded since 1H 2023.

Ultra-high-net-worth buyers seeking a home are typically drawn to homes with coveted addresses in Districts 9, 10 and 11. Apart from location, they seek out specific requirements, such as a preference for freehold units, large floor plates, and more bedrooms.

Some buyers were specifically looking for a new home as many of the older projects may not fully meet the requirements of these buyers. Such projects that has ticked all their boxes may have come into the market, including the launch of 21 Anderson in April 2025, prompting buyers to make their purchase.

Ultra-luxury condos in District 9, 10 and 11 with coveted addresses appeal to ultra-high net worth buyers, accounting 85.7% of condos above $10 million. They could be in exclusive housing precincts such as being in a Good Class Bungalow (GCB) area. The remaining three units are either in the CBD or in Sentosa Cove.

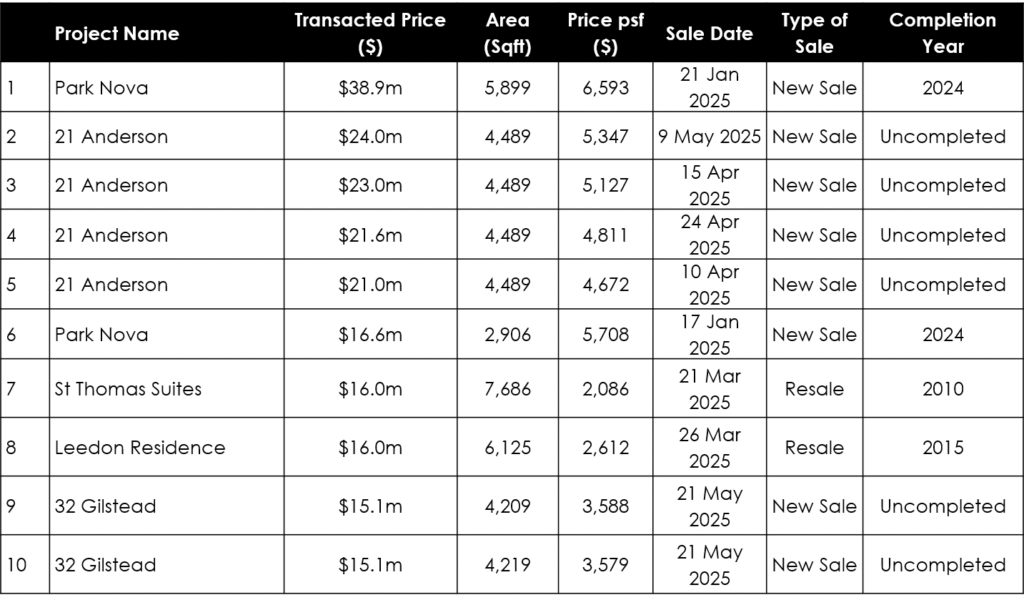

In January 2025, a 5,899 sq ft unit at Park Nova was transacted for $38.9 million, translating to $6,593 per square foot (psf). This marks the second-highest unit price achieved to date, trailing only the sale of a 3,089 sq ft unit at The Marq on Paterson Hill, which fetched $20.5 million ($6,650 psf).

Table 1: Top 10 Transactions of Non-Landed Homes

All ten of these transacted luxury homes are in Districts 10 or 11 and have a freehold tenure.

Profile of UHNW Buyers

Of the 28 transactions that took place in 1H 2025, 57.1% of them were made by Singapore PRs (SPRs), including a $38.9 million unit at Park Nova bought by a SPR from China. Singaporean buyers accounted for 25.0% of these transactions. Based on nationalities that were specified, there were 4 Chinese, 2 Indonesian and 2 Malaysian buyers.

More significantly, we have seen a notable increase in the number of SPRs purchasing ultra-luxury homes this year. Foreign buyers who are based in Singapore and have made significant economic contributions may have held off their purchases until they have been awarded their PR status.

The ABSD rate for foreigners is a hefty 60%, while PRs only pay 5% on their first residential property purchase. Hence, it is likely that some of these are newly minted PRs entering the market. With a large quantum, they can take advantage of the lower ABSD payable, which will be a sizable amount considering the quantum of the purchase.

Singapore Permanent Residents (SPRs) are generally not allowed to purchase landed homes unless they receive special approval, while foreigners are not permitted to buy landed property at all, except in Sentosa Cove where special approval is required.

While foreign demand has fallen since the doubling of ABSD on foreigners to 60% in April 2023, some ultra-high net worth foreigners have not been deterred by the higher tax and proceeded with their purchase when they have found a suitable home.

First Branded Residence to launch since 2019

Branded residences are luxury residential properties that are developed in collaboration with well-known brands, typically from the hospitality, fashion, automotive, or lifestyle industries. These brands bring prestige and are a status symbol. In Singapore, some well-known names include Pullman, The Ritz-Carlton and St Regis.

These properties combine private homeownership with high-end brand services, design, and prestige. UHNW buyers around the world have been drawn to such homes in recent years. Apart from the high-quality product with high-quality finishings, they are professionally managed and comes with a 24-hour concierge and housekeeping service. While they come with hefty price premiums, these UHNW buyers are unlikely to be deterred.

Presently, there are only five branded residences in Singapore, showcasing the scarce supply of homes available. The last branded residence launched in Singapore was Pullman Residences, located in Newton, in 2019.

Current Stock and Upcoming Launches

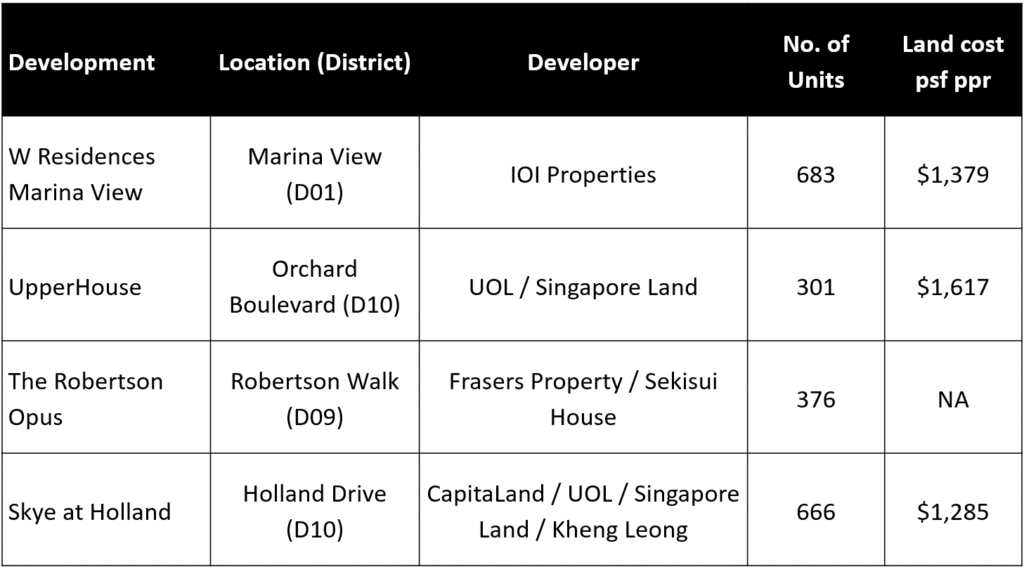

The second half of 2025 will see several launches located in prime areas. Larger units could be priced over $5 million, such as penthouses or those on the higher floors.

Apart from The Robertson Opus, which holds a 999-year leasehold tenure, the other developments are on 99-year leaseholds. Nonetheless, the larger units in these developments could be priced upwards of $5 million. W Residences Marina View, a branded residence, could have units priced above $10 million.

Table 2: List of Upcoming developments with luxury homes

Conclusion

To UHNW investors, buying a home is not merely for profits, but also for long-term wealth preservation, with a clear set of criteria and attributes in mind. Well-heeled buyers targeting luxury developments are more discerning, usually taking a longer time to deliberate their options. While they may have been exploring luxury properties for some time, there has been a gap in suitable offerings. Despite their strong interest, these buyers are often willing to wait until they find a suitable project that meets all their criteria.

Looking at the available stock in the market, the older projects in the prime areas may be large, but they might not have as many rooms which is a requirement for larger families. However, the following months will see several launches in the prime districts. These ultra-high net worth buyers who were waiting on the sidelines could seize the opportunity if they find a suitable property.

Depending on the project’s offerings in terms of unit mix and product range available, demand could be healthy. This would mean that prices are likely to remain stable, although volume is unlikely to increase significantly due to buyers’ affordability.

In the longer-term, buying activities is unlikely to ease. Singapore’s push to become a wealth hub, serving both portfolio and foreign direct investment flows will continue to attract family offices, financial institutions and tech firms to locate here. This will in turn continue to boost demand for luxury homes, especially if cooling measures are tweaked for foreign buyers.