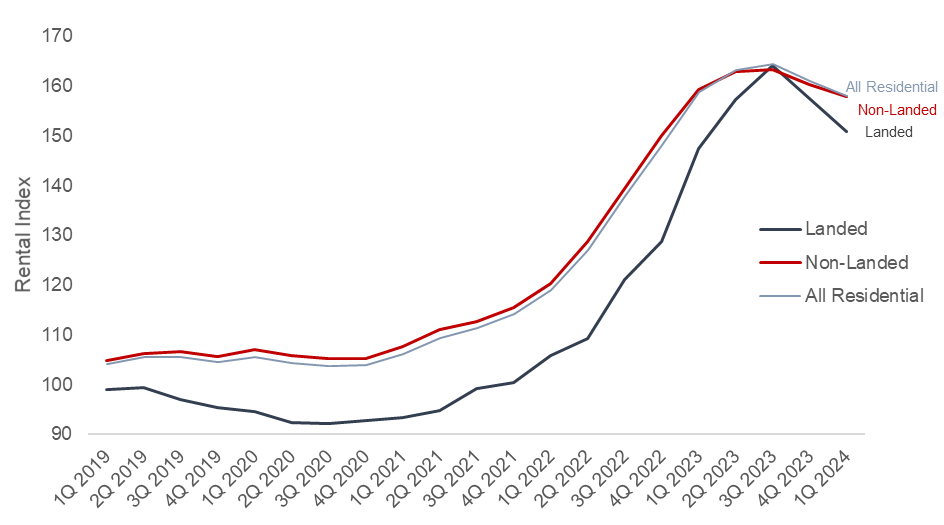

Rental Index

The rental index of All residential properties decreased by 1.9% quarter-on-quarter (q-o-q) and 0.6% to year-on-year (y-o-y) 157.9 in 1Q 2024. This marked the second consecutive quarter of decline.

The Landed property rental index decreased at a faster rate of 4.2% q-o-q compared to the Non-Landed property rental index, which decreased by 1.6% q-o-q.

The Non-Landed property rental indexes across all regions saw declines in 1Q 2024. Rents for Core Central Region (CCR) and Outside Central Region (OCR) dipped by 1.6% and 1.4% q-o-q respectively, while the Rest of Central Region (RCR) saw a more significant contraction of 1.9% q-o-q.

Chart 1: Private Residential Rental Indexes

Source: URA as of 17 May 2024, ERA Research and Market Intelligence

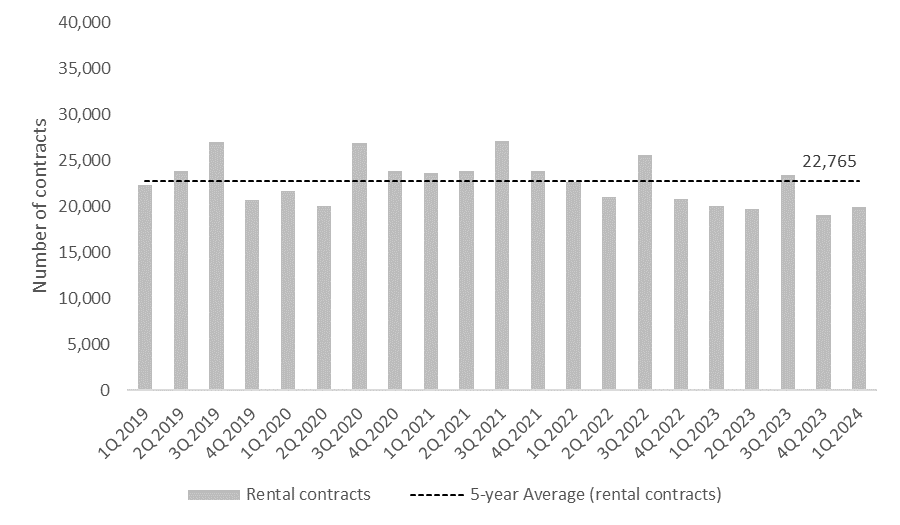

Rental Contracts

Total private rental contracts (landed and non-landed) island-wide rose 4.8% q-o-q to 19,954 in 1Q 2024, but were still 0.6% lower y-o-y and 12.9% lower than the 5-year average.

Chart 2: Private Residential Rental Contracts

Source: URA as of 17 May 2024, ERA Research and Market Intelligence

With another 8,616 private non-landed units expected to be completed in 2024, this could lead to an increased number of rental properties entering the market and further saturating the rental supply.

Some landlords, particularly those in the OCR, which saw a number of recently completed projects, may find it more challenging to secure a tenant with higher competition for tenants. Amid elevated interest rates, some landlords may have to compromise on lower rents rather than leave their units vacant, in order to cover their mortgage payment.

The higher rental occupancy cap, which has increased from 6 to 8 unrelated persons since January 2024, has also helped ease rental demand, particularly from corporate tenants. The change is welcomed by corporate tenants as it alleviates demand and helps manage rental expenses for companies.

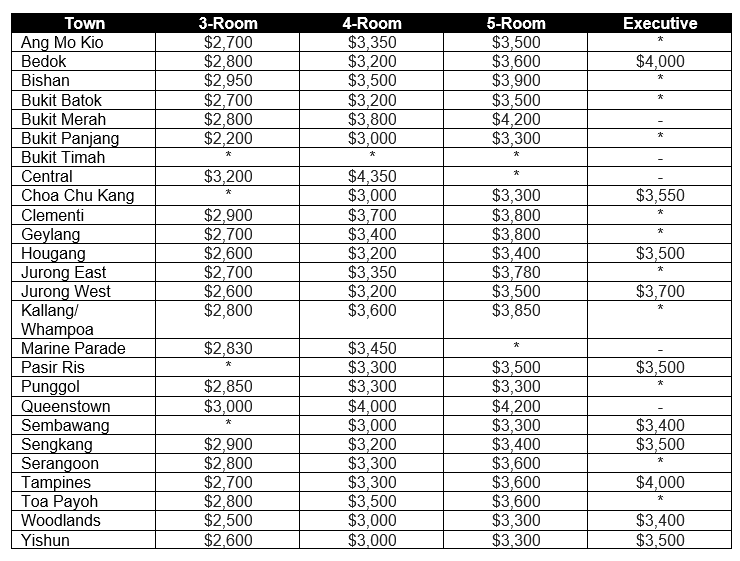

Lower HDB median rents across all towns for 3, 4 and 5-room flats

HDB rents have started to come off, with median rents across all flat types and towns falling by an average of 0.2% y-o-y. This fall was mitigated by a 2.6% increase in rents for Executive flats.

On average, HDB median rents across all towns for 3, 4 and 5-room flats have declined, led by 5-room flats rents falling by 1.0% y-o-y. The average HDB median rent for 3 and 4 room flats fell by 0.5% and 0.2% y-o-y respectively.

Table 1: HDB Median Rents in 1Q 2024

Source: HDB, ERA Research and Market Intelligence

However, median rents for executive flats rose 2.6% y-o-y on average. As the HDB hasn’t built any new executive flats since 2005, there is a limited supply of such properties in the market. Large families, and those accustomed to a larger living space will look towards renting an Executive flat. In addition, the increase in rental cap to 8 occupiers would have also contributed to higher demand as such larger units can house more tenants.

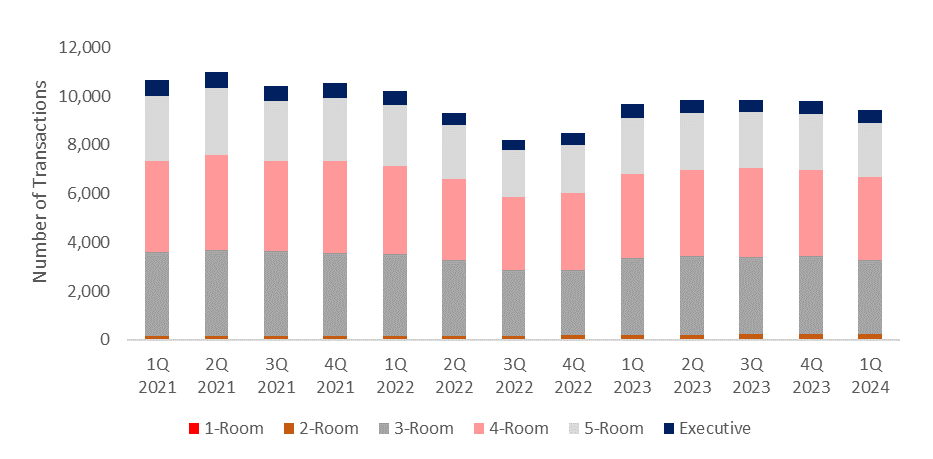

HDB rental demand holds firm amid moderating rents

HDB rental demand is still holding although rents are falling slightly. The number of approved applications is 9,434, a decline of 3.6% q-o-q, following the 0.7% q-o-q decline in 4Q 2023.

Chart 2: Number of approved applications to rent out HDB flats by flat type

Source: HDB, ERA Research and Market Intelligence

The rental market favours tenants in 2024

The moderated private residential rents have bolstered the number of rental contracts in 1Q 2024.

With some 21,000 private residential units (excluding EC) completed in 2023, and other another 8,616 private non-landed residential units slated to complete in 2024, the market could see an increased number of rental properties, further saturating the rental supply. This could lead to more competition for tenants, potentially softening the rental market further.

With that, ERA predicts a potential easing of private residential rental prices by up to 5% y-o-y in 2024, with the number of rental contracts ranging between 75,000 and 80,000.

When it comes to the HDB rental market, the narrowing rental gap between HDB and private homes may encourage some tenants to pay a slight premium to rent a condominium instead.

But the HDB market can expect to see higher rental growth due to a a shortage of rental inventory. HDB rental market will stay fairly resilient, with average rental prices to grow by up to 10% in 2024.

ERA forecasts the number of HDB rental approvals to range between 36,000 to 38,000 contracts in 2024, down from 39,138 in 2023.