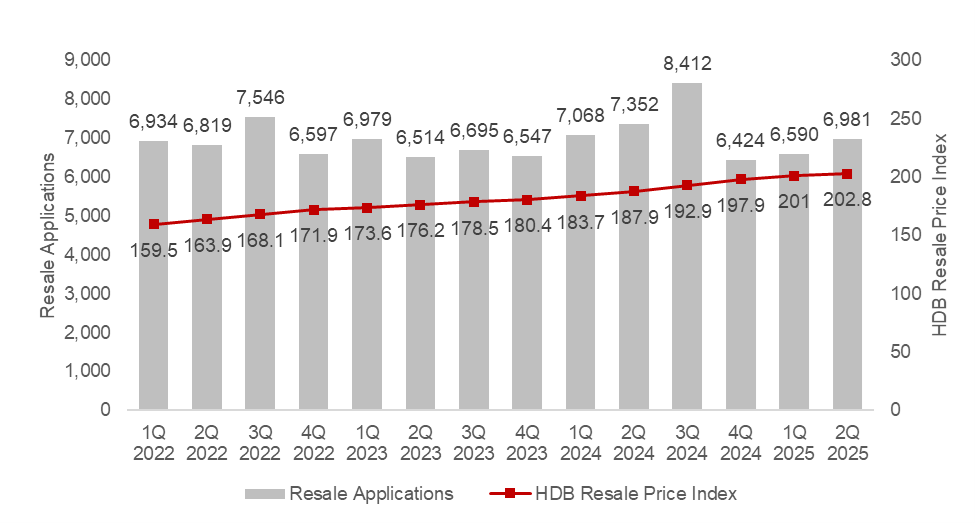

Resale Price Index (RPI) Continues to Grow in Moderation

According to the Housing and Development Board (HDB)’s flash estimates, the HDB RPI rose to 202.8, a 0.9 % increase quarter-on-quarter (q-o-q) in 2Q 2025.

This is the 21st consecutive quarter of growth of the RPI, which is on track to fall in line with ERA’s forecast of 3-6% annual price growth by the end of 2025.

Chart 1: HDB RPI vs Number of Transactions

Transaction Volume Down Amid Seasonal Lull

There were a reported 6,981 HDB resale transactions recorded in 2Q 2025. This was a 5.0% decline y-o-y.

The lower transaction volume witnessed can be attributed to the seasonal school holiday lull, uncertain economic sentiments and the upcoming Build-to-Order (BTO) and Sale of Balance Flat (SBF) exercises in July that drew buyers’ attention.

The heightened global uncertainty and weaker trade demand could dampen homebuyers’ confidence, though the full impact remains to be seen. As a result, the Ministry of Trade and Industry has downgraded Singapore’s GDP growth forecast to 0.0% to 2.0% for 2025, from the earlier 1.0% to 3.0%.

Separately, Singapore’s resilient labour market continues to underpin housing demand. Unemployment remains low, providing households with some assurance amid an increasingly volatile global environment.

Some Buyers Holding Out for BTO and SBF Exercise in July

HDB earlier announced that they will launch another 5,500 Build-To-Order (BTO) flats and another 3,000 Sale of Balance Flats (SBF) in July. This is in addition to the bumper crop of over 10,000 BTO and SBF units offered through the February sale exercise. July’s BTO exercise will offer units in popular estates such as Bukit Merah, Clementi, Toa Payoh and Tampines (Simei).

All these new BTO locations are provide compelling options for buyers. As such, some buyers may be holding off their purchase to see what units are available in these exercises. Should they not be able to secure a unit, we could very well see them return to the resale market in the later months.

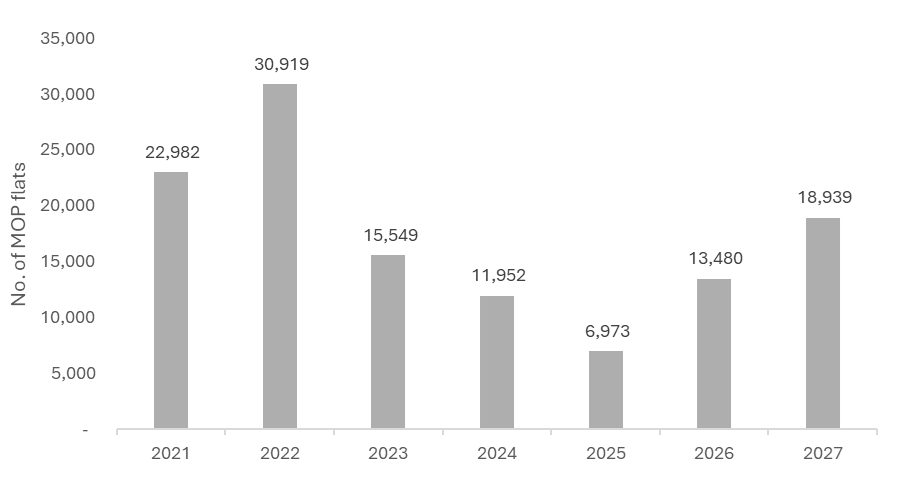

Fewer MOP flats compared to 2024

In 2025, we will see 6,974 HDB flats fulfil their Minimum Occupation Period (MOP), the lowest in 11 years since 5,301 units reached their MOP in 2014.

This has led to stress being placed on resale prices and is significantly apparent for resale flats in central locations and mature estates. But the number of MOP flats is slated to more than double in 2026, which could offer some reprieve to homebuyers by then.

Chart 2: Number of MOP Flats by year

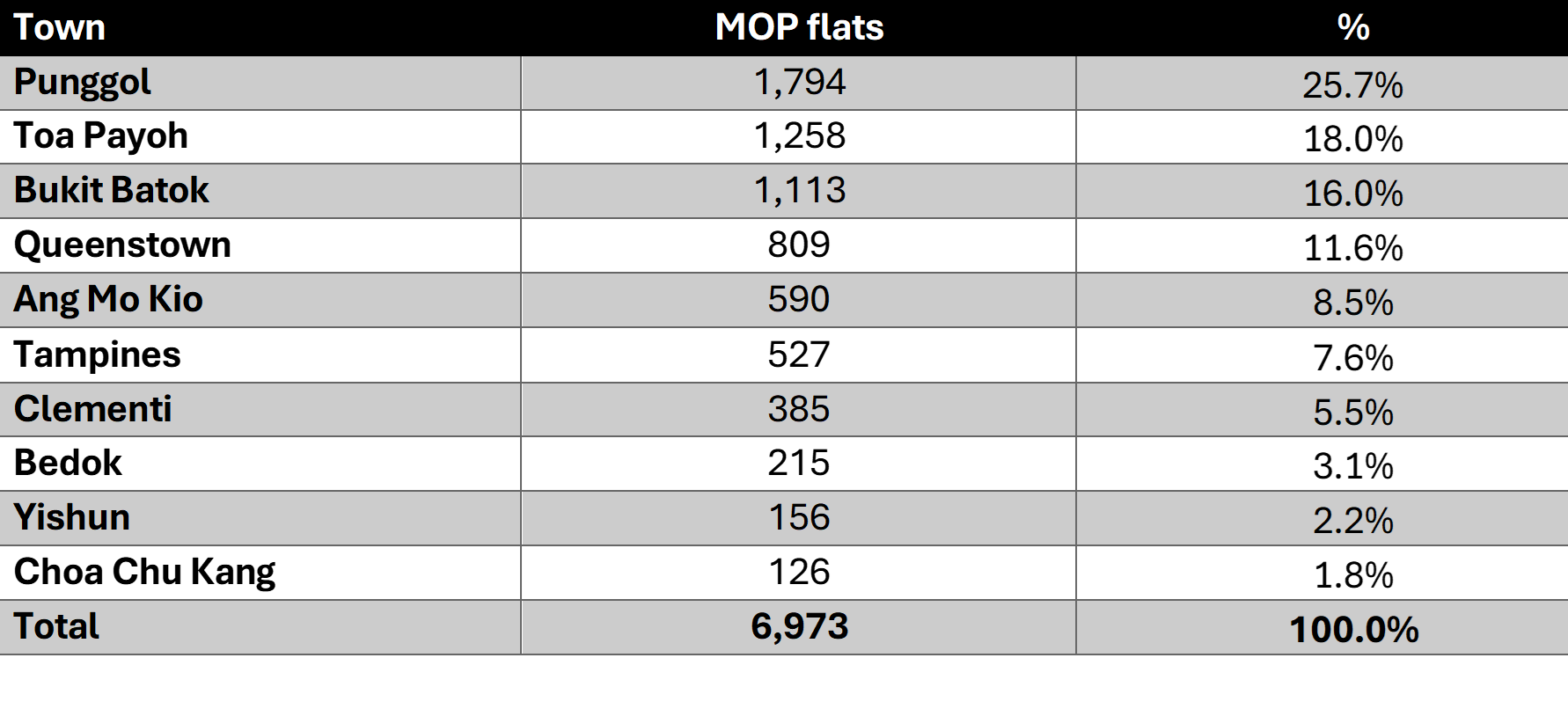

Table 1: Distribution of MOP Flats by Town in 2025

Among the flats reaching MOP in 2025, 30% of them are located in popular, centrally located housing estates such as Toa Payoh and Queenstown, which tend to command higher resale prices. They are popular among buyers, since they are not subject to the more stringent resale restrictions under the new “Plus” and “Prime” classification.

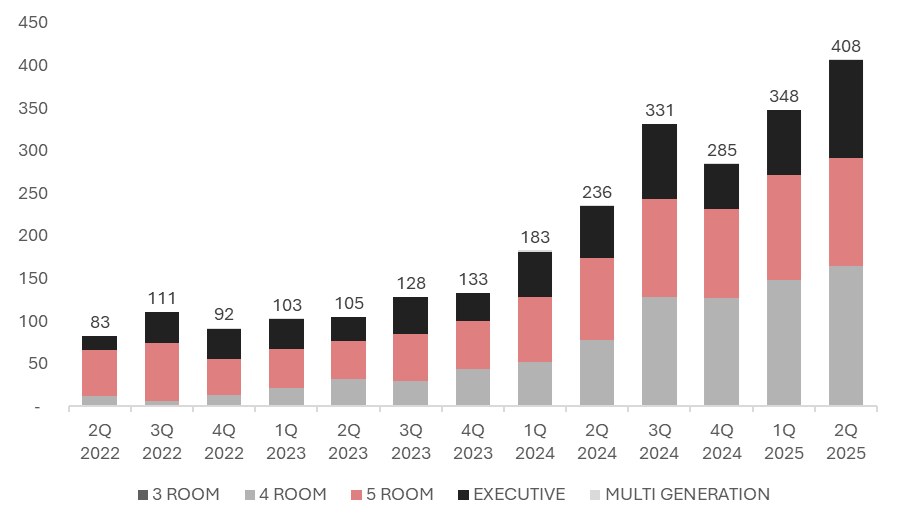

Million-Dollar Flat Transactions on the rise

Million-dollar flat transactions reached a record high of 408 in 2Q 2025, up from 348 in 1Q 2025. The percentage of million-dollar flat transactions in 2Q 2025 accounted for 4.4% of all transactions, falling from the 8.9% in 1Q 2025.

Collectively, the 1H 2025 has seen some 756 million-dollar flat transactions, compared to 1,035 transactions seen for the whole of 2024. More 4-room flats were sold for at least $1 million. Specifically, the number of such transactions rose to 165 units in 2Q 2025, up from 148 units in 1Q 2025.

Chart 3: HDB Flat Transactions over $1m

Flats in mature estates continue to make up the bulk of the million-dollar flat transaction, highlighting the demand for homes in more centrally located towns, and/or with more comprehensive amenities.

Apart from private home downgraders, there are increasingly more HDB dwellers willing to shell out a premium for a newly and centrally located flats. They may choose to upgrade within the HDB market itself, opting to purchase larger homes in central locations with longer leases, such as newly-MOP flats. These homes offer outstanding location attributes, with good transport connectivity, amenities and proximity to good schools, making them a great choice.

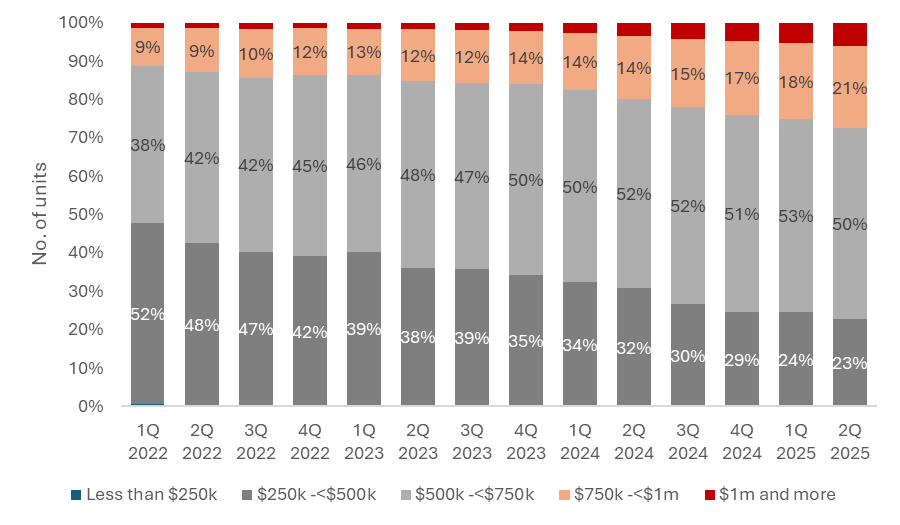

Chart 4: HDB Transactions by Price Ranges

Despite this, the majority of HDB resale flats remain affordable. Half of all HDB resale transactions in 2Q 2025 were priced between $500,000 and $750,000, a range considered affordable for many local buyers. Meanwhile, an additional 23% were transacted between $250,000 and $500,000.

Together, this reflects that close to three-quarters of HDB resale transactions still remain affordable ranges for the average homebuyer.

Possible Removal of 15-Month Wait-Out Period For Private Right-sizers soon

The wait-out period for private property downgraders looking to buy a resale flat may be relaxed before 2027, with an expected rise in supply of new and resale flats. While its effectiveness has likely waned, the 15-month wait-out period remains relevant for moderating buying activity and keeping resale HDB prices in check. This perspective is warranted as private homeowners will represent a continuous pool for right-sizing and subsequent demand, even with the wait-out period in effect.

With the number of MOP flats slated to rise in 2026 and 2027, removing the wait-out period could offer private right-sizers greater flexibility, especially during this period of heightened economic volatility.

ERA’s Outlook and Forecast for the Rest of the Year

We should see a recovery in transaction volume in the following quarters as applicants of the BTO and SBF exercises that took place in the quarter are likely to look towards the resale market in the following months if they are unable to secure their units. This should, in turn bolster transaction volume in the months ahead.

With a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years, we should see a moderate price growth, and fewer transactions to close out the year. We anticipate an overall 3% – 6% price growth, with 26,000 – 27,000 resale HDB flat transactions by end-2025.