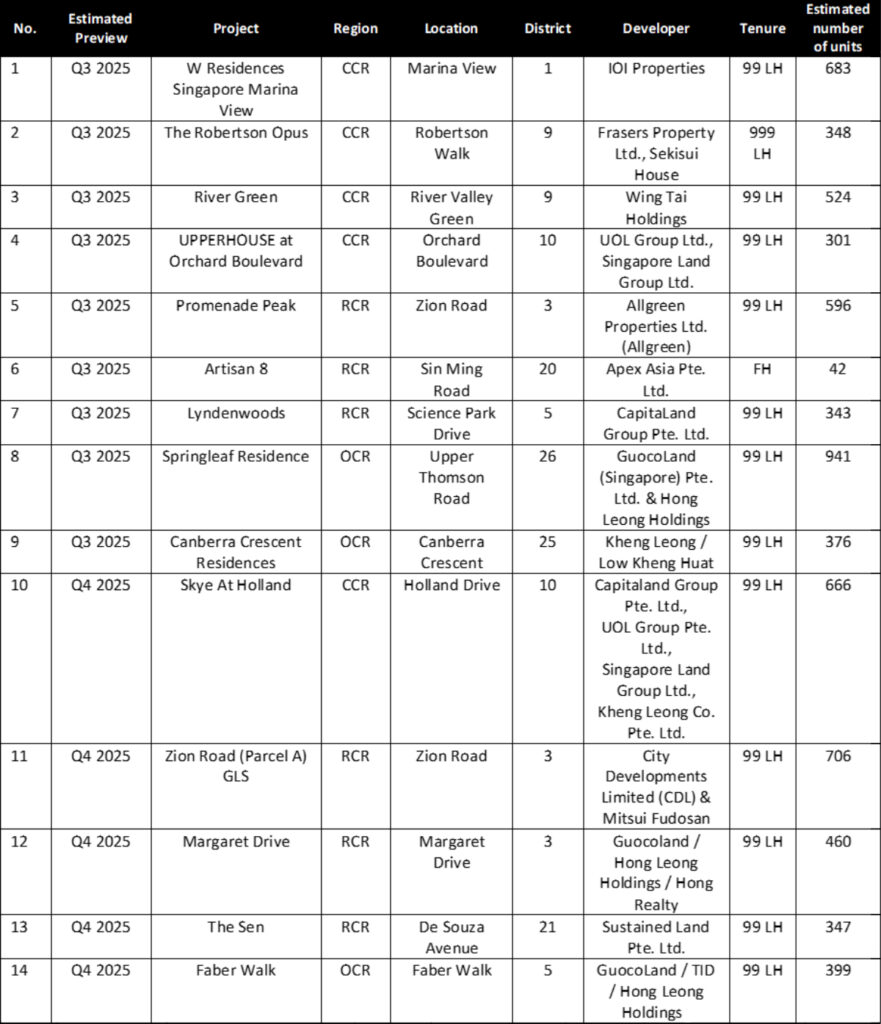

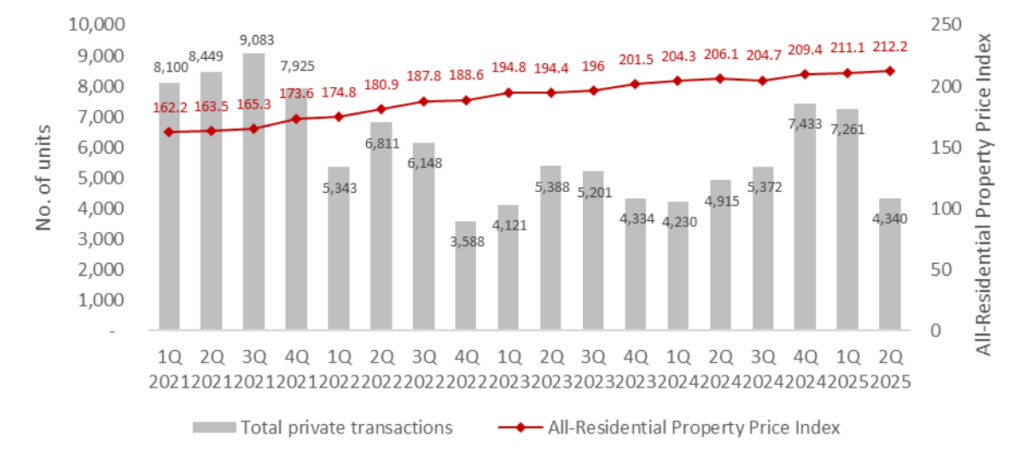

According to URA’s flash estimates, the All-Residential Property Price Index exhibited a modest increase of 0.5% quarter-on-quarter (q-o-q) in 2Q 2025, while the total transaction volume of private homes dipped 40.2% q-o- to 4,340 units.

Chart 1: All-Residential Property Price Index and Total Private Transaction Volume

Also, according to flash estimates released by the Urban Redevelopment Authority (URA), the non-landed CCR property index showed the most pronounced growth among regional sub-markets, with a moderate 2.3% q-o-q increase.

Similarly, the non-landed OCR property price index saw a 0.9% q-o-q growth. The softer pace of growth across all segments is largely attributable to weaker new launch sales over the quarter. RCR non-landed prices, on the other hand, fell by 1.1%.

New Sale (Non-Landed Homes, Excluding ECs)

New sale transactions saw a sharper decline in 2Q 2025, primarily due to a fewer and smaller-scale new home launches. This includes, 21 Anderson (19 units), Bloomsbury Residences (358 units), One Marina Gardens (937 units) and Arina East Residences (107 units). Some launches were held back due to May’s election period and the June school holidays.

According to URA caveats (30 June 2025), new home sales in 2Q 2025 fell sharply by 66.1% q-o-q to 1,124 units. This steep decline comes off a higher base seen in 1Q 2025, which saw robust sales driven by several blockbuster launches in popular locations, such as Parktown Residences and The Orie.

Despite the pullback in transaction volume, 2Q 2025’s performance remains higher than last year. In total, 2Q 2024 saw just 688 new home transactions, which is markedly lower than 2Q 2025’s 1,124 units.

Among the projects launched in 2Q 2025, Bloomsbury Residences and One Marina Gardens stand out for their locations in emerging residential precincts near business hubs; these are areas that typically draw greater interest from investors. Likewise, this also explains the more gradual take-up rate, given that investors have more time to assess their options.

Both 21 Anderson and Arina East Residence are freehold boutique developments catering to more discerning buyer profiles given their freehold status. 21 Anderson features ultra-luxury, large units in District 10 which naturally see a smaller pool of buyers. By contrast, Arina East Residences is located in the Tanjong Rhu precinct that will set to see massive transformation over the next decade. These qualities likely drew strong interest from buyers seeking exclusivity and long-term value.

The coming months will see several new launches making their debut, particularly in the CCR. Given the significant price increases in the RCR, CCR homes may appear as value buys in comparison. This could contribute to a revival of demand for CCR properties in the new home market in the foreseeable future.

Chart 2: New Sale Transactions and Median Price for Non-Landed Homes (excluding ECs)

Table 1: Top 10 Best-Selling Projects in 2Q 2025

Executive Condominium (EC)

With no new EC launches, there were just 137 transactions in 2Q 2025, representing an 83.5% fall q-o-q. In the midst of this dry spell, EC buyers turned to the remaining stock of prior projects. The majority of units sold during the quarter (63 units) were at Aurelle of Tampines after sales were opened up to second-timer buyers in April. Both Aurelle of Tampines and Altura were sold out in June 2025.

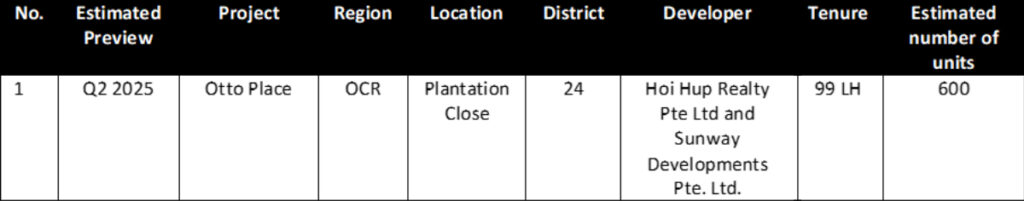

With buyers snapping up the depleting stock of EC units, the current supply of new EC homes is fairly limited. As of 30 June 2025, there are only four EC units remain unsold. Furthermore, with only one EC launch at Plantation Close (Otto Place) slated to be launched this year, its supply will likely fall short of demand.

Resale and Sub-Sale (Non-Landed Homes, Excluding EC)

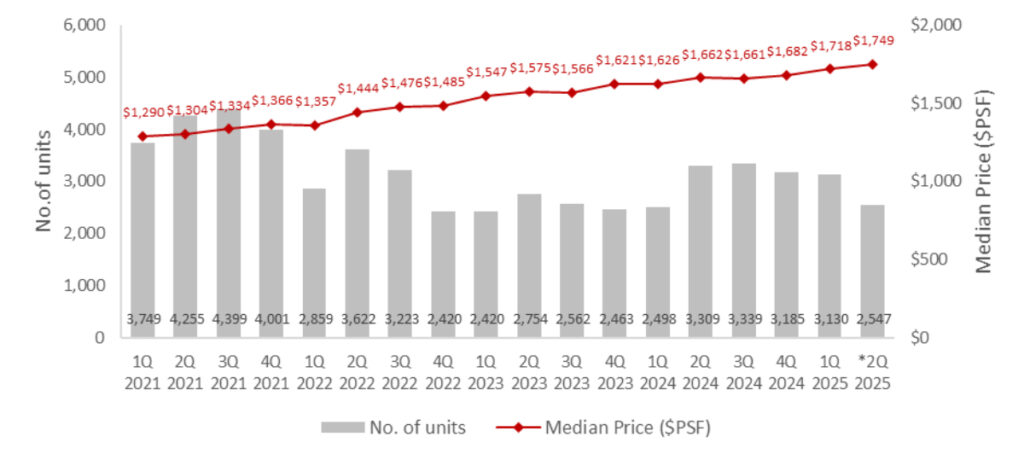

Resale transactions fell for the second consecutive quarter in 2Q 2025 amid a reduced pipeline of private home completion. Based on URA caveats (30 June 2025), a total of 2,547 resale units changed hands during the quarter. This marks a 18.6% q-o-q decline, extending the downtrend observed from last quarter.

In terms of the resale segment’s share of market activity, the resale transactions accounted for 66.0% of all non-landed private home sales (excluding ECs) that took place in 2Q 2025.

The higher proportion of resale transactions stands in contrast to 1Q 2025 when such deals comprised just 46.4% of all non-landed private home sales (excluding ECs). This shift is likely due to a quieter primary market, where the slowdown in new launches caused the resale segment to emerge as the primary source of buying activity for 2Q 2025.

Chart 3: Resale Transactions and Median Price for Non-Landed Homes (excluding ECs)

The reduced pipeline of private home completions was the main contributing factor to a slower resale market in 2Q 2025, though weakened buyer sentiment may have also played a role. Private home completions (excluding ECs) are estimated to reach 5,920 units in 2025, which is a marked decrease from the 8,460 units from 2024.

Amid fewer completions, prices in the resale market grew once more in 2Q 2025. A slight 1.8% q-o-q uptick was registered as median unit prices rose from $1,718 psf in 1Q 2025 to $1,749 psf to 2Q 2025.

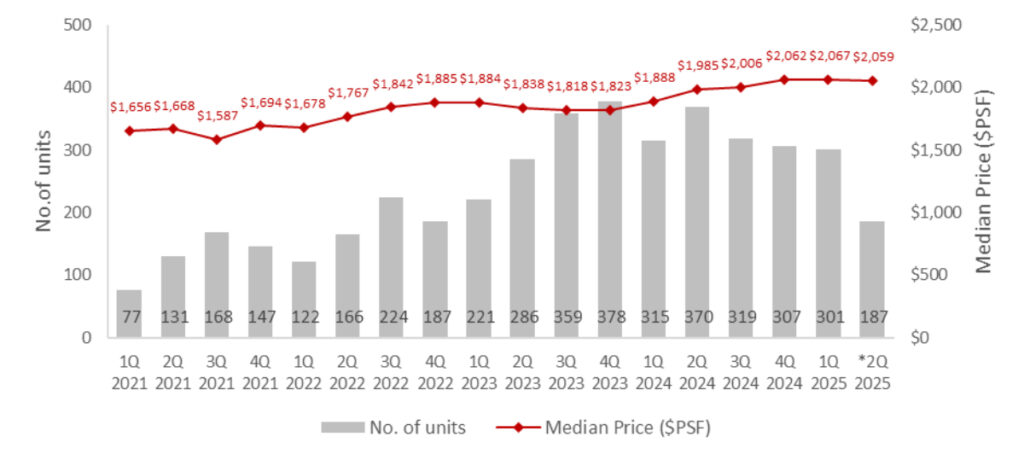

Chart 4: Sub-Sale Transactions and Median Price for Non-Landed Homes (excluding ECs)

Following a similar trajectory to the resale market, the total sub-sale transactions saw a steeper decline of 37.9% q-o-q to 187 units. This figure also puts the sub-sale market’s share of quarterly transactions at 4.8% for 2Q 2025.

Median unit prices for sub-sale transactions also edged down, slipping 0.4% from $2,067 psf in 1Q 2025 to $2,059 psf in 2Q 2025. However, this modest dip is likely a temporary fluctuation, as 2Q 2025’s median unit price remains well above the past five-quarter average of $2,002 psf recorded from 1Q 2024 to 1Q 2025.

Market Outlook

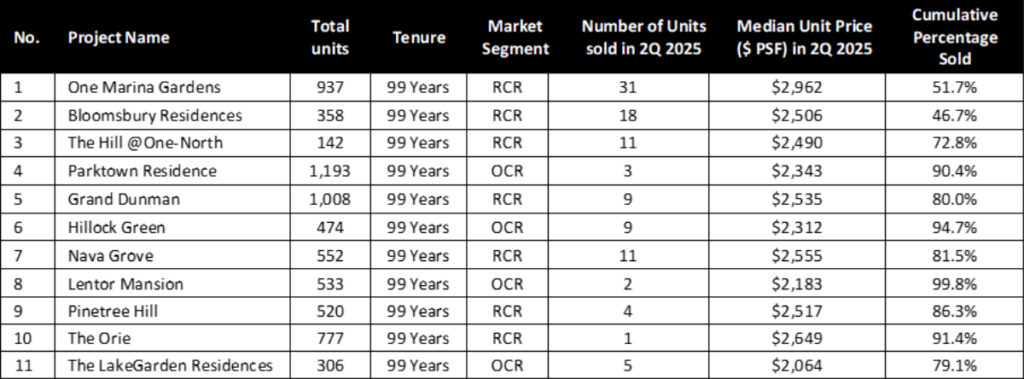

Come 3Q 2025, we will likely see nine new private home launches (totalling 4,154 units) across various estates in Singapore. They will cater to a diverse range of buyer profiles, depending on their needs, lifestyles, and preferred locations. Notable launches in 3Q 2025 include The Robertson Opus (CCR), River Green (CCR), UPPERHOUSE at Orchard Boulevard (CCR), Lyndenwoods (RCR), and Springleaf Residence (OCR).

In particular, the CCR is set to see four new launches in 3Q 2025, following a relatively quiet pipeline in recent years. These projects will offer a wider selection, from luxury residences to more mass-market projects. That said, new home sales in the CCR are still likely to progress at a more measured pace given their higher price point. Therefore, we expect the bulk of new home sales in 3Q 2025 to still come from upcoming RCR and OCR launches.

Collectively, 2H 2025 will see 15 new private home launches and 1 EC that will bring a total of 7,332 homes.

Within the secondary market, it is expected that resale and sub-sale transactions will continue as a shrinking number of fresh completions continues to weigh on the available supply for both market segments.

Turning towards a broader outlook, we also expect to see more widespread economic impact arising from global uncertainty and weaker trade demand. These outcomes may further dampen consumer sentiment, leading homebuyers to adopt a more prudent stance before committing to a purchase.

However, possible silver linings may be found in a potential interest rate cut by the Feds in July, as well as the recent 2025 Draft Master Plan announcements. The latter saw the introduction of new housing neighbourhoods in areas such as Dover, Defu, Newton and Paterson, in addition to integrated community hubs in Sengkang, Woodlands North, and Yio Chu Kang on top of other initiatives. Together, these developments could help promote buyer confidence by reinforcing the Government’s long-term plans for urban renewal and liveability.

Looking ahead, ERA projects new home sales to fall between 8,500 – 9,500 units for the whole of 2025. In conjunction, sub-sale and resale transactions are also expected to reach between 1,100 to 1,300 units and 14,000 to 15,000 units respectively by the close of 2025.

Table 2: Upcoming launches in 2025