April 2024 saw a decline in new home sales due to muted new home launches.

A total of 278 new private homes were launched in April, compared to 877 units in March. This represents a decrease of 68.3% month-on-month (m-o-m). April’s new homes sale numbers fell 58.8% m-o-m to 352 units (excluding ECs).

With no new EC launch, buyers have snapped up the remaining unsold EC stock. April saw the sale of another 51 units, and North Gaia accounted for 64.7% of the transactions. The number of unsold EC stock fell 8.1% m-o-m to 329 units.

There were three new launches in April namely, The Hill @ One North (142 units), The Hillshore (59 units) and 32 Gilstead (14 units).

32 Gilstead is a ultra luxury freehold development in the Core Central Region (CCR) moved four of its 14 units (28.6%). These transacted units are of at least 4,100 sqft and sold for upwards of $14.2 million to local buyers.

While The Hill @ One-North and The Hillshore are located in the Rest of Central Region (RCR), they are situated outside the typical heartland areas. Hence, they appeal to a distinct group of buyers, which explains for their gradual sales rate.

The Hillshore moved three of its 59 units (5.1%) at a median price of $2,599 psf.

Among the three new launches in April, The Hill @ One-North performed the best, selling 42 of its 142 units (29.6%) at a median price of $2,614 psf.

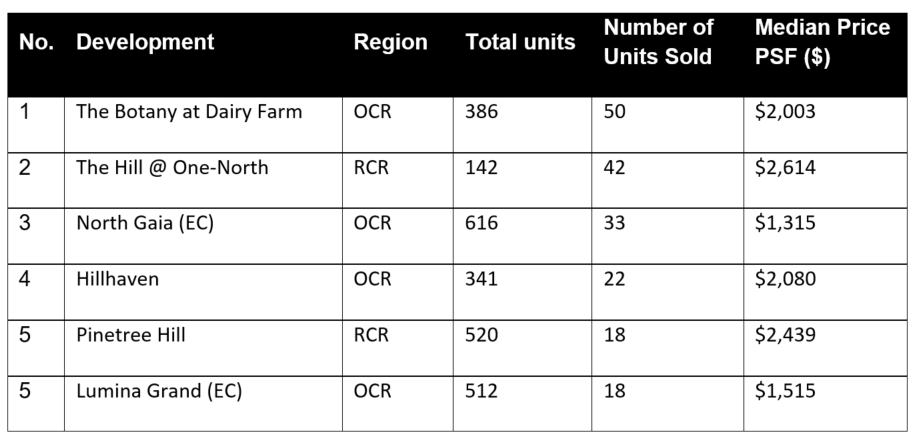

Top Performing Projects in April

Four of the top five performing developments were found in the Outside Central Region (OCR).

The Botany at Dairy Farm was the best-selling project in April, with 50 units sold at a median price of $2,004 psf. With new OCR projects transacting at a median of $2,204 psf as at April, The Botany at Dairy Farm is a value buy for new home buyers.

North Gaia was the best-selling EC project in April, moving another 33 units at a median price of $1,315 PSF. Lumina Grand also moved another 18 units at a median price of $1,515 psf.

Table 1: Top five best performing developments in April 2024

Source: URA, ERA Research and Market Intelligence

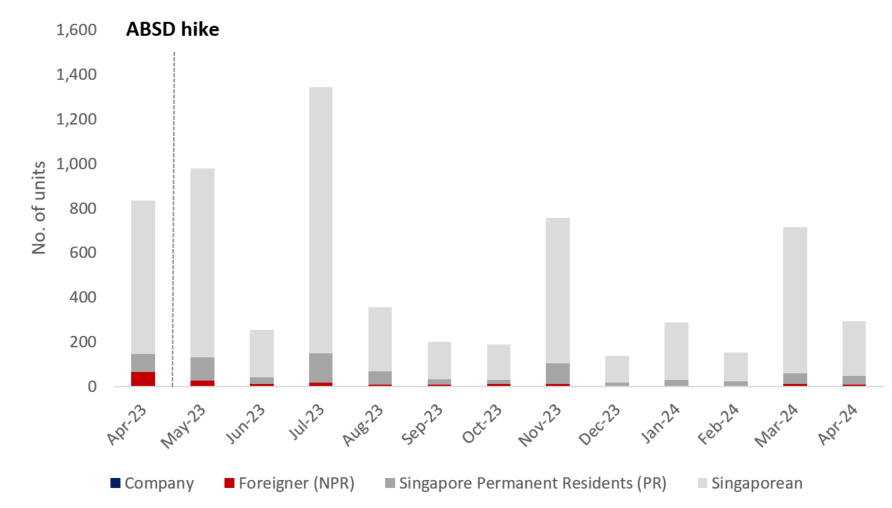

Buyer profile

Singaporeans made up the majority of new home buyers (82.9%) in April 2024, a decline from 91.6% in March. Foreign buyers accounted for another 10 transactions (3.4%).

Chart 1: Buyer profile for new homes excluding ECs

Source: URA, ERA Research and Market Intelligence

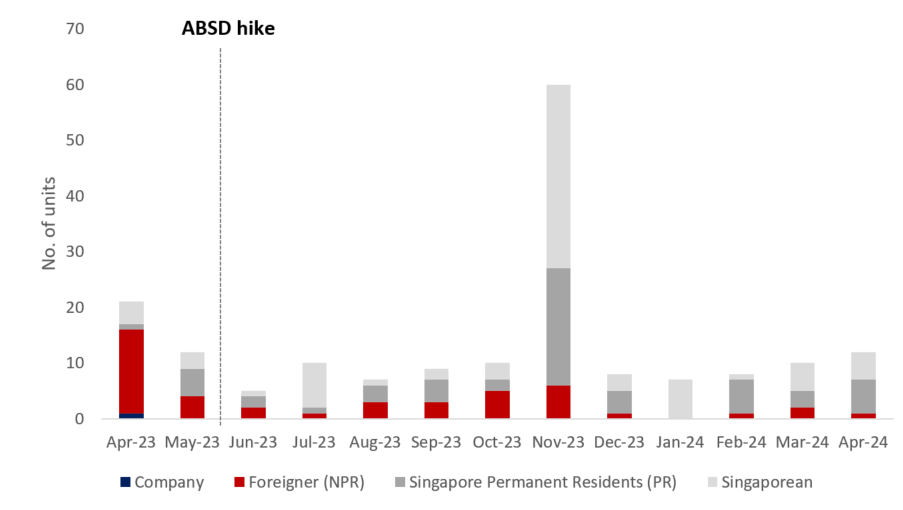

Luxury properties (non-landed home $5 mil and above)

Twelve luxury new homes were sold in April 2024. Of these twelve units, five were purchased by Singaporeans, six by Singapore Permanent Residents (SPRs), and one by a foreigner. The luxury home purchased by a foreigner was a 1,851 sqft unit at Watten House was transacted for $6.2 million.

Five of these 12 luxury homes were at Watten House, which has sold 78.9% of its 180 units since November 2023. Another four units were sold at 32 Gilstead, targeting high-net-worth buyers with prices starting at $13 million.

The highest-transacted property was a 4,209 sqft unit at 32 Gilstead, purchased by a local buyer for $14.5 million ($3,455 PSF).

Singapore residents accounted for 91.7% of new home luxury market sales in April, as the punitive ABSD rates continue to deter foreign buyers.

Chart 2: Buyer profile for home $5mil and more

Source: URA, ERA Research and Market Intelligence

New home sales momentum to remain slow in May with only one boutique development being launched

May will only see the launch of Straits at Joo Chiat, a boutique development comprising 16 units.

New home buying activities could only pick up after July as we expect fewer launches in May and June.

In 2H 2024, highly anticipated projects such as The Chuan Park (916 units) and Emerald of Katong (846 units) are expected to capture home buyers’ interest and boost new home sales.

Amid the economic headwinds, geopolitical instability, rising retrenchment exercises and higher-for-longer interest rates, buyer sentiment remained lukewarm. Furthermore, there have been emerging concerns around the persistently high inflation rate in US which could impact the Federal Reserve’s decision to cut interest rates this year. As a result, some prospective homebuyers may hold back on home purchases till second half of the year.

Barring any unforeseen circumstances, ERA forecasts new home sale to ranging between 7,000 and 8,000 units in 2024.