Overview

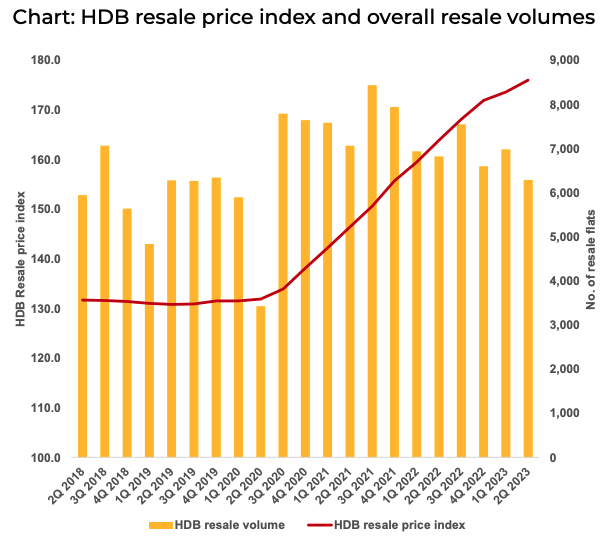

Mirroring the decline in private residential prices, HDB resale prices experienced a modest uptick of 1.5% q-o-q in 2Q2023. Nevertheless, this growth rate remains below the average quarterly increase of 2.5% observed in 2022, indicating a moderation in HDB resale prices since the implementation of cooling measures in September 2022.

HDB resale volumes also fell 6.7% q-o-q with 6,514 flats transacted. This decline comes after a 5.8% growth in the previous quarter and marks the lowest level recorded since the Covid-19 ‘Circuit Breaker’ in 2Q2020 when only 3,426 flats were sold.

2Q’s figures suggest that the slower price increase observed in the first quarter was not an isolated event. Instead, it points towards a shift towards a more sustainable growth trajectory for HDB resale prices following the robust price surges experienced in 2022.

Resilient Prices but Dampened Resale Volumes

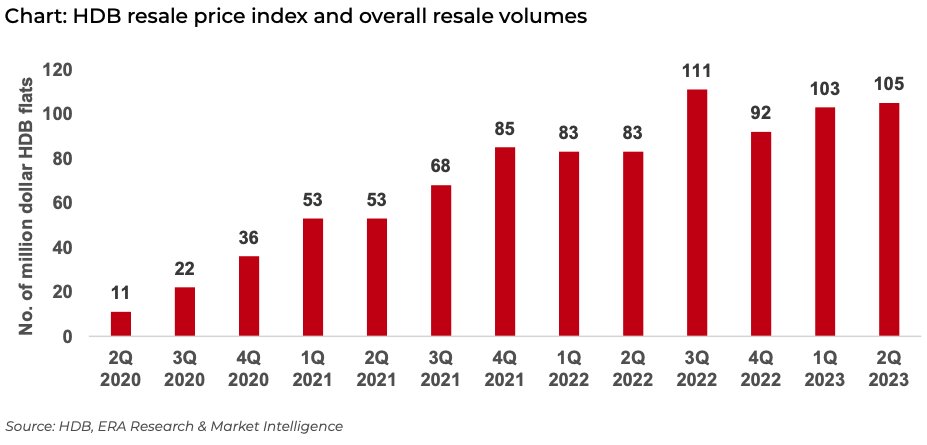

The number of HDB flats which crossed the million-dollar mark continued to exceed 100 in 2Q2023, reflecting the price expectations of HDB sellers pushing prices to new heights. Potential buyers are discouraged by these soaring prices. As a result, the decline in overall transaction volumes reflected buyer unwillingness to participate in a seller’s market. For example, three years ago, the median price of 4-room HDB resale flats in Geylang were $427,500 (2Q2020). In 2Q2023, the median price of these flats shot up by almost 55% to $661,000.

Resilient Prices but Dampened Resale Volumes Source: HDB, ERA Research & Market Intelligence Chart: HDB resale price index and overall resale volumes The drop in HDB resale volumes can also be attributed to several factors. The lack of OCR condo launches and Executive Condominiums (EC) launches has discouraged existing HDB homeowners from selling their properties to upgrade to these new developments. Furthermore, the implementation of a 15-month cool-off period for private property downgraders has also played a role in reducing HDB resale activity. This rule means that condo downgraders must wait until the beginning of 2024 before they can purchase an HDB flat, causing a delay in market transactions.

Increase in Proportion of 4-room Flats Hitting The Million-dollar Mark

There was a notable increase in the proportion of 4-room resale HDB flats hitting the million-dollar mark. The figure rose from 20.4% in 1Q 2023 to 30.5% in 2Q 2023. However, 5-room HDB resale flats continued to maintain their position as the majority, accounting for 43.7% and 42.9% of flats hitting the million-dollar mark in 1Q 2023 and 2Q 2023, respectively.

HDB Towns With Most Resale Transactions

The top 5 HDB towns with the most resale transactions are Punggol, Woodlands, Sengkang, Yishun, and Bukit Batok. These towns combined already constitute 38.8% of all resale transactions. Among these 5 towns, the most expensive and cheapest flats are found in Bukit Batok – an executive flat priced at $1,088,000, and a 2-room flat at $294,000.

OUTLOOK

Looking ahead, the HDB resale market is expected to stabilize, primarily driven by the government’s plan to release up to 13,000 BTO flats in the second half of 2023. The upcoming 6,700 BTO units in August, located in attractive areas such as Kallang Whampoa and Queenstown are likely to divert the demand of both first-time and second-time buyers away from the resale market.

HDB resale volumes hit 13,493 flats in the first half of 2023. We expect the overall demand for HDB resale flats to remain healthy as more homeowners demonstrate flexibility in their asking prices. ERA predicts resale volume to be 26,000 to 27,000 flats for the whole of 2023.

The introduction of new suburban condo and EC launches in the near future will maintain HDB resale prices at a relatively high level, as some individuals aspire to kickstart their asset progression journey. As a result, we forecast HDB resale prices to grow sustainably between 5% and 6% as the dynamic interplay of pull and push forces between buyers and sellers continues to influence the market.