Overview

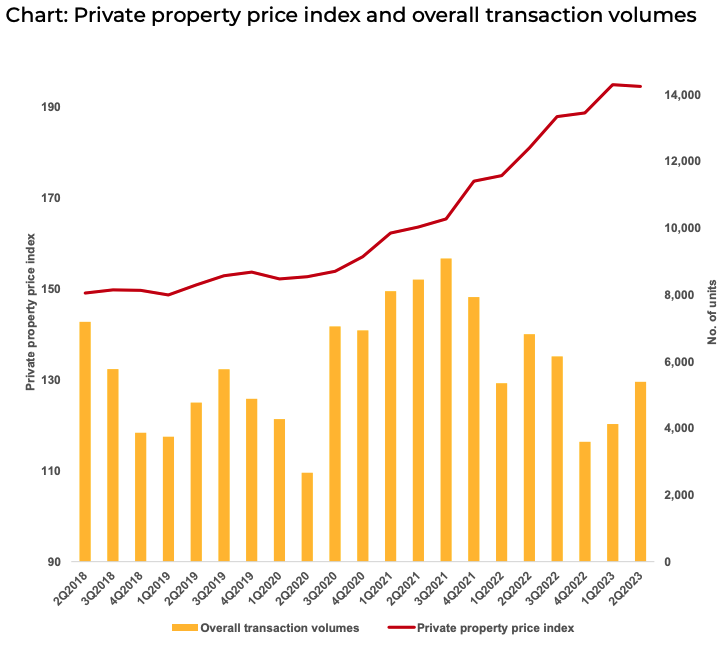

According to the quarterly statistics published by URA on Jul 28, private residential property prices witnessed a marginal decline by 0.2% quarter-on-quarter (q-o-q) in 2Q2023, a reversal from the 3.3% increase in the previous quarter. The decline broke a streak of 12 consecutive quarters of growth in property prices and registered the lowest y-o-y price increase over the past two years.

Even though transaction volumes have been picking up mainly driven by four new launches in the city fringe, the 5,388 units transacted in 2Q2023 were still 15.2% lower than the previous 12 quarters’ average.

These indicators suggest that the property market could be beginning to exhibit signs of moderation after three rounds of cooling measures since December 2021 amidst a high interest rate environment.

Non-Landed Residential Market

Prices of all non-landed homes experienced a slight 0.6% q-o-q decline, mainly driven by a 2.5% q-o-q price drop in the Rest of Central Region (RCR).

Outside Central Region (OCR) had the most robust non-landed price growth among the three regions, experiencing a healthy increase of 1.2% q-o-q. This growth was primarily driven by the resale market, where median prices saw a significant rise of 3.9% q-o-q, to $1,370 psf. Interestingly, the OCR market exhibited the highest price gap of 48.3% between new sales and resales compared to the other two regions. This significant price difference has resulted in a stronger shift in demand towards the resale market in the OCR region.

Signs indicating a moderation in CCR property prices after the April 2023 cooling measures were evident in 2Q2023. Primarily targeted on Foreign buyers, the 0.1% q-o-q decline is unlikely to be a mere blip but rather reflects a genuine moderation as more Foreign buyers held off on purchasing CCR properties. The number of CCR homes purchased by Foreign buyers fell to approximately 100 in 2Q2023, compared to 163 in the previous quarter.

However, the CCR market is expected to remain resilient as more locals continue to enter the market. Despite a lack of major new launches in the CCR, the narrowing price gap between homes in prime areas and those located in the city fringe has further strengthened the appeal of CCR properties to potential buyers.

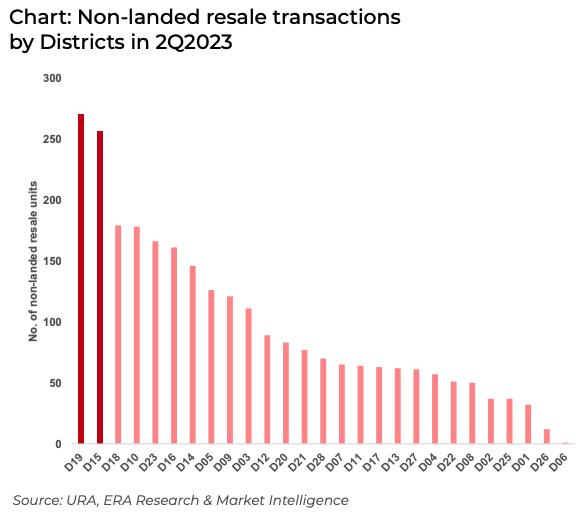

Districts with Most Non-Landed Resale Transactions

In 2Q2023, the non-landed resale market witnessed 2,625 transactions—an impressive 25.5% higher than the new sales market. Notably, 54.1% of these transactions fell within the price range of $1 million to just under $2 million.

The most sought-after districts in terms of resale transactions were Districts 19 and 15, recording more than 250 units each.

Landed Homes

Landed property prices grew 1.1% q-o-q, reflecting resilience in this market. As the most prestigious asset class known for its high quantum deals and rare status, sellers are not willing to cut price while buyers are cautious with their spending. As a result, prices for landed homes rose but transaction volumes dropped 11.7% q-o-q, with only 286 homes being sold.

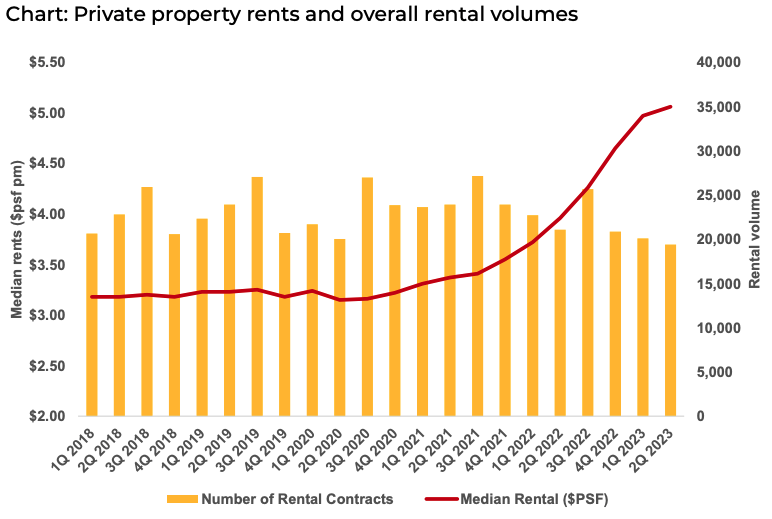

Private Residential Rental Market

After 6 consecutive quarters of exponential growth between 4Q2021 and 1Q2023, growth in median rents for private residential properties have finally moderated to 1.8% qoq in 2Q2023, marking the first time overall rents have surpassed the $5 psf mark.

In 2Q 2023, rental contracts have returned to levels last seen in 4Q2017, falling below the 20,000 mark. The total number of rental contracts for this quarter reached 19,396, the lowest figure recorded since 4Q2017, which saw 19,281 rental transactions.

The decline in rental volume can be attributed to a mismatch in rental pricing expectations between landlords and tenants. Some landlords, influenced by their neighbors’ sky-high rents in the past few quarters, have set new and lofty expectations, and are unwilling to compromise despite subdued rental demand. This has led to a reduction in rental volumes as potential tenants are put off by such high rents.

Another factor impacting the rental market is the significant volume of condominiums attaining their Temporary Occupation Permit (TOP) in 2023. According to URA, approximately 19,291 units, including Executive Condominiums (EC), are projected to be ready for occupancy this year. This anticipated increase in supply may potentially alleviate pressures on the local rental market, offering more options for prospective tenants.

OUTLOOK

With the implementation of the April 2023 Property cooling measures, which entailed doubling the Additional Buyer’s Stamp Duty (ABSD) from 30% to 60% for foreigners and the removal of the “Commercial & Residential” zone from SLA’s list of land use zones to align with the intent of the Residential Property Act, we anticipate a greater proportion of local demand in the private residential market.

In the coming months, prospective buyers will have a plethora of properties to consider, with 4,625 new launch units scheduled to be introduced. Notable projects in the CCR include TMW Maxwell and Orchard Sophia, while OCR will see the launch of The Shorefront, The Lakegarden Residences, and The Arden. The slowing growth in SORA rates as well as the decline in fixed rates for home loans are also expected to fuel activity in the property market. Consequently, overall activity is likely to witness an upswing in both the primary and secondary markets.

We expect developers to sell 7,000 to 8,000 units for the whole of 2023. Last year, developers sold 7,099 units (excluding EC). It is expected to meet this target as the number of new sales in 2023 up to date (July) is already at 4,717 units.

Even though resale volumes for the first half of 2023 already stood at 5,598 units, we expect sales to reach 10,000 to 11,000 units for the whole year amidst a high interest rate environment. ERA predicts that private home prices will experience a rise of 4% to 5% in 2023, assuming no unforeseen events affecting the market.