HDB resale price holding up even as the resale market shows signs of stabilising

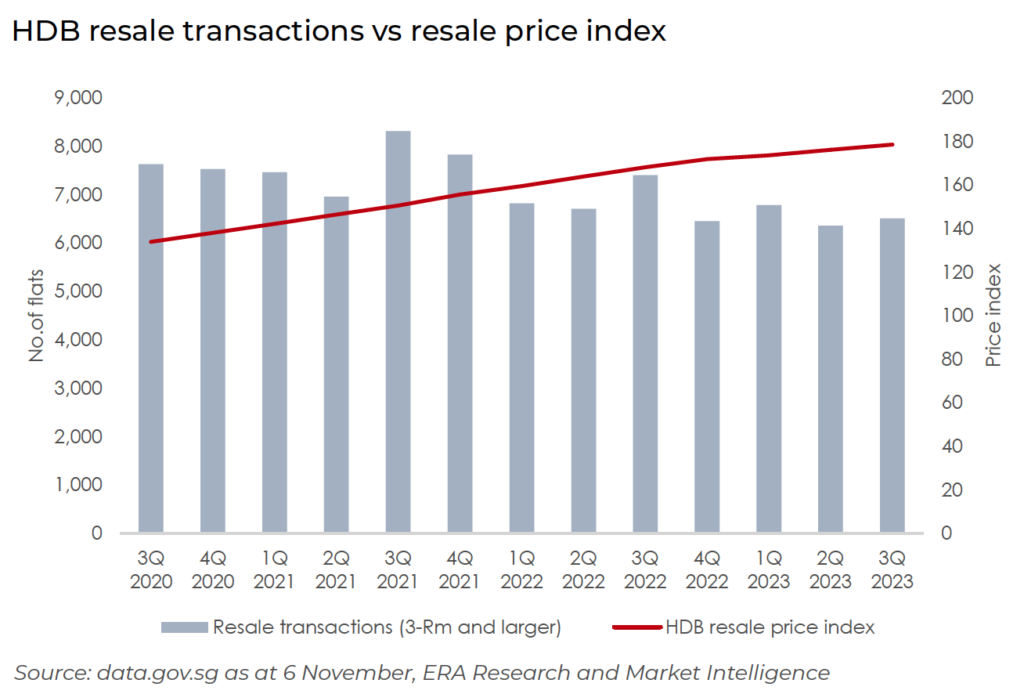

The HDB resale price index reported a modest growth of 1.3% quarter-on-quarter (q-o-q) to 178.5 in 3Q 2023. While HDB resale price index grew in 3Q 2023 for the 14th straight quarter, but its rate of growth has slowed compared to 2Q 2023.

HDB resale volume rose 2.8% q-o-q to 6,695 cases in 3Q 2023, but declined 11.3% y-o-y.

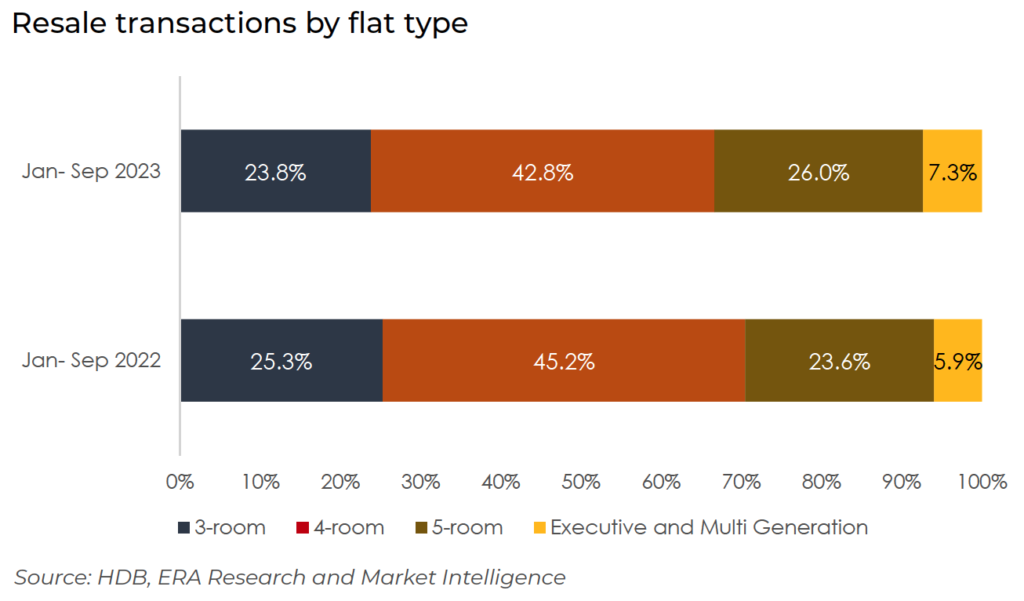

Demand for 3-room and 4-room flats stayed fairly resilient in the first nine months of 2023 compared to the same period in 2022. Comparatively, demand for 5-room and larger flats have tapered since the introduction of the 15-month wait-out period for private residential property owners buying HDB resale flats in September 2022.

In 3Q 2023, transaction volume in mature estates and non-mature estates fell by 15.9% and 7.7% q-o-q respectively. The sharp decline in mature estate transaction volume was largely due to fewer properties listed for sale.

Meanwhile, property listings in non-mature estates are taking longer than usual to sell, but listings located near amenities and major transport nodes remain highly sought after.

Highest number of million-dollar flats sold in 3Q 2023

A record high number of million-dollar HDB flats, 128 units, were transacted in 3Q 2023. In the first nine months of 2023, a total of 336 million-dollar HDB flats were transacted. Close to 43% of these transactions were from mature estates like Bukit Merah, Central Area, Kallang/Whampoa and Queenstown.

4Q 2023 BTO sale launches could divert buyers away from resale market

HDB has launched some 6,800 Build-To-Order (BTO) flats in Choa Chu Kang, Kallang Whampoa, Queenstown, and Tengah in early October. Come December 2023, HDB will offer another 6,000 flats in Bukit Panjang, Jurong West, Woodlands, Bedok, Bishan, Bukit Merah and Queenstown. Starting from the October sales launch, HDB has tighten rules and introduced more punitive penalties on non-selection of flats. Regardless, these sales launches are expected to divert some buyer demand away from the resale market in 4Q 2023.

Outlook for the HDB Market

We expect to see a divergent in demand for HDB resale flats moving forward. The upcoming BTO sales launches could divert resale demand in non-mature estates. In contrast, due to fewer properties being put up for sale, resale demand for mature estate is expected to hold and prices are expected to trend higher. With 20,188 resale transactions recorded during the first nine months of 2023, the number of HDB resale transactions is forecast to reach between 26,000 and 27,000 units by end 2023.