Private residential prices showed resilience amid easing transaction volume

Against the backdrop of elevated interest rates, the hike in Additional Buyer’s Stamp Duty (ABSD) rates in April 2023 and rising economic headwinds, demand for private residential home eased in 3Q 2023. Additionally, the Hungry Ghost Festival, which began on 16 August and lasts for a month, has also impacted demand for private residential homes. Despite muted demand from foreign buyers and companies, there are genuine homebuyers looking to commit to a home purchase in the near future.

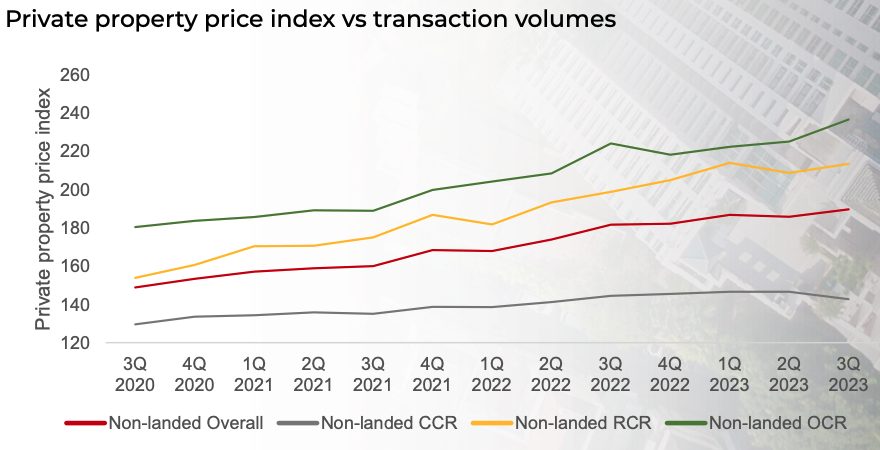

Islandwide private price bolstered by stronger price growth in RCR and OCR

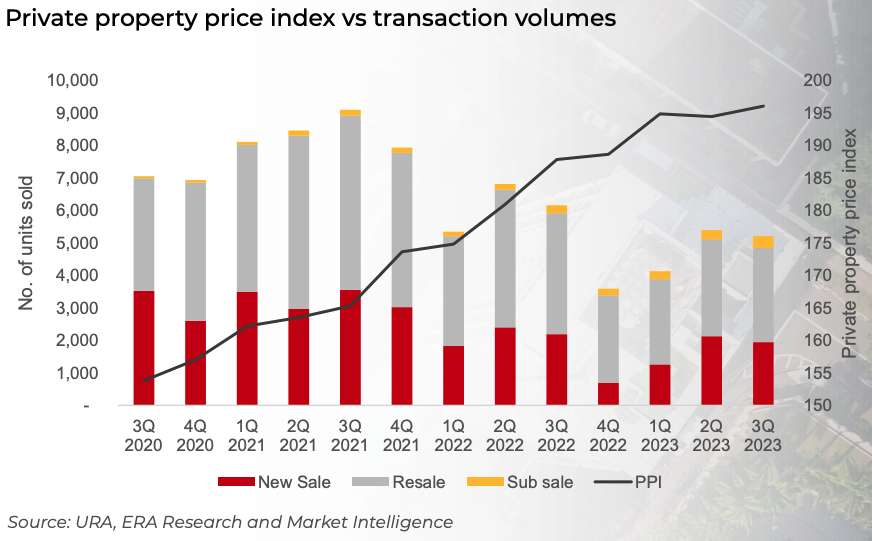

The private residential property index inched upwards to 196, reflecting 0.8% quarter-on-quarter (q-o-q) growth in 3Q 2023, after a marginal decline in the preceding quarter.

Overall, non-landed property prices have increased by 2.2% in 3Q 2023. Non-landed property prices in RCR and OCR rose by 2.1% and 5.5% q-o-q respectively in 3Q 2023. Conversely, Core Central Region (CCR) prices fell 2.7% over the same period.

Transaction volume eased in 3Q 2023

Total transaction volume totalled 5,201 units, declining by 3.5% q-o-q and 15.4% y-o-y in 3Q 2023.

Some 2,900 resale units were transacted in 3Q 2023, marking a 22.0% y-o-y decline. Transaction volume in CCR, RCR and OCR fell 26.0%, 17.4% and 23% y-o-y respectively in the quarter.

A total of 355 sub sale transactions were recorded in 3Q 2023. There will be an increase in sub sale transactions expected in the coming months as more projects attain their Temporary Occupation Period (TOP) status.

Some of these mega-developments such as Treasure at Tampines (2,203 units, OCR), Florence Residence (1,410, OCR) and Avenue South Residences (1,074, RCR) saw more units changed hands. At least 45 and 54 sub sale caveats were lodged at the Affinity at Serangoon (1,052 units, OCR) and Riverfront Residences (1,472 units, OCR) in Q3 2023 respectively.

New homes demand resilient even with the lack of new launches since August

A total of 1,946 units of new homes (excluding ECs) were sold in 3Q 2023, demonstrating resilient buyer demand for new homes. Most of these major projects were launched prior to the “Hungry Ghost Month”.

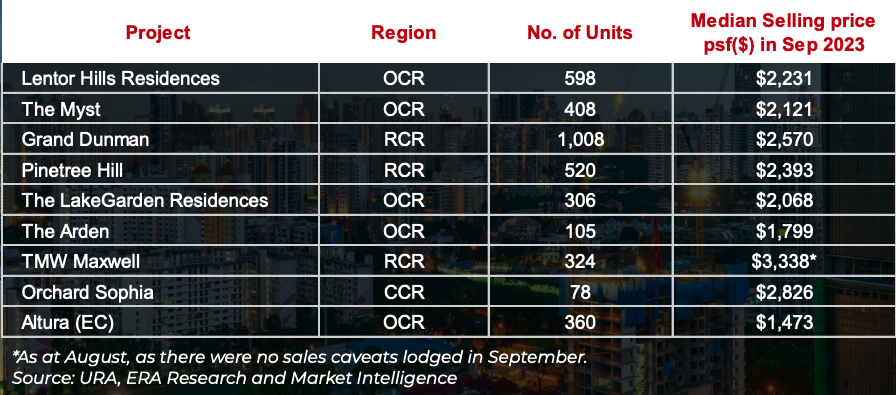

A total of nine projects were launched in RCR and OCR in 3Q 2023. Grand Dunman and Lentor Hill Residences sold 55% and 56% of its units at the first month of launch, echoing resilient buyer demand. Altura, the only Executive Condominium (EC) launched in 2023, sold at a median price of $1,481 psf during its launch month of August 2023.

Major launches in 3Q 2023

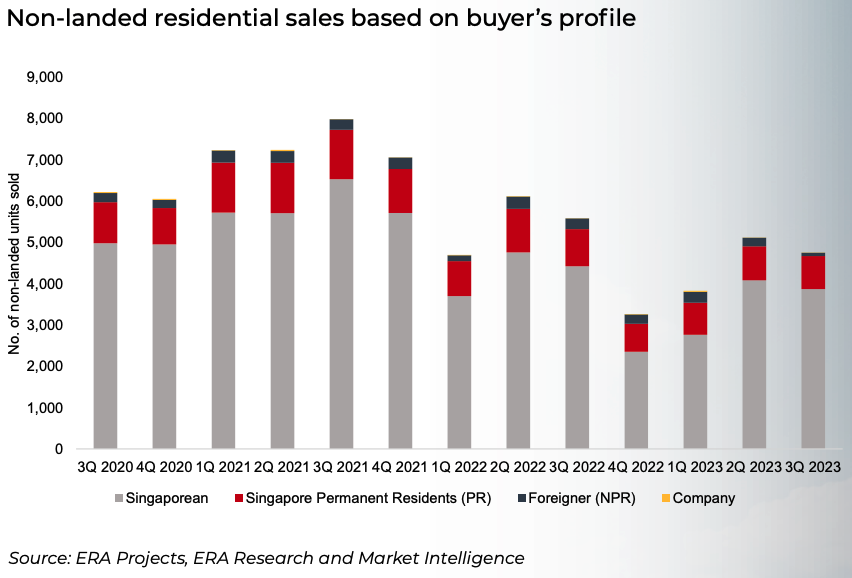

Dwindling interest from foreign buyers and companies

The number of foreign buyers and companies purchasing non-landed residential properties dwindled since 2Q 2023 after the hike in ABSD introduced in April 2023.

Outlook

Moving forward, new non-landed home prices are expected to hold firm for the rest of 2023. New home prices have steadily inched upwards on the back of higher land, construction and interest costs.

Resale and sub sale price set to creep up in 4Q 2023, as more projects attain TOP status in the coming months. These newly completed projects offer a strong value proposition for buyers who seek to take immediate possession of the units.

Three major projects are set to launch in 4Q 2023, Watten House, J’Den and Hillock Green, and that could bring the total new home sales (excluding EC) in 2023 to between 6,000 units and 7,000 units.

J’Den will be closely watched by homebuyers and investors as this is the first mixed development in Jurong, presenting an opportunity for first-movers to capitalize on the on-going masterplan development within the Jurong Lake District.

Hillock Green will be the third new home launch in the Lentor area. Lentor Hill Residences which was launched in 3Q 2023, sold some 56% at its first month of launch. Buyers looking to gain a first-mover advantage in the Lentor area will have more options to choose from.

Resale and sub sale transactions could taper in 4Q 2023 with the holiday season. Total resale and sub sale transactions could reach the range of 12,000 units and 13,000 units for the whole of 2023.