The Government has announced two changes to the Seller’s Stamp Duty (SSD) for residential properties:

(a) An increase in the holding period from three to four years, and

(b) increase of the SSD rates by four percentage points for each tier of the holding period.

These changes will take effect for all residential properties purchased on and after 4 July 2025, 12.00am. The revised SSD will not affect HDB owners due to the Minimum Occupation Period for HDB flats.

The Government has announced two changes to the Seller’s Stamp Duty (SSD) for residential properties:

An increase in the holding period from three to four years, and

An increase of four percentage points in SSD rates for each tier of the holding period.

These changes will take effect for all residential properties purchased on or after 4 July 2025, 12:00 a.m. The revised SSD will not affect HDB owners, as it is subject to the Minimum Occupation Period for HDB flats.

This reversion to the pre-2017 SSD holding period of four years aims to reduce speculative demand by lowering the number of sellers who flip their homes after just three years.

According to IRAS, the SSD for residential properties is payable for properties acquired after 20 February 2010. In most instances, the date of purchase/ acquisition of a property refers to:

Date of Acceptance of the Option to Purchase* or

Date of Sale and Purchase Agreement or

Date of Agreement for Lease (for new HDB flat) or

Date of transfer to a beneficiary where the property was originally held on trust for non-identifiable beneficial owner(s) or

Date of Transfer where the above (a), (b), (c) and (d) are not applicable

*Excludes an Option to Purchase that is subject to the execution/ signing of the Sale and Purchase Agreement

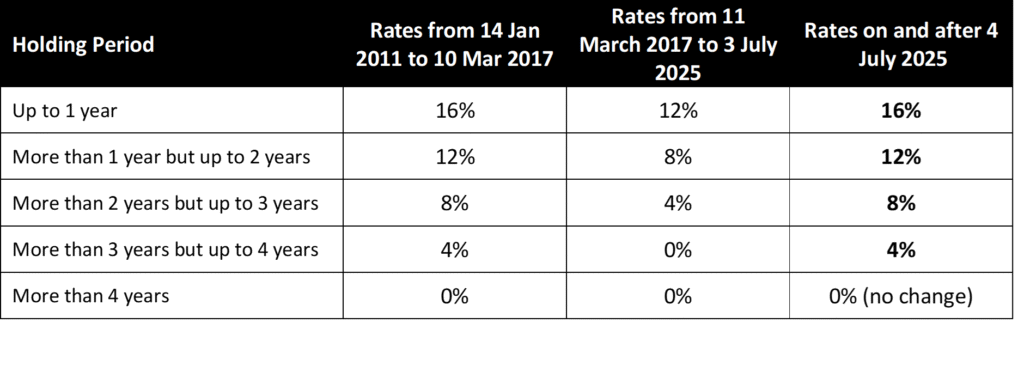

Table 1: Seller Stamp Duty Schedule

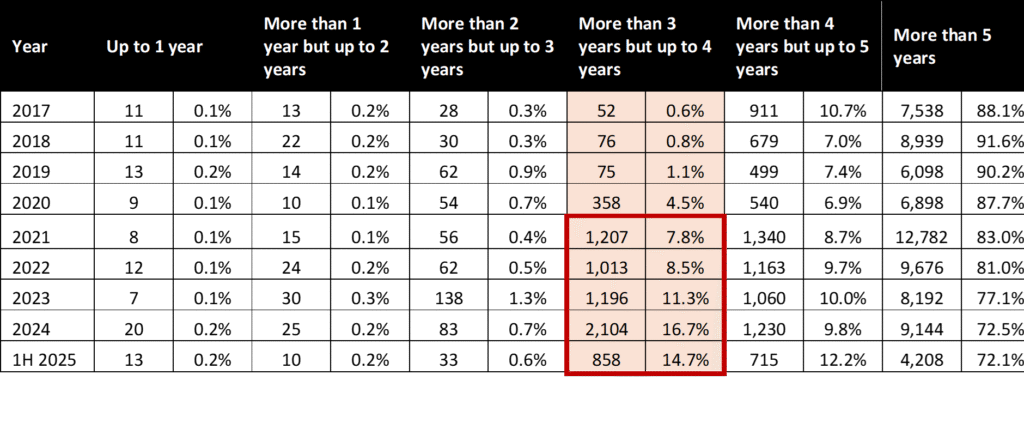

While more owners are selling after holding their homes for three to four years in recent years, they remain a minority.

There has been a significant jump in sellers who sold their homes after holding for more than 3 years but up to 4 years since 2021.

According to URA caveats, in 2020, only 358 sellers sold their non-landed homes after holding them for three to four years; however, by 2024, this number had surged to a peak of 2,104 sellers. In 1H 2025, sellers who had held their non-landed homes for more than 3 years but up to 4 years accounted for 858 transactions, or 14.7% of the total transactions.

Despite this increase, the majority of homeowners continue to sell only after holding their properties for five years or more.

In 1H 2025, about 72.1% of homeowners sold their homes after five years. This trend is further supported by SingStat data, which shows that the proportion of owner-occupied residential households remained high at 90.8% in 2024.

Table 2: Breakdown of Non-landed private homes sold by holding period

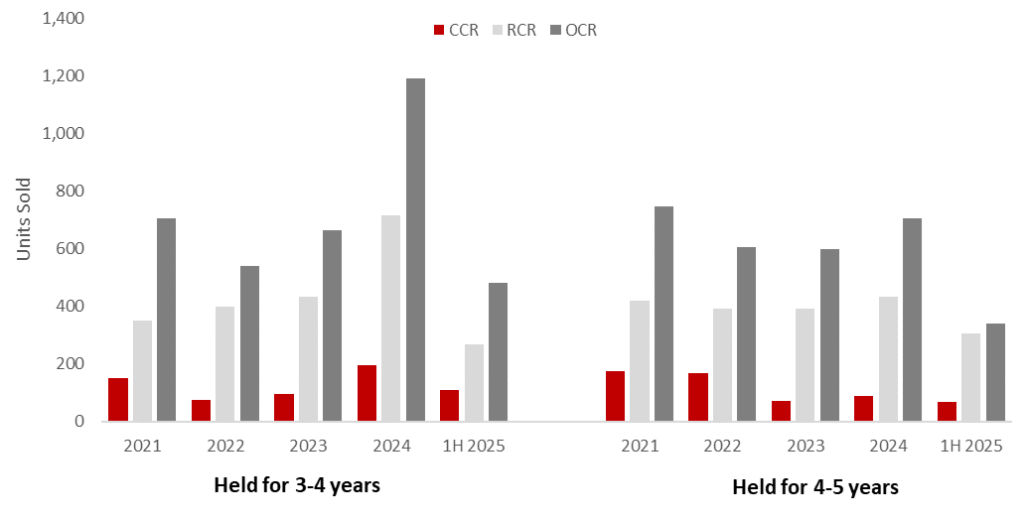

Outside Central Region saw the highest volume of homeowners selling within 3-4 years

Among the regions, the Outside Central Region (OCR) saw the highest volume of homeowners selling within 3-4 years, followed by the Rest of Central Region and the Core Central Region. This could be largely due to the more palatable price quantum of OCR homes compared to the other regions.

Chart 1: Breakdown of Non-landed private homes sold by Market Segment

Higher interest rates and property tax saw more investors extending their holding periods despite significant profits

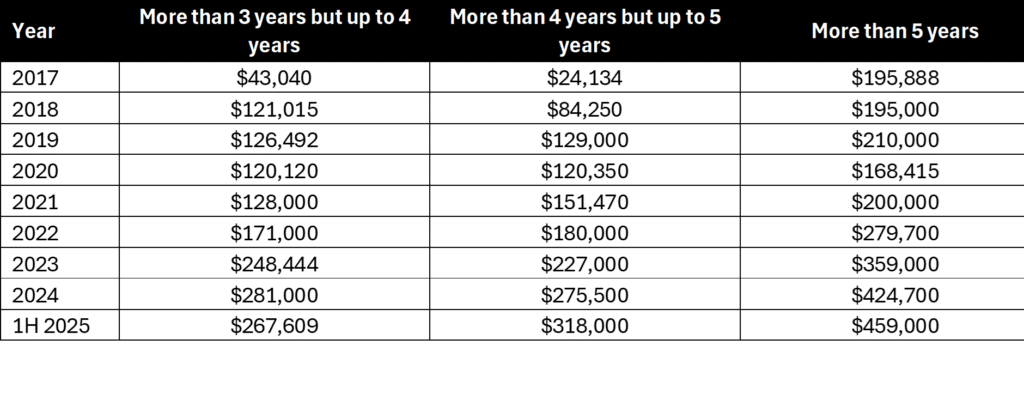

Looking at the median gross profitability of non-landed homes by holding period shows that while there are significant profits to be made after holding for three to five years, sellers who held their properties for more than five years saw the highest profitability.

Table 3: Median Gross Profitability of Non-landed private homes sold by holding period

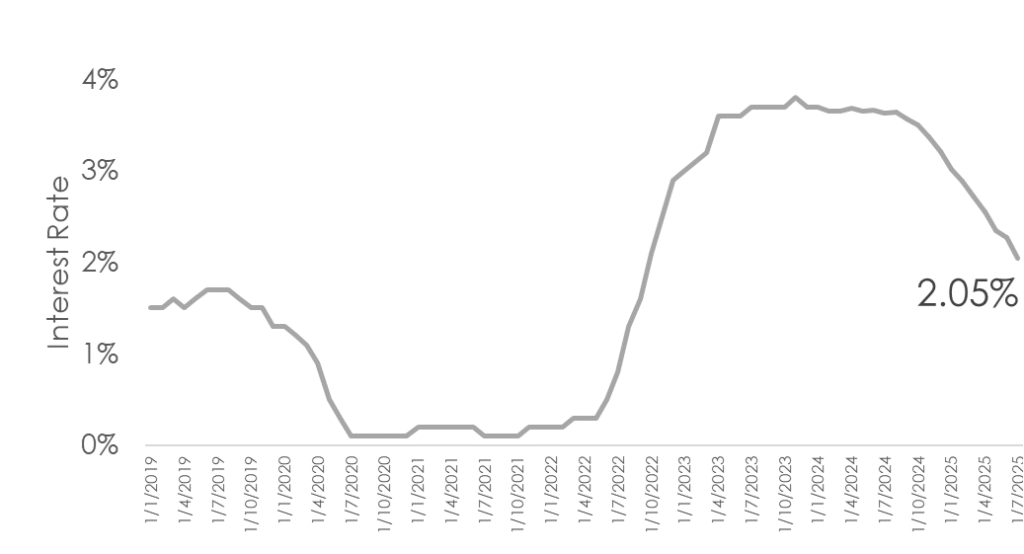

Notably, the elevated interest rates since September 2022 have eroded meaningful profits for property investors, which may have led them to extend their holding periods, especially now that interest rates have eased in recent months. The property tax revisions introduced in 2023 have also resulted in higher taxes on non-owner-occupied residential properties, which may have contributed to this trend as well.

Chart : 3-month Compound SORA

In conclusion

With the introduction of additional Buyer’s Stamp Duty tiers in April 2023, the residential market has shifted primarily towards local and owner-occupier demand.

Alongside increasing economic uncertainty in recent months, buyers have become more cautious, and more now view property as a long-term investment. We are likely to see property investors, who often buy and sell their units within three years, most affected by this change. However, the majority of homebuyers, who are owner-occupiers and long-term investors, are unlikely to be impacted.