Overview

June 2024 saw muted new sale demand with no new home launches, registering 228 units (excluding Executive Condominiums (ECs)) sold. This marked a 3.2% increase month-on-month (m-o-m).

In addition to this, another 50 units of ECs were sold.

Excluding ECs, the top five selling projects included four projects in the OCR, with one in the RCR.

Best performing New Launches in June

Table 1: Top five performing new launch projects in June 2024

| Name | Total no. of units | No. of units sold in June 2024 | Median price ($psf) in June 2024 | Market segment | District |

|---|---|---|---|---|---|

| The LakeGarden Residences | 306 | 23 | 2,119 | OCR | 22 |

| The Botany @ Dairy Farm | 386 | 21 | 1,979 | OCR | 23 |

| Tembusu Grand | 638 | 20 | 2,542 | RCR | 15 |

| Hillhaven | 341 | 18 | 2,124 | OCR | 23 |

| Pinetree Hill | 520 | 15 | 2,548 | OCR | 21 |

Source: URA as of 18th June 2024

Three of the top five selling launches, namely The Botany at Dairy Farm ($1,979psf), Hillhaven ($2,124psf) and The LakeGarden Residences ($2,124psf) transacted at prices below the island-wide median new sale transaction price of $2,248psf.

Topping the sales chart for June, The LakeGarden Residences saw 23 units sold at a median price of $2,119 psf. Remarkably, this surpasses the 22 units sold from January to May 2024. Prospective buyers were holding off their purchases until after Sora’s preview, before committing to a decision.

In addition to this, 19 of the 23 units sold at The LakeGarden Residences were 75sqm and larger. This indicates a strong demand for larger sized units for buyers, possibly HDB upgraders, looking for their own stay purposes.

Promise of a major development of the large white site in the Jurong Lake District led by a five-party consortium could have given buyers confidence to purchase a property in the JLD, and fueled demand for new sale homes in the area.

In second place, the Botany at Dairy Farm moved 21 units at a median price of $1,979 psf. The project has seen a steady demand over the past quarter, which can be largely attributed to its affordable entry price.

Executive Condominiums (ECs)

June 2024 saw 50 EC units sold, a 25% increase m-o-m from May. As there were no new ECs launched in the month, these sale numbers were made up of existing stock on the market.

Of these units, 29 of them were from the sale of homes for North Gaia at a median price of $1,311psf. Lumina Grand also moved another 16 units at a median price of $1,508psf.

As the next available new EC projects will only hit the market in 2025, buyers are snatching up remaining stock, especially when they are available at an affordable price point.

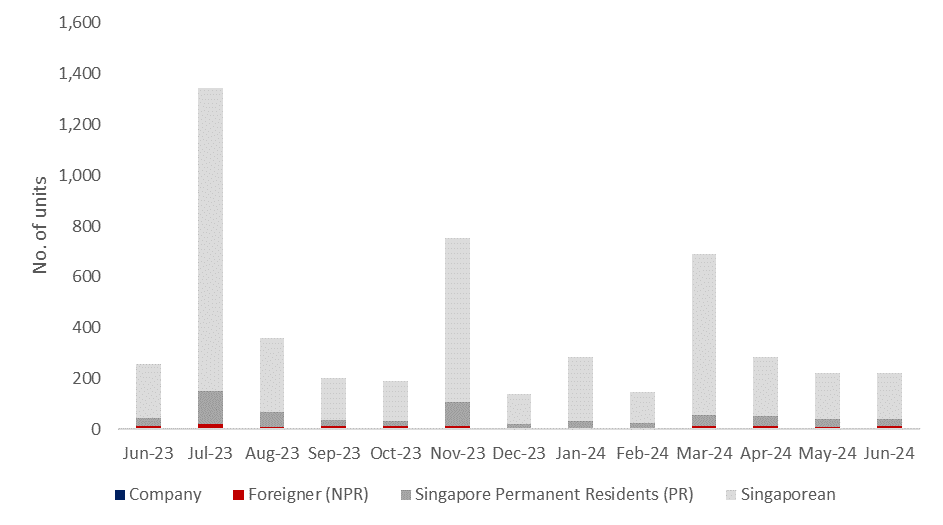

Foreign Buyer Activity

The doubling of Additional Buyer Stamp Duty rates for foreign buyers since April 2023 continued to curbed foreign buyer interest in Singapore’s residential property market on a large scale.

Only 11 caveats were lodged by foreign buyers in June 2024, and these transactions took place in the CCR and RCR market segments.

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA as of 15 July 2024, ERA Research and Market Intelligence

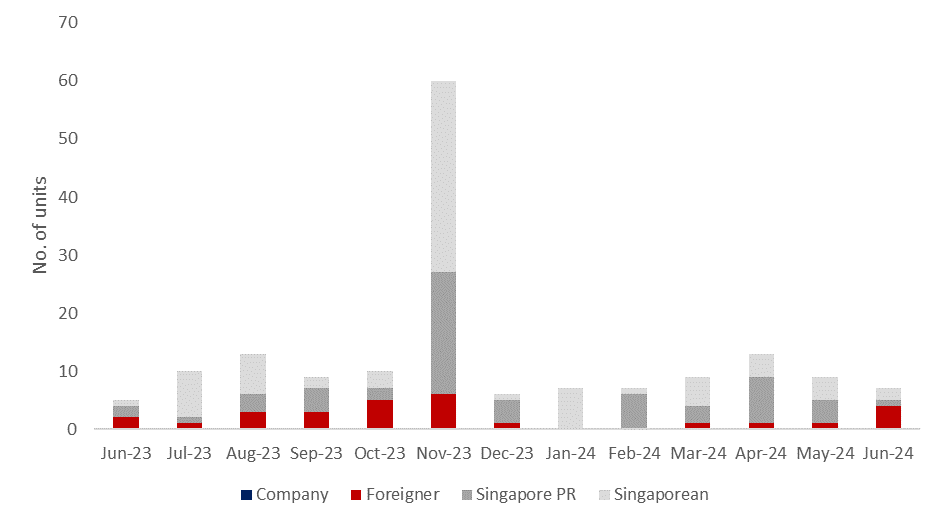

Luxury Homes $5m and above

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA as of 15 July 2024, ERA Research and Market Intelligence

In total, seven luxury homes ($5m and above) were transacted in June 2024. All of these transactions took place in the CCR. Of the seven luxury homes sold, four of them were purchased by foreigners, although from unspecified nationalities. The highest transaction was for a 1,808sqft unit at Midtown Modern, which was sold for $6,688,000, at $3,698psf.

What can we expect in 2H 2024?

Based on our observations, homebuying momentum is likely to pick up in 2H 2024 with the upcoming launch of highly anticipated new projects comprising Sora, Kassia, The Chuan Park, and Emerald of Katong.

In the 2H 2024, ERA expects the launch of approximately 17 new home projects, which will introduce around 8,400 new homes.

Factoring a softer labour and with higher-for-longer interest rates, ERA has revised our new home forecast to between 5,500 to 6,500 units by the end-2024, down from the previous forecast 7,000 to 8,000 units. New home price growth is expected to reach between 4% and 6% y-o-y by end-2024.