At present, Singapore’s shophouse market marks a departure from past performance, when transaction volumes were notably higher.

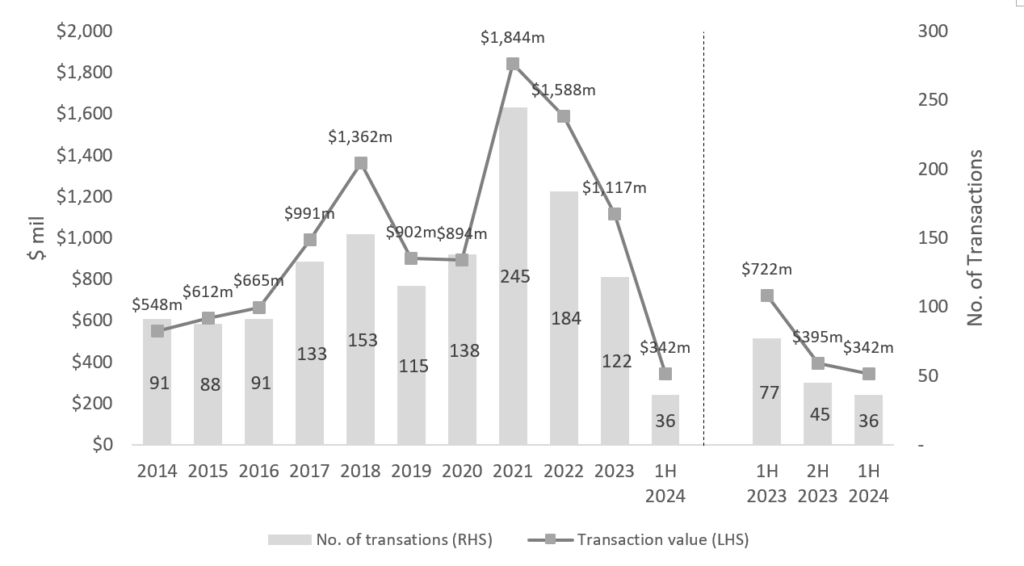

As of 10 July 2024, based on lodged caveats, only 36 shophouses changed hands in the first six months of 2024, amounting to a total transaction value of $341.7 m. This is a far cry from the market’s peak in 2021, which witnessed approximately 245 shophouses with a cumulative worth of $1.8 b being sold in a year.

Year-on-year (y-o-y), compared to 1H 2023, 1H 2024’s transaction volume and value moderation has declined by 53.3% and 52.7% on respectively; these results come on the back of a continued slowdown that initially started in 2H 2023, when only 45 shophouse units were transacted.

Preceding this slowdown, prices of shophouses were inflated by transactions made by buyers linked to the $3b money laundering cases, resulting in a frothy market. These buyers were willing to pay above-normal prices, and with their exit from the market, buying momentum slowed.

Presently, most shophouse sellers are not under distress and are in no hurry to sell. Moreover, with the exception of those facing foreclosure or money laundering investigations, most shophouse sellers have benchmarked their asking prices to past years.

Buyers, on the other hand, are waiting on the sidelines till shophouse prices ease to enhance their prospects for future capital appreciation. Additionally, buyers may also be biding their time due to higher-for-longer interest rates, which have exerted downwards pressure on yields.

Consequently, this mismatch in price expectations between shophouse buyers and sellers has led to a standstill in transactions.

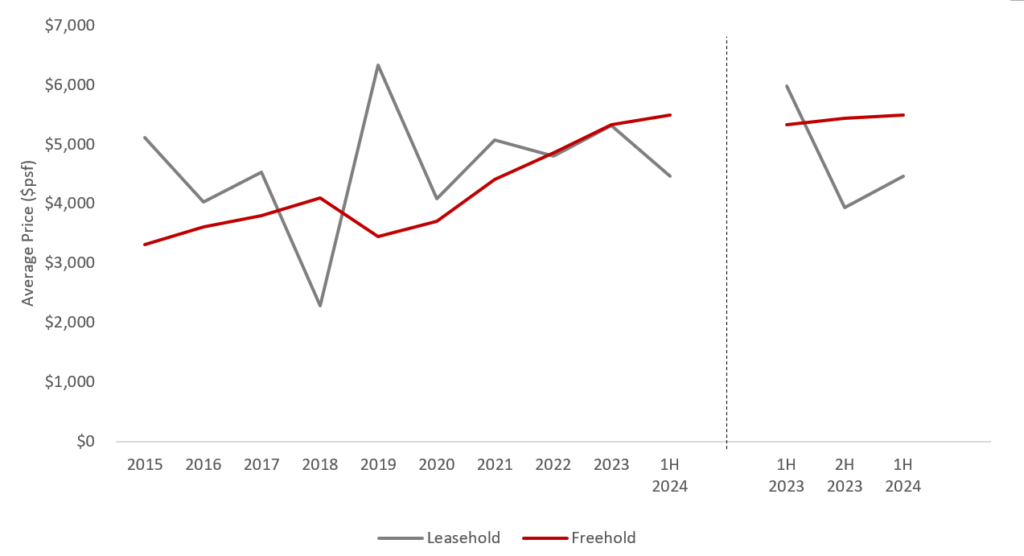

Freehold landed shophouse prices rise year-on-year, while 99-year leasehold counterparts see price decline

Chart 1: Transaction volume and transaction value of landed shophouses

Of the 36 shophouses transacted in 1H 2024, 86.1% (31 units) were of Freehold (FH), inclusive of shophouses with 999-year leasehold tenure.

Both these types of shophouses represent compelling investment opportunities, owing to their rarity. Furthermore, due to their immunity to lease decay, these properties are able to hold their value over the long term. A greater number of FH shophouses also contributes to price stability, as they are less susceptible to strong volatility.

Average prices of FH shophouses grew 2.0% y-o-y in 1H 2024. In contrast, 99-year leasehold shophouses saw just four transactions over the past half-year, with average prices falling by 76.7% y-o-y.

There have also been some notable deals made by high-profile family office investors and high-net-worth individuals who were willing to pay a premium. With lower sales, these higher value transactions have a more pronounced effect on average prices in the market.

One of the more notable shophouse deal was The Rail Mall, which Paragon REIT divested for $78.5m on 20 June 2024 to a private investor. The property has a remaining lease of 21 years 8 months.

Chart 2: Average PSF prices for landed shophouses

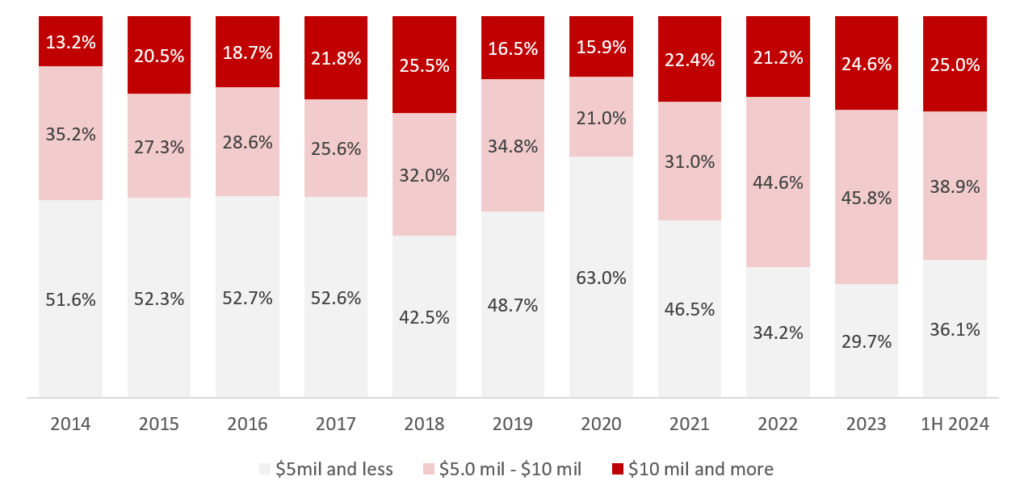

Higher proportion of shophouses transacted below price quantum of $5 million

Some 36.1% of landed shophouses transacted in 1H 2024 were sold for under $5m, while another 25.0% of transactions in the same period were made for $10m or more.

While overall transaction values in the market are falling, the limited supply of landed shophouses have kept demand resilient over the years. Being assets that see capital appreciation, this dip in landed shophouse prices may just be a slight blip as the market corrects.

Chart 3: Price quantum of landed shophouse in the last ten years

Singapore shophouse: An asset class that captivates foreign investors

The scarcity of landed shophouses, coupled with Singapore’s robust economy, stable political climate, and low tax regime, have led to these properties being coveted by institutional investors and family offices. Oftentimes as vehicles to achieve their clients’ goals of capital appreciation and wealth preservation.

Earlier in February this year, Business Times reported a high-profile landed shophouse deal, said to have been made by the spouse of Alibaba Group co-founder Jack Ma; having purchased three 99LH shophouses on Duxton Road with balance terms of 63 years.

The deal, which was understood to be worth a combined total of between $45 – $50m, will see the purchased units converted into mixed-use developments with ground-floor restaurants and upper-floor office spaces. The properties were originally acquired by their previous owner for a combined value of $22.2m in 2018.

Popularity of Central Region shophouses

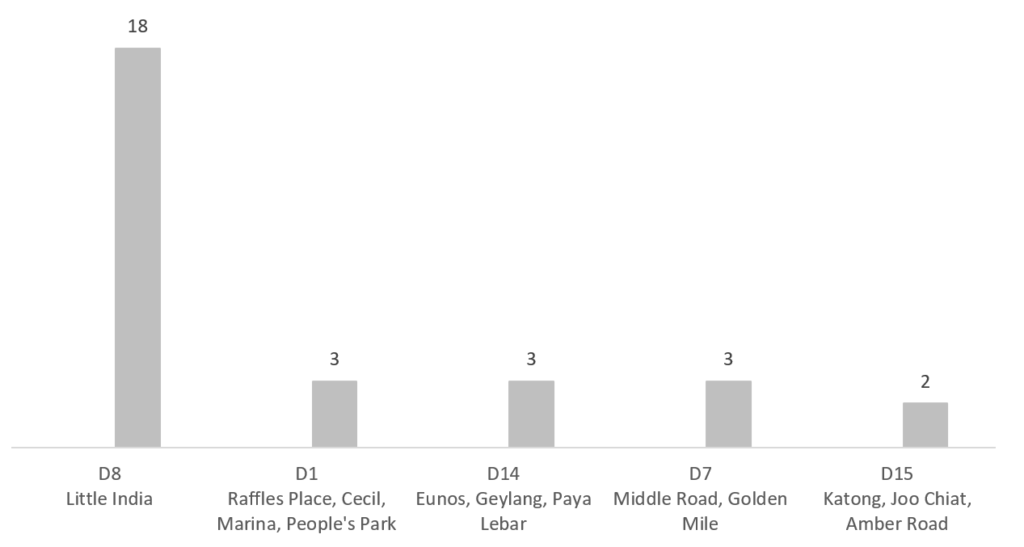

Among the 36 shophouses sold in 1H 2024, 33 were located in the Central Region – an area popular for eateries, fitness studios and co-living spaces. As such, owners of Central Region landed shophouses will likely be able to command higher rents on their properties.

District 8 was the most popular area for landed shophouse buyers, making up half (18 units) of the total transactions in 1H 2024. There could also be opportunities for value buys present in District 8, as seven of these transactions were transacted below $5m.

Chart 4: Top five districts by transactions volume in 1H 2024

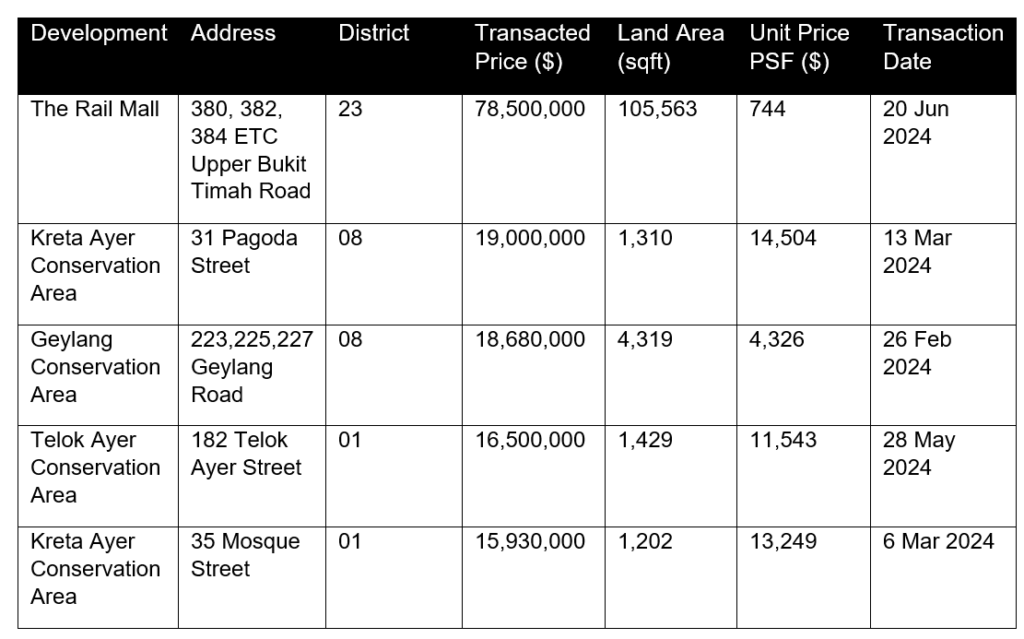

Table 1: Top five shophouse transactions in 1H 2024

Shophouse demand expected to remain subdued in 2024

Amid rising prices and softer yields, the demand for landed shophouses is expected to stay soft this year. However, their allure as proven assets that are low in supply may keep investors and institutional funds interested, assuming that interest rates start to come off in the coming months.

However, their allure as proven assets remain owing to their rarity and heterogeneity, as no two shophouses are identical. Furthermore, shophouses are zoned Commercial, they are not subject to Additional Buyer’s Stamp Duty and Seller’s Stamp Duty. Correspondingly, unlike residential properties, commercial shophouses have no restrictions on foreign ownership.

Owing to the abovementioned qualities, shophouses will still hold appeal for foreigners and entities, such as institutional funds, who wish to hold local property in their portfolios. As such, should interest rates come off, we can anticipate a growth in shophouse transaction volumes.

Furthermore, should banks put up more shophouses seized from money laundering cases at lower asking prices, we may witness a correcting effect on the market, subject to transaction outcomes.

Likewise, if the gap between sellers and buyers’ price expectations narrows, we are likely to see more shophouse transactions take place, albeit without any strong fluctuations in prices. Otherwise, a continued stalemate will lead to transaction volumes dwindling further.