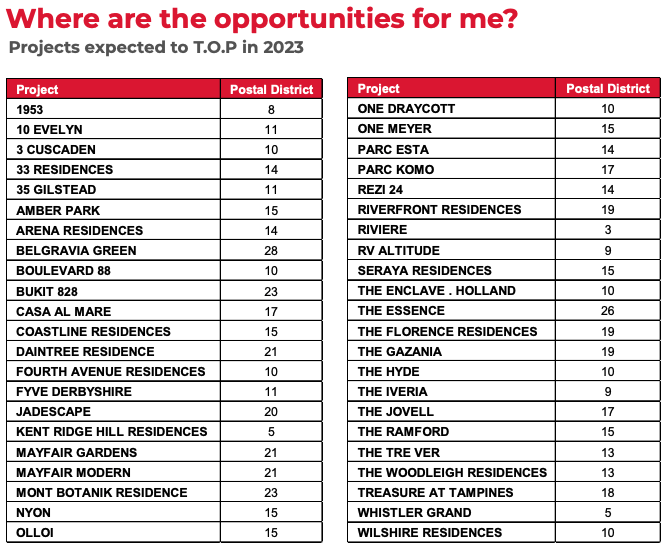

DEFINITION OF T.O.P

6 Jun 2023 – A Temporary Occupation Permit (TOP) is a government-issued document in Singapore that allows residents to live in a completed building or development project temporarily, while any final construction works are being completed. A TOP is required for property developers to hand over the units to the buyers, and it permits the buyers to occupy their new homes before the construction is fully completed. The process is handled entirely by the developers and units in the development would be handed over in batches. Upon receiving TOP, the purchaser can choose to either occupy the premises, rent or sell it on the resale market.

WHAT TO EXPECT UPON REACHING T.O.P?

Upon collection of the keys, the purchaser should anticipate two key factors that will significantly impact one’s finances.

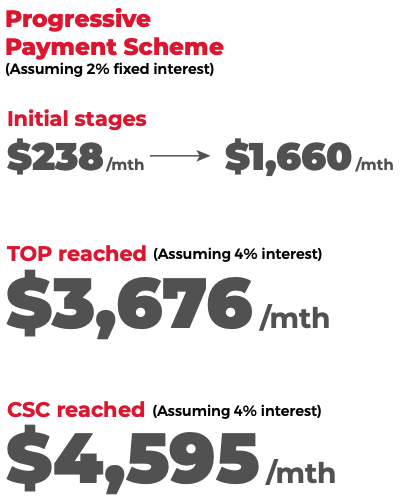

In the initial stages, buyers of new launches can benefit from the Progressive Payment Scheme (PPS) during the construction phase of their developments. This payment scheme is highly favoured by consumers as it allows them to progressively pay a range from 5% to 10% as more of the development is completed. Hence, their periodic repayments would be significantly reduced. However, it is important to note that repayments will increase substantially once the buyers’ units achieve TOP. Subsequently, monthly loan repayments will be based on a lump sum of 60% upon TOP and full 75% upon receiving the Certificate of Statutory Completion (CSC).

CASE STUDY BASED ON ACTUAL TRANSACTION

Based on the provided scenario, a buyer would only be required to make prepayments ranging from $238 to $1,660 per month during the progressive payment period. However, following the attainment of TOP, their monthly repayment will see a significant increase to $2,846 and $3,557 after CSC. The figures assume that the buyer’s loan remain at a fixed rate of 2% (according to the market rate in 2019). However, the actual loan repayments may be higher around $3,676 and $4,595 monthly if we factor in the market SORA rate after the end of the buyer’s lock-in period (assume 4%).

Option 1: Rent Out

Higher Property Tax

As of 1 Jan 2023, property tax rates have revised upwards together with annual values (AV) amidst a rising rental market for most residential properties. Owner-occupied properties remain to enjoy lower tax rates compared to non-owner-occupied properties. In this particular scenario, as Property A is being rented out, the tax rates for investment properties will be 11% to 27% in 2023, and further to 12% to 36% in 2024.

Therefore, it is important to be prepared to pay higher tax rates. For instance, if an owner-occupied property has an annual value of $55,000, the property tax amount would be $2,430. However, if the entire property were to be rented out, the tax amount would significantly increase to $6,200.

Maintenance Fees

Condo maintenance fees are usually paid quarterly in advance and are divided into two components: the sinking fund and management fund. The sinking fund covers non-recurring expenses for maintaining the condo’s condition and value, while the management fund covers recurring expenses like routine maintenance, cleaning, and security. Monthly maintenance fees vary based on the unit’s assigned share value, with larger units having higher fees. New mass-market condos usually have fees around S$70 to S$80 per share value.

For example, a 3-bedroom unit with a share value of 7 would be paying $70 x 7 = $490 monthly in maintenance fees. That is as much as $5,880 a year!

Higher Loan Repayments with Fluctuating Interest Rates

As mentioned earlier, once a property reaches its TOP, the monthly repayments will significantly increase. By taking into account interest rates fluctuations, mortgage payments can even be higher. In the current market, there is a possibility that interest rates could remain high, which could negatively impact your profit margins.

Option 2: Sell After Reaching T.O.P

Enjoy Capital Gains

There are a few reasons why a property will likely enjoy capital gains after reaching TOP. Firstly, homebuyers value more on tangible properties. Secondly, TOP condos are in a move-in ready state and thus can be rented out.

In the case study, Property A gained a whopping 22.4% profit between 2019 and 2023 (before paying off mortgage balance). The property attained TOP in 2022.

No Seller’s Stamp Duty payable

Once the property attains its TOP, it also signifies the completion of the Seller Stamp Duty (SSD) period. The SSD period lasts for 3 years. The rate of SSD can be as high as 12%, depending on the timeframe of property disposal. If you sell the property within a year of acquiring it, you would be required to pay the full 12% of the property’s market value as SSD. However, once TOP is reached, usually after 3 years, this cost will no longer be applicable.

No More Hefty Mortgage Payments

The monthly mortgage payments for property A will substantially increase upon reaching its TOP stage. However, one can effectively mitigate this situation by opting to sell their property by then, settling the remaining loan amount and reaping the benefits of capital gains. By repeating this process and investing in a new launch, you can enjoy the advantage of progressive payments during the initial years.