TRANSACTION VOLUME

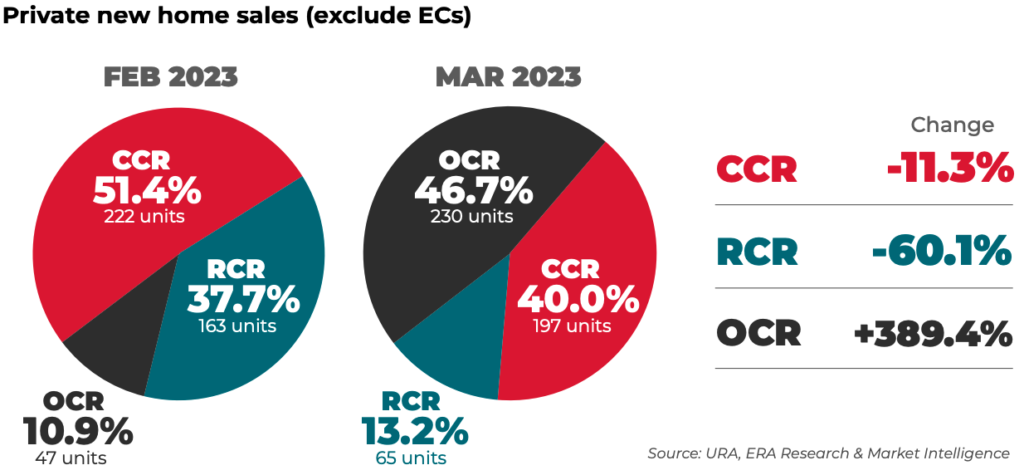

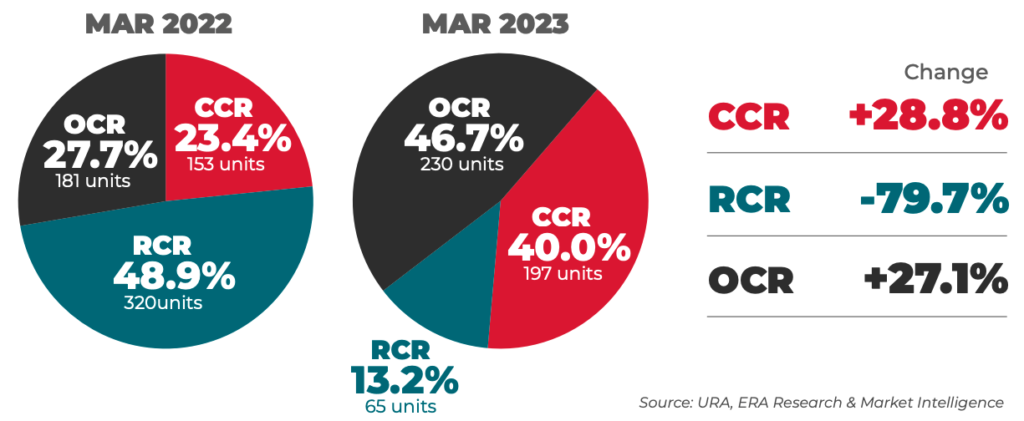

17 April 2023 – Developers observed higher sales in the month of March as new private home sales (excluding Executive Condominiums) rose by 13.9% month-on-month (mom) from 432 to 492 units. On a year-on-year (yoy) basis, private home sales contracted by 24.8% from 654 units in March 2022.

Unlike the low of 47 Outside of Central Region (OCR) units sold in Feb 2023, the OCR market recorded the highest number of units sold in March 2023. Sales in the OCR market was primarily bolstered by the launch of The Botany at Dairy Farm. Even though there was no new launch in the Core Central Region (CCR) market, a total of 197 prime units were sold in March 2023. This may signify an underlying demand for CCR homes. Among all three market segments, the Rest of Central Region (RCR) market was lacklustre with sales declining sharply by 60.1% mom and 79.7% yoy.

PRICE

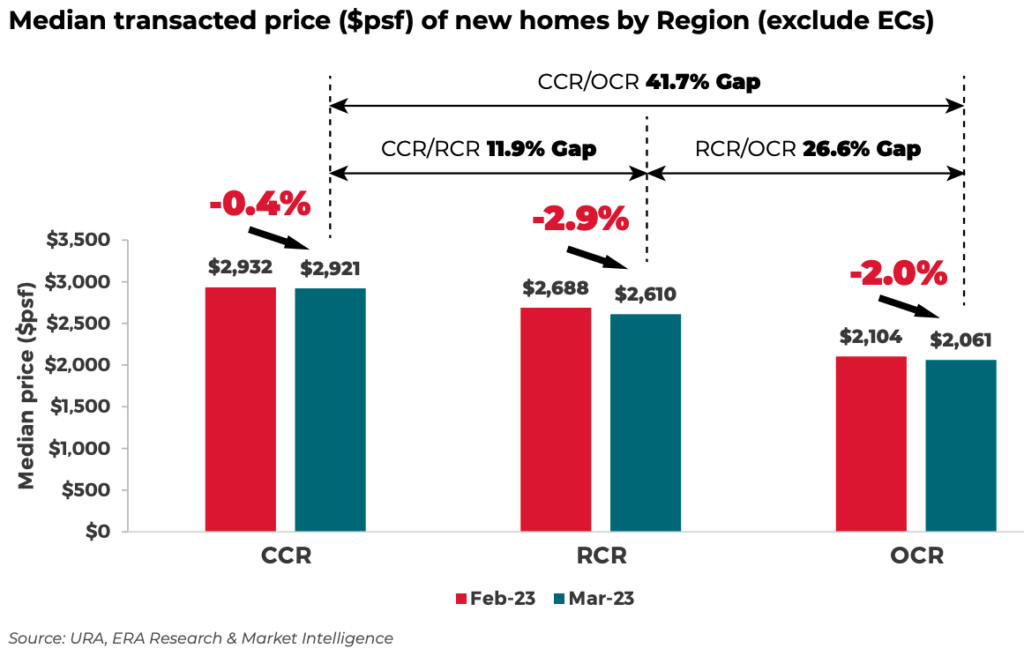

The median transacted prices of new sales in all the market segments contracted in March 2023. Prices of new homes in the RCR market softened the most with a drop of 2.9% mom. The price correction was least significant in the prime CCR market with only a 0.4% decline. This resulted in a reversal of the narrowing price gap for CCR and RCR homes from 9.1% to 11.9%.

The property market bull run in the last two years have displayed signs of slowing down due to present issues of economic headwinds, high interest rate environment and global uncertainties. Nonetheless, the brisk sales of The Botany at Dairy Farm may offer developers some respite, as it is a clear indication that underlying demand continues to persist in the market.

NEW LAUNCH IN THE MASS MARKET SEGMENT

Despite challenging conditions, there is still demand for new properties. The launch of The Botany at Dairy Farm observed a satisfactory take-up rate of new sales in the mass market segment. Out of 386 units, the project moved almost 50% of its total units during the weekend launch. This propped up total private residential sales (excluding ECs) in the OCR market, with a 46.7% mom jump to a total of 230 units sold in March 2023.

Based on our research, the 1-BR and 2-BR units saw a robust take-up rate. These smaller units are highly favourable among investors and smaller families due to the lower price tag from around $1 to $1.6 million which fits perfectly within most homebuyers “sweet spot” range from $1.5 to $3 million. For buyers with children or those who value larger spaces arising from the new hybrid work culture, this group of buyers tend to deviate towards the 3-bedroom units.

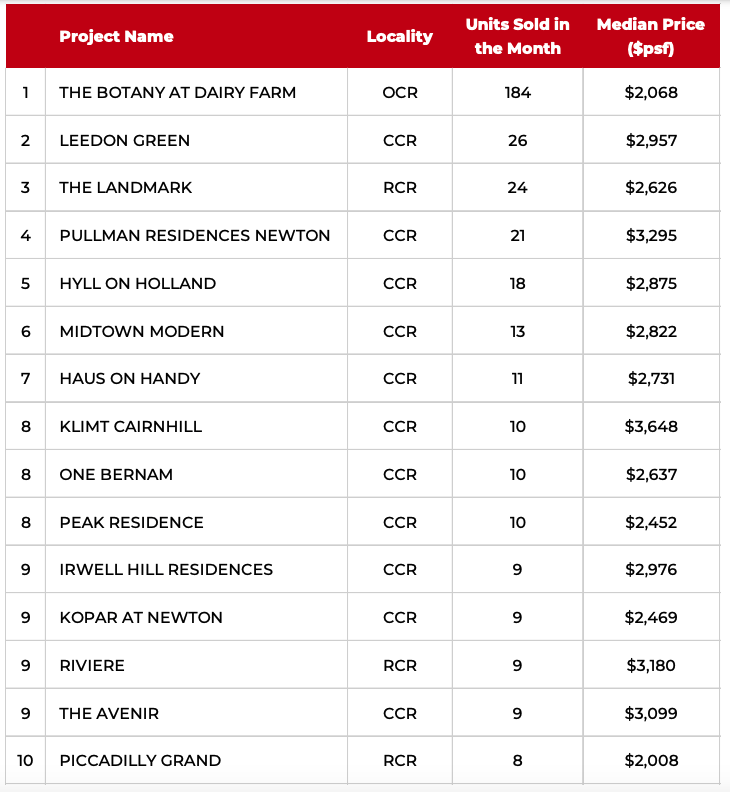

TOP 10 BEST SELLING

PRIVATE RESIDENTIAL PROJECTS

It comes as no surprise that The Botany at Dairy Farm emerged as the top best-selling project in March 2023. What may raise some eyebrows would be that a sizeable number of these projects are prime properties located in CCR market. For example, 26 units in Leedon Green were sold at a median price of $2,957, leaving only a mere 12.5% or a total of 80 units unsold.

Due to the measured price growth of CCR properties in the last few quarters, a growing proportion of investors or homebuyers may find it an opportune time to enter the prime market segment.

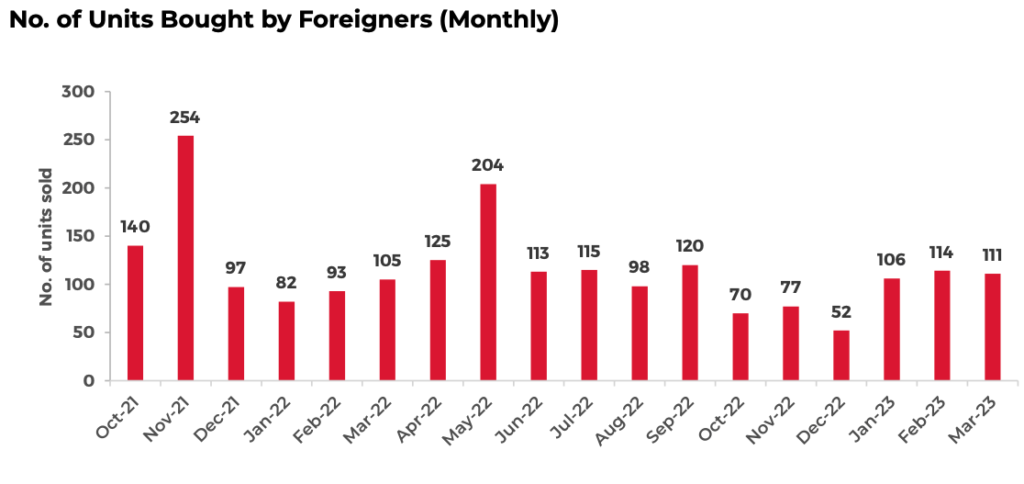

ANTICIPATED DEMAND FROM FOREIGN BUYERS

Foreign demand continues to remain present as the overall market recorded a total of 111 units purchased by Non-Permanent Resident (PR) foreigners. The number of transactions made by foreigners have been hovering at a higher level than the 52 units sold in December 2022. The volume is anticipated to increase on the re-opening of China as more high net-worth individuals and foreign firms set foot upon Singapore. Given the city’s business-friendly environment, elevated living standards, and position as a key entry point to the Asia-Pacific region, foreigners looking to be shielded from risks, tensions and uncertainties may continue to seek property investments in Singapore.