New home sale fell with muted project launches in Sep-2023

Some 217 new homes were sold in September 2023, which marked an 87% fall a year ago. There was only 119 units launched, a significant decline from the 913 units launched in September 2022. Only one new project was launched in September – The Shorefront (OCR) comprising 23 units. Due to the lack of projects launching, only 217 units were sold in September 2023.

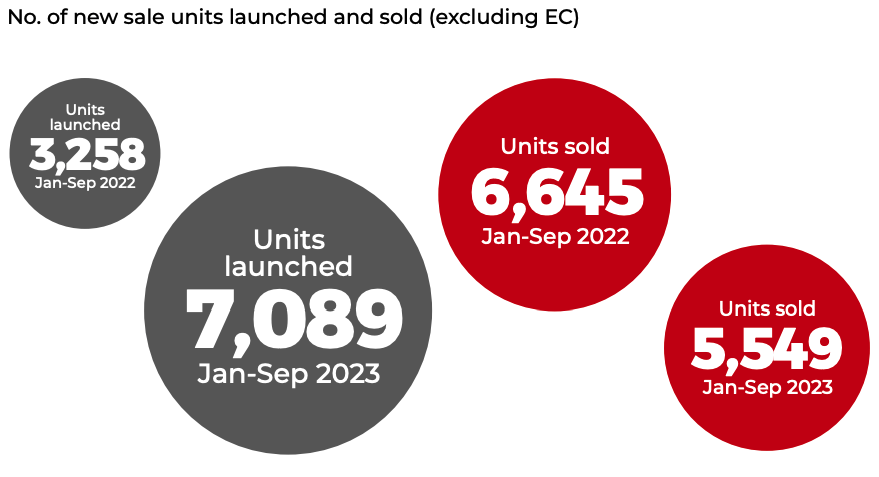

Number of units launched and sold

Collectively, the number of units launched (excluding EC) from Jan-Sep 2023 stood at 7,089 which is more than double the units launched in the same period 2022.

Meanwhile, a total of 5,549 new home units (excluding EC) were sold from Jan-Sep 2023, working out to 16.5% lower than the same period in 2022.

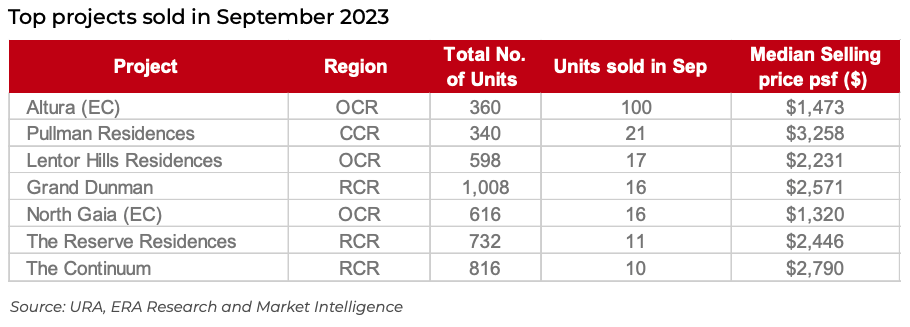

Demand for EC remains strong

There was a total of 118 EC transactions in September 2023. Altura, is the only EC launch in 2023. In September, the unsold units were open up to second-timers and another 100 units were sold, increasing the total take-up rate to 88%. Altura has set a new benchmarked EC pricing of $1,585 psf. North Gaia, previously launched in April 2022 also moved 16 units in September, taking the total to 270 (43.8%).

Anticipated demand for launches in 4Q 2023

There are a few upcoming developments that are slated to be launched in the last quarter of the year at popular locations giving buyers more choices. Some notable projects are J’den in Jurong East (OCR), Hillock Green (OCR) in Lentor and Watten House in Bukit Timah (CCR). Buyers may be waiting out to consider their options when more developments are launched before making a final decision.

Top selling development and district

The top selling project (excluding ECs) in September was Pullman Residences, making up 21 of 24 units sold in District 11. Based on URA REALIS data, 18 of the 24 transactions were by Singaporeans, 3 were PRs and 3 were by foreigners. Pullman Residences is expected to receive the Temporary Occupation Permit (TOP) this year. Buyers who want a new development without waiting 3-4 years for construction will look towards those that have recently or will be getting the TOP soon.

District 15 was the highest selling district with 32 transactions, of which 84% were by Singaporeans and 16% were by PRs. The district sold at an average price of $2,577 psf, buoyed by strong sales at Grand Dunman and The Continuum.

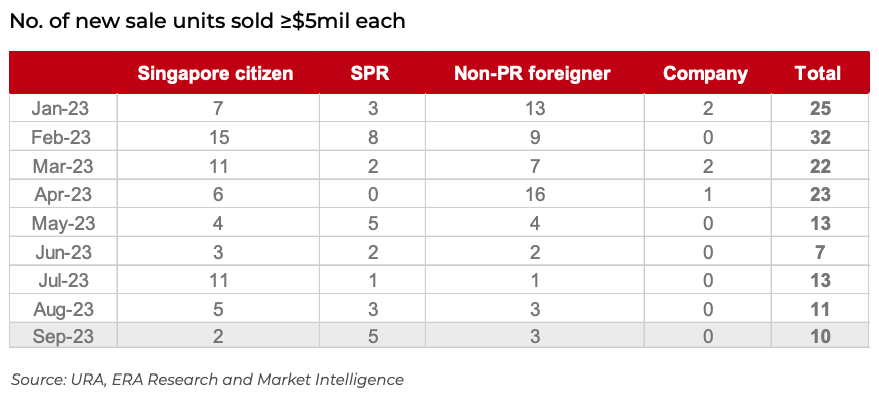

New home sales by price quantum

New sale units priced between $1 to $2.5 million continues to take up the bulk of the transactions (64.1% in September 2023)

New home sales by resident status

Singaporean buyers still take up more than 80% of transactions. However, despite the higher Additional Buyers’ Stamp Duty (ABSD) rate on foreigners, there were 13 transactions made. The proportion of foreign buyers have crept up by another 1.3% in September 2023.

Luxury Property Market

There were 10 transactions for new homes priced S$5 million and above amid higher interest rates. One unit at Terra Hill (RCR) sold for $5.34 million ($2,819 psf), with the remaining nine units from the CCR, priced $3,106 psf and above. Only one unit sold for above $3,000 psf in the RCR segment, a 678 sqft unit at The Landmark for $2.11 million ($3,108 psf).

Due to the higher ABSD rates, foreign buyers have stayed away from the luxury property market which have a higher quantum for now.

The highest transacted property by a foreign buyer is a 2,164 sqft unit at Dalvey Haus (CCR) for $7 million. The development received TOP in December 2022.