Following April’s 57.7% month-on-month (m-o-m) fall in new sale numbers, May 2024 saw a further decline of 25.9% m-o-m to 261 units (including Executive Condominiums (ECs)). This is on the back of the launches of smaller developments such as Skywaters Residences (198 units) and two boutique projects – Straits at Joo Chiat (16 units) and Jansen House (20 units).

A total of 248 new private homes were launched in May, compared to 278 units in April. This marked a 10.8% m-o-m decrease. Correspondingly, a total of 221 new homes, excluding ECs, were sold, registering a 26.6% m-o-m decrease.

EC sales momentum slowed in May 2024, with 40 units sold. With no new EC launches since January 2024, buyers are snapping up the remaining units of current EC stock. North Gaia (19 units) and Lumina Grand (20 units) accounted for 97.5% of EC units sold, with the other sold unit from Provence Residence.

EC stock fell to only 299 new EC units remaining across the five projects – North Gaia, Altura, Lumina Grand, Parc Greenwich and Tenet. Demand for ECs is likely to stay subdued until the current stock of limited options is fully sold, given the limited selection. The next ECs will likely only be launched in early-2025. as the Plantation Close and Tampines Street 62 (Parcel B) sites were awarded in September and October 2023 respectively.

Performance of New project launched in May

Jansen House moved three units at a median transacted price of $2,098 per square foot (psf) while Straits at Joo Chiat ($2,091 psf) moved two units. Boutique developments typically cater to a specific buyer profile, such as those who prioritise exclusivity and a quieter living environment without the need for facilities. While they have a lower price compared to larger developments in the same area, boutique developments may not be the most accessibly located. Moreover, these two developments launched were either of freehold or 999-year leasehold tenure, which may cater to the needs of buyers looking for legacy assets.

Skywaters Residences is located in the Downtown Core. Based on URA caveats lodged, there was one transaction in May, a 7,761 sqft unit to a foreign buyer for $47.3 million ($6,100 psf). Till date, this is the highest recorded psf for a 99-year leasehold property in Singapore.

Top performing projects in May

Excluding ECs, all five top performing developments were found in District 23 (Bukit Batok, Bukit Panjang) or District 26 (Mandai, Upper Thomson) of the Outside Central Region (OCR).

Lentor Hill Residences was the best-selling project in April, with 25 units sold at a median price of $2,164 psf. The development has now sold 88.1% of its 598 units. Following Lentor Mansion’s launch in March at benchmark prices in the Lentor Hills Estate, there was an uplift in prices for the surrounding developments that were launched previously. The median price psf for Lentor Hills Residences’ increased from $2,114 psf in March to $2,164 psf in May 2024. Similarly, Hillock Green also moved another 21 units at a median price of $2,128 psf, increasing from $2,109 psf in March.

Homes in District 23 ($2,047 psf) and 26 ($2,176 psf) presented value buys for new home buyers as their median prices are below the island-wide median of $2,206 psf (excluding ECs) in May 2024.

ECs continue to provide a strong value proposition for buyers due to the subsidies provided. However, with no new EC launches till early-2025, buyers will continue to take up existing units in the market, seen from the moving of 39 units from Lumina Grand and Altura.

Table 1: Best performing developments in May 2024

Source: URA as of 18 June 2024, ERA Research and Market Intelligence

Buyer Profile

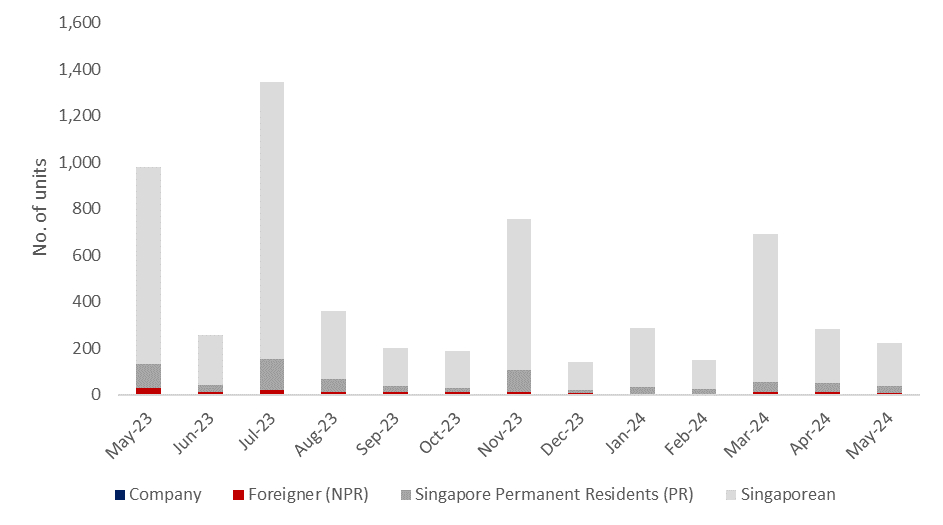

Singaporeans made up the majority of new non-landed home buyers (82.5%) in May 2024, marginally lower than the 82.3% in April. Foreign buyers accounted for another six transactions (2.7%).

May 2024 also marks one year since the doubling of Additional Buyer Stamp Duty rate for non-permanent resident (PR) foreign buyers to 60%. Between June 2023 and May 2024, foreign buyers only accounted for an average of 3.1% of total new sale buyers each month. This is significantly lower than the previous 12-month period, where foreign buyers accounted for an average of 11.2% of new sale transactions each month.

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA as of 18 June 2024, ERA Research and Market Intelligence

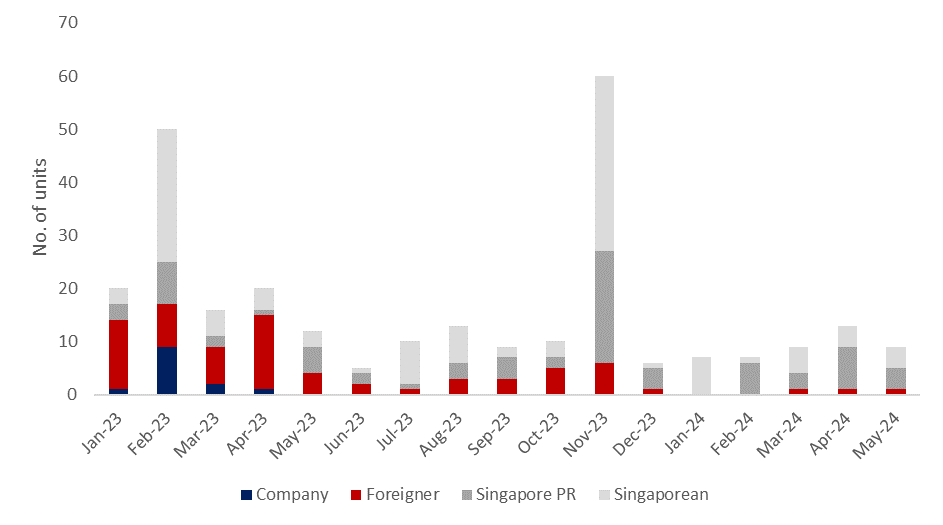

Luxury properties (non-landed home $5 mil and above)

Nine luxury new homes were sold in May 2024. Of these nine units, four were purchased by Singaporeans, four by Singapore Permanent Residents (SPRs), and one by a non-PR foreigner. The luxury home purchased by the foreigner was a 7,761 sqft unit at Skywaters Residences that transacted for $47.3 million, wherein the buyer shelled out $28.4 million for the ABSD.

These nine transactions were across six different developments in the Central Region. Seven of them were in the Core Central Region (CCR) while two are in the Rest of Central Region (RCR). The two luxury home transactions in the RCR were at The Reserve Residences, which has sold 93.7% of its 732 units since its launch in May 2023. Despite being in the city fringe, buyers are willing to pay a premium for large sized units in an integrated development which offers convenience and easy accessibility.

19 Nassim and Watten House also moved another two luxury home units each, owing to the fact that they are developments with prestigious addresses that are attractive to high net worth buyers.

Chart 2: Buyer profile for home $5mil and more

Source: URA as of 18 June 2024, ERA Research and Market Intelligence

New home sales momentum to remain slow in June with no new launches slated during the school holiday month

June 2024 will likely continue to see subdued sales as there are no expected launches. Moreover, the school holiday period seasonally sees more subdued sales as more people travel out of the country

New home buying activities could only start picking up in 2H 2024. Kassia (280 units) and Sora (440 units), two small-to-mid sized developments in Changi and Jurong Lake will be open for booking in July 2024. Moreover, highly-anticipated large projects such as The Chuan Park and Emerald of Katong slated for launch in 3Q 2024 are expected to capture the interest of home buyers and boost new home sales.

For now, buyers are cautious and remain sensitive to overall price quantum especially since interest rates are likely to stay elevated for longer. The initial forecast of rate cuts may be delayed further into 2024, given the persistent high inflation rate in the US. However, we could see the return of buyer interest once the rate cuts are implemented in the later part of the year.