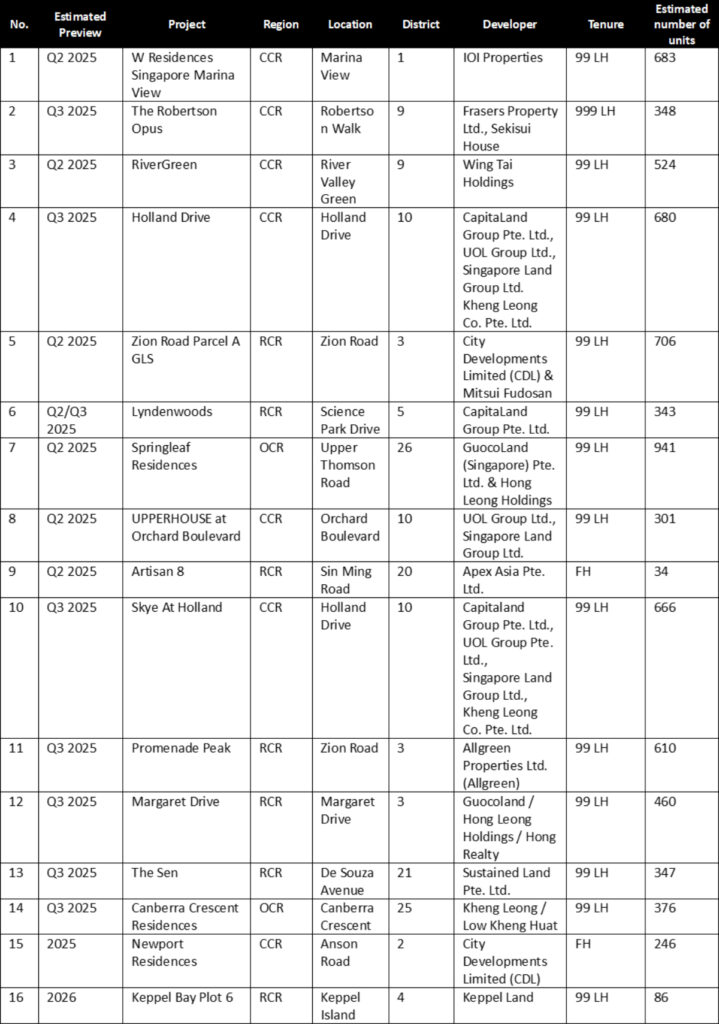

In May 2025, developer sales reached 312 new private homes (excluding ECs), reflecting a 52.9% month-on-month (m-o-m) decline. The lower number of new home sales in the month could be attributed to a lack of new launches.

Likewise, the executive condominium (EC) market saw 25 units sold in May amid a quiet month.

A total of 4,376 new private homes (excluding ECs) were sold in the first five months of 2025. This figure far exceeds the 1,476 units sold over the same period in 2024. With the launch of Arina East Residences on the first weekend of June, this total has reached 4,178 – although it is unlikely to increase by much, given that developers prefer not to launch new developments during the month of June, where families are often overseas for the school holidays.

Table 1: New home sales over the last six months

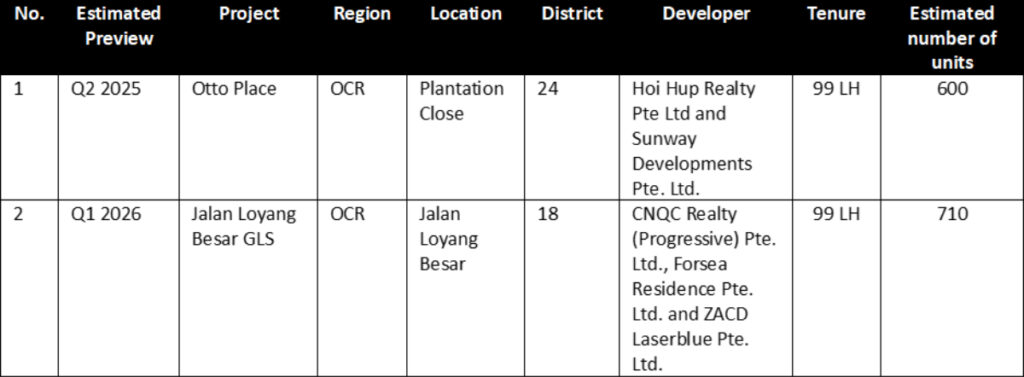

While there were no new launches in the month, we noted that the duo of projects launched last month, One Marina Gardens (63 units sold) and Bloomsbury Residences (32 units sold) to be the top two best-sellers, alongside The Hill @ One-North in third place (26 units sold).

Best Performing New Launches

Table 2: Top ten performing new launch project (excluding ECs) in May

One Marina Gardens continues to attract investment buyers a month after its debut

One Marina Gardens’ launch in April marked the first-ever residential project to debut in the Marina South precinct. The 99-year leasehold project by Kingsford Group drew significant interest from owner-occupiers and investors alike, particularly those interested in securing a first-mover advantage in an emerging growth location.

Following its launch in April, which saw a 41% take up rate (384 of 937 units sold), we witnessed a further 63 units sold in May, putting the project at 47.7% sold to conclude the month.

In the month, 56 of 63 (88.9%) of units sold were 721 sqft and smaller in size, in 1- and 2- bedroom configurations. The buyer group for units of this sizing are most commonly investment buyers, who felt draw in by the in a new RCR location.

A few attributes stand out about the project that might have compelled these investment buyers, such as proximity to Marina South MRT station, especially when compared to other sites in the Marina Gardens precinct. With regards to the overall precinct, it is also envisioned as a ’10-minute neighbourhood’ where residents can satisfy their live, work, and play needs with just a short walk.

According to caveats lodged for the purchases of these 1- and 2-bedroom units, we found that they transacted at a median price quantum of $1.27 million. This price point presents a compelling entry-level opportunity for first-timer upgraders targeting a Rest of Central Region (RCR) property located close to Singapore’s downtown core.

Bloomsbury Residences sees encouraging sales with two-bedders snapped up

Bloomsbury Residences is the first private residential project to debut within the new Media Circle precinct. The project, located in the new car-lite district sold an additional 32 units in May, raising the tally to 147 of 358 (41.1%) of units sold to date.

We saw considerable interest for investor-sized units in May, moving 29 1- and 2-bedroom units under 689 sqft. Units at Bloomsbury residences offered a great value proposition, particularly for 2-bedroom units. These transactions saw a median price of $1.66 million, which was below the RCR median price of $1.79 million for units between 600 and 700 sqft in size in the month. This pricing could be seen as attractive and palatable for buyers looking for a 2-bedroom unit.

Additionally, buyers were likely to have been drawn in by a mix of factors – including the opportunity to be early movers into the Media Circle precinct, as well as one-north’s long-term potential as a multi-sector business hub in the city fringe.

The Hill @ One North sees more larger units sold amidst higher price quantum

In the month, 16 out of 26 units sold were 1,022 sqft and bigger, which comprises of 3-bedroom, 3-bedroom + study and 4-bedroom configurations. Based on in house data (ERAPro), as of 13 June 2025, all 4-bedroom units have been sold out. The buyer group for units of this sizing are most commonly families with school going children.

The rise in uptake of 3 and 4-bedroom configurations can be attributed to its locational attributes. The Hill @ One North is near Buona Vista MRT station and one-north MRT station, both of which are within 7 mins walk from the development. The development is also close to educational institutions such as Anglo-Chinese Junior College, which is just 5 mins walk away.

Executive Condominiums (EC)

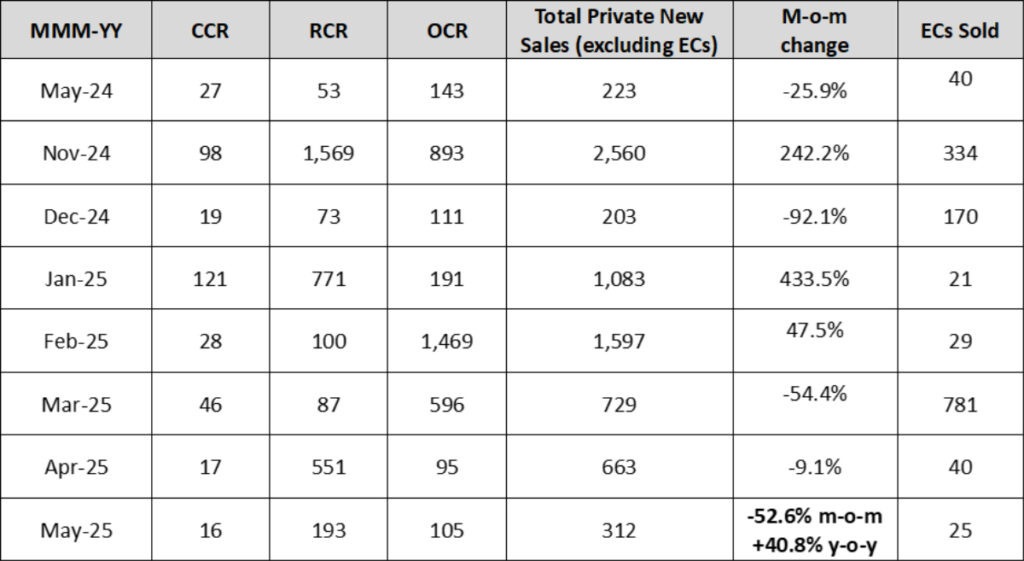

This lack of available stock should create substantial demand for the launch of Otto Place at Tengah Plantation Close, which is expected to launch in 3Q, as early as in July. This is especially considering the warm reception that the neighbouring EC, Novo Place received upon its launch late last year. EC supply will be further bolstered by the currently unnamed project at Jalan Loyang Besar, which could launch in 4Q 2025.

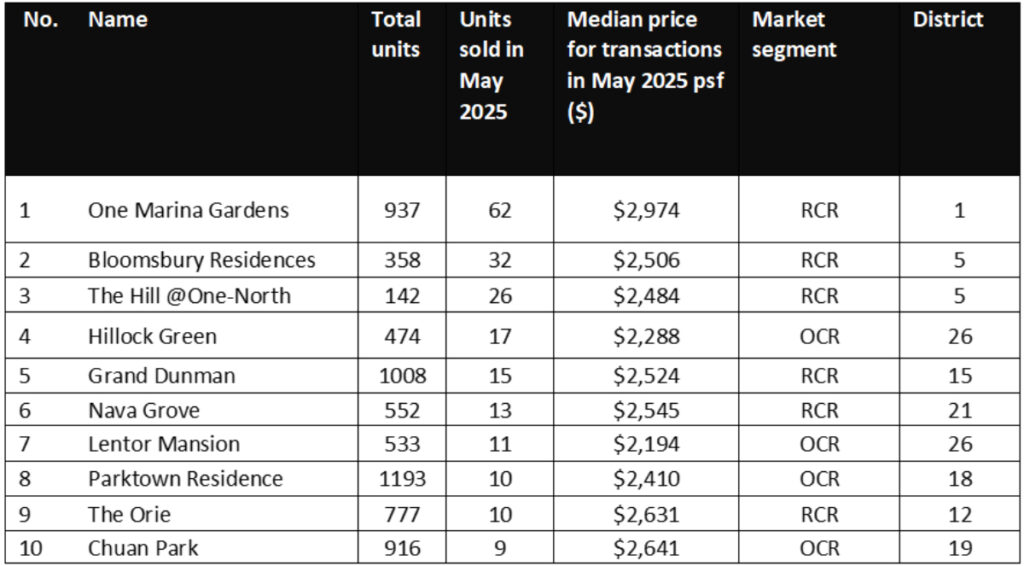

Buyer Profile

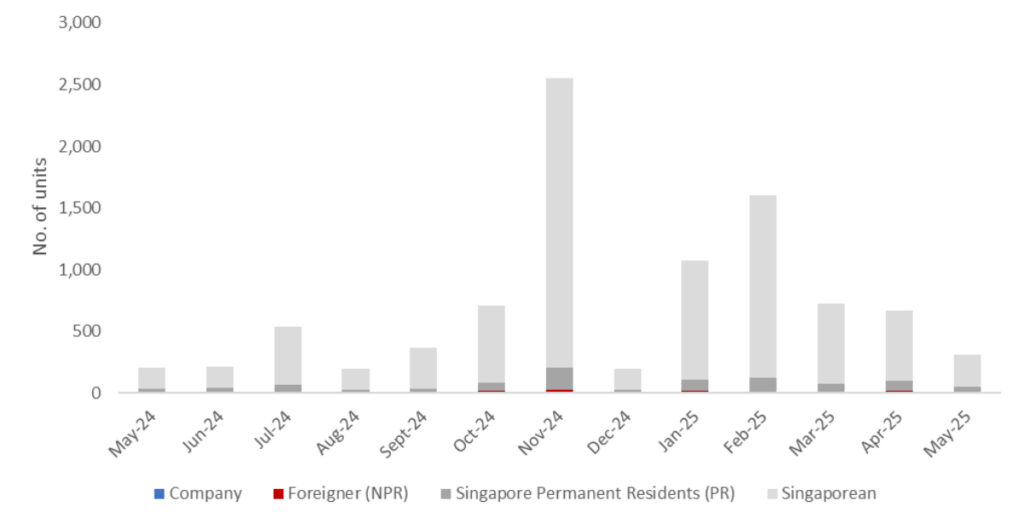

Chart 1: Buyer profile for all new non-landed homes excluding ECs

With the punitive Additional Buyer’s Stamp Duty still in effect, foreigner demand for new private homes continued to stay flat. May saw a total of seven transactions made by foreign buyers, making up just 2.2% of the month’s total deals. Meanwhile, Singapore Permanent Resident (SPR) buyers clocked 45 transactions in April, accounting for 14.4% of all new private home (excluding ECs) purchases in the month.

Lastly, Singaporeans continued to dominate the market in April, accounting for 261 transactions or 83.4% of total new private home sales (excluding ECs) for the month.

Luxury Homes

Chart 2: Buyer profile for homes transacted at $5mil and more

In May, the luxury home market saw a slight increase in activity with 14 new home transactions priced at $5 million and above. Luxury property purchases in the month were primarily driven by locals and Singapore Permanent Residents (SPRs), accounting for seven transactions each respectively. In contrast there were no purchases by foreigners.

The top three luxury transactions were made by three SPRs, and they all involved freehold ultra-luxury homes at 21 Anderson and 32 Gilstead. The units transacted at these developments were all four-bedders, albeit with large floor sizes of approximately 4,500 sq ft. Said luxury homes also sold for amounts ranging from $15.1 mil to $24.0 mil.

However, Watten House emerged as the most popular development for new luxury home transactions in May 2025, accounting for four out of 14 luxury transactions.

Buyers seeking high-end properties may be drawn to homes such as 21 Anderson, 32 Gilstead and Watten House due to their coveted address within one of Singapore’s most prestigious districts. These projects share desirable traits amongst luxury home buyers, who often look for a freehold tenure, as well as a small unit count – a sign of heightened privacy and exclusivity. Furthermore, these are the most sensible home for wealthy PR buyers who are locked out of buying a landed home in Singapore.

Closing Thoughts and Forecast

Since early April, shifting trade policies implemented by U.S. President Donald Trump have dampened economic sentiment globally, while also prompting some property buyers to adopt a wait-and-see approach in the face of uncertainty. They might be also waiting for higher profile projects such as Robertson Opus, Lyndenwoods and Upperhouse to be launched later in the year.

In a turn of events, the U.S. and China begun engaging in a series of trade talks in Geneva, resulting in a joint agreement to roll back tariffs for a 90-day period as both sides continue negotiations aimed at mitigating ongoing trade tensions. While this outcome falls short of a definitive resolution and uncertainties still loom, it offers a glimmer of hope for de-escalation, suggesting that both nations may be steering away from a full-blown fallout.

Amidst this ongoing global uncertainty, Singapore’s property market remains grounded in stable fundamentals, that anchor real estate activity in genuine housing needs, rather than speculative motivations.

The next month, June, should see similar performance to May, as it is the seasonal lull with families choosing to travel during this school holiday season. We can expect a rebound in the market in July, where projects will start launching again, notably the EC project, Otto Place – which is expected to replenish the remaining EC stock of 30 units.

Overall, ERA Singapore projects 8,500 to 9,500 new homes to be sold for the whole of 2025.

Table 3: Upcoming new project launches for 2025