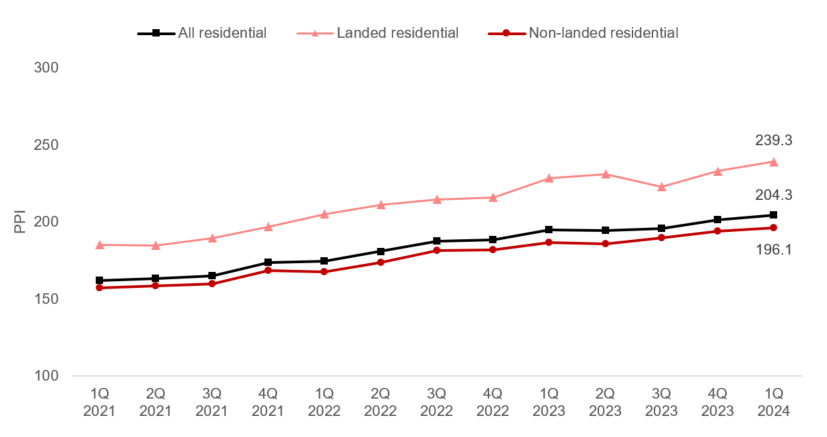

The All-residential Property Price Index (PPI) reported a modest increase in 1Q 2024, registering a 1.4% quarter-on-quarter (q-o-q) and 4.9% year-on-year (y-o-y) growth.

The non-landed PPI grew 1.0% q-o-q and 5.0% y-o-y. The price growth was largely buoyed by Core Central Region (CCR) non-landed home prices, which grew 3.1% q-o-q. Two units at The Ritz-Carlton Residences sold for $5,397 per square foot (psf), while another unit at Ardmore Park transacted at $4,472 psf, which have helped propped CCR home prices.

In a similar vein, non-landed homes in the Rest of Central Region (RCR) and Outside Central Region (OCR) saw more moderate price growth of 0.3% and 0.2% q-o-q respectively.

Chart 1: Singapore Residential Price Index

Source: URA, ERA Research and Market Intelligence

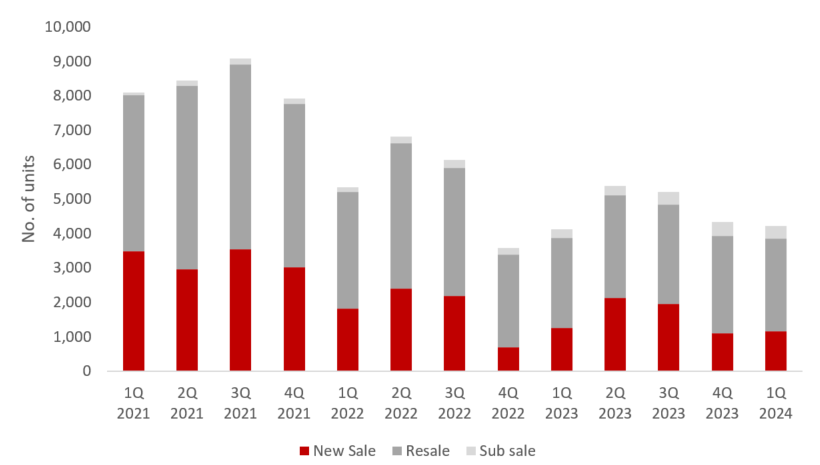

Chart 2: All Residential Transactions

Source: URA, ERA Research and Market Intelligence

Total transaction volume (excluding ECs) fell 2.4% q-o-q, but rose 2.6% y-o-y in 1Q 2024. OCR transactions accounted for 65% of the total transactions, this is the highest seen since 3Q 2016.

The 1Q 2024 typically sees slower transaction volumes due to festivities. But more significantly, more prospective homebuyers may be holding back on home purchase plans in view of the stronger economic headwinds, geopolitical instability, rising retrenchment exercises and higher-for-longer interest rates.

New Sale

In 1Q 2024, developers launched 1,304 uncompleted residential units (excluding ECs) for sale, compared to the 1,060 units in 4Q 2023. Separately in the same quarter, another 512 EC units were also launched for sale.

In the first three months of 2024, five new projects and one Executive Condominium (EC) project were launched. Four of these projects are in OCR while the other two are in RCR.

New home sales fared better in 1Q 2024, rising by 6.6% q-o-q. Developers sold 1,164 private residential units (excluding ECs) in 1Q 2024, compared with the 1,092 units sold in the previous quarter. However, this was still 7.3% lower y-o-y.

The highlight in new sale was the successful launch of Lentor Mansion, which achieved 75% sales, 409 units out of 533 units, on its launch weekend. Lumina Grand, which is the sole EC launch in 2024, sold 370 units in 1Q 2024.

The successive project launches in the preceding months may have led to decision paralysis among some buyers. This is evident as the number of uncompleted unsold private residential units jumped 17.8% q-o-q to 19,936 units in the 1Q 2024, and OCR accounted for 38.6% of the unsold stock.

Resale and Sub-sale

There were 2,689 resale transactions 1Qr 2024, compared with the 2,831 units transacted in the previous quarter. Resale transactions accounted for 63.6% of all sale transactions in 1Q 2024, compared with 65.3% in the previous quarter.

A total of 377 sub-sale transactions were recorded in 1Q 2024, falling by 8.3% q-o-q as more projects attaining completion status.

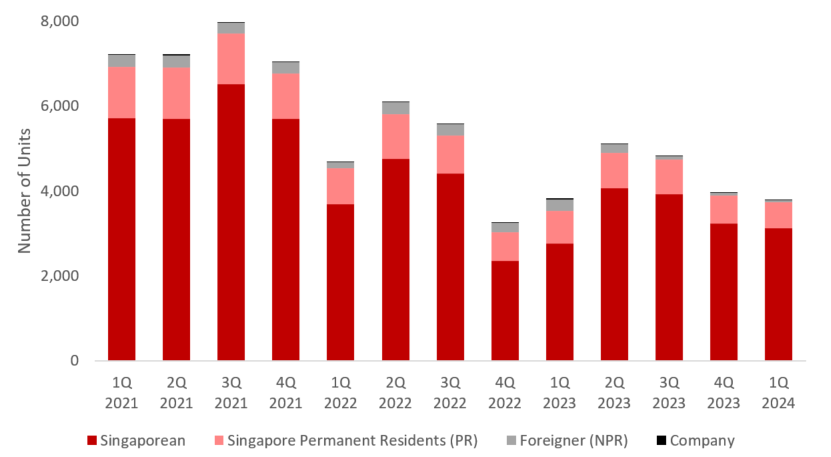

Muted demand from foreign buyers and companies

Singaporean buyers still account for 82.5% of transactions, with this proportion above 80% since the ABSD hike.

Conversely, the proportion of foreign buyers and companies purchasing non-landed residential properties has dwindled since 2Q 2023 after April 2023’s hike in ABSD rates.

Foreign buyers number continued to dwindle to just 43 transactions (1.1%) in 1Q 2024. Prior to the ABSD hike, foreign buyers accounted for 6.9% of transactions in 1Q 2023. The punitive ABSD rate for foreigners will continue to cool demand from foreign buyers.

Chart 3: Buyer’ profile for all non-landed residential transactions

Source: URA, ERA Research & Market Intelligence

Government Land Sale

Supply of new homes in the market will help stabilise prices in the mid-to-long term. URA has released more units via Government Land Sales (GLS). Private housing supply in 2023 was the highest in a decade, with 9,250 units. Another 5,450 units are in the GLS pipeline for 1H 2024 in the confirmed list, the highest since 2H 2013.

Recent GLS exercises showed signs of moderating land prices, which could have been attributed to the harmonisation rule. Other factors such as a more fragmented supply chain, sustainability considerations, and higher-for-longer interest rates have driven construction cost higher, and that will likely to keep new home prices elevated in the long term.

Outlook

Amid the economic headwinds, geopolitical instability, rising retrenchment exercises and higher-for-longer interest rates, some prospective homebuyers may hold back on home purchases. Furthermore, there have been emerging concerns around the persistently high inflation rate in US which could impact the Federal Reserve’s decision to cut interest rates this year.

Furthermore, on the back of rising number of unsold inventory, some developers may consider pushing out some upcoming new home launches until more favourable market conditions are in sight.

Barring any unforeseen circumstances, ERA estimates that the new home sale volume to between 7,000 and 8,000 units in 2024, while resale and sub-sale transaction could reach between 13,000 and 14,000. Private home prices are expected to rise by a more muted 3% to 5% range by the end of the year.