Why do we need another home report?

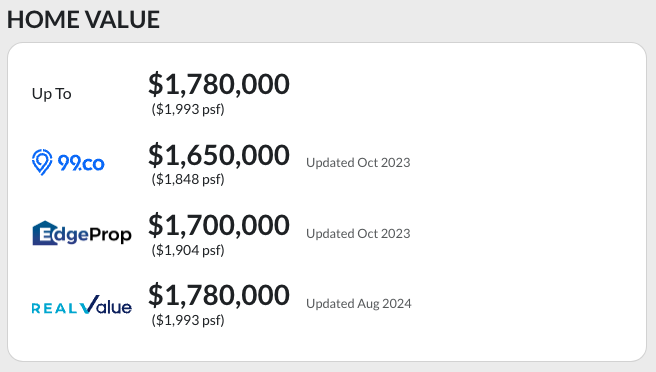

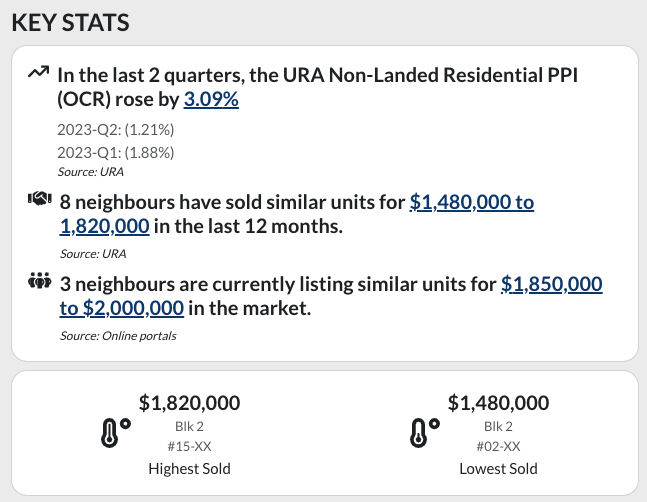

Conventional home reports make use of past transactions as the only basis to value your home. This method is backward-looking and potentially prices your home inaccurately in a moving market. We needed a better home report so we created our own. JP Home Report combines indicative valuations, key market statistics, and current listings. It allows our clients to better price their homes.

Sample Reports (Condo)

J Gateway 3 Bedroom

Click for full report

The Brownstone 3 Bedroom

Click for full report

Soleil @ Sinaran 2 Bedroom

Click for full report

Sample Reports (HDB)

Pinnacle @ Duxton 5-Room

Click for full report

Compassvale Mast 4-Room

Click for full report

Park Central @ AMK 4-Room

Click for full report