Private residential rental trended downwards as demand eased

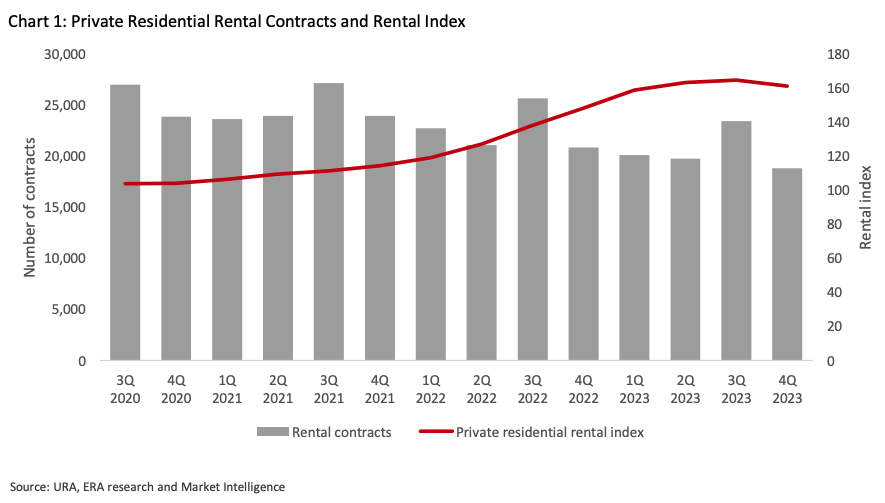

In 4Q, the rental index of residential properties decreased 2.1% quarter-on-quarter (q-o-q) to 161.0. This is a significant drop compared to 3Q especially since the rental index had initially increased by 0.8% from 2Q to 3Q. However, there was still a positive 8.7% increase year-on-year (y-o-y) from 4Q 2022 to 4Q 2023.

Landed property rentals decreased by 4.1% q-o-q, while non-landed property rentals decreased by 1.8% q-o-q.

According to URA, total rental contracts (landed and non-landed excluding EC) island-wide fell by 9.9% y-o-y to 18,777 contracts. A total of 82,005 rental contracts were lodged between Jan-Dec 2023, compared to 90,291 rental contracts in 2022, marking a 9.2% fall in 2023.

Rental demand is typically lower in 4Q ahead of the festivity and economic uncertainty towards the end of the year may also delay tenants’ decisions to renew or look for a new unit.

Non-landed property rental index in the Core Central Region (CCR), Outside Central Region (OCR) and Rest of Central Region (RCR) all saw declines in 4Q 2023. CCR and RCR rentals dipped by 1.6% and 1.2% q-o-q respectively while OCR saw a more significant contraction of 2.8%. Rentals in RCR and OCR saw their first q-o-q decline since 2Q 2020 and could moderate further in 2024.

All regions have seen rents easing since the beginning of 2023. In light of the softer economic outlook, more tenants have been prudent with their rental budgets, choosing to downsize their apartments, or move further outskirt to capitalise on more affordable rents.

HDB Rental Application Trended Downwards in 4Q

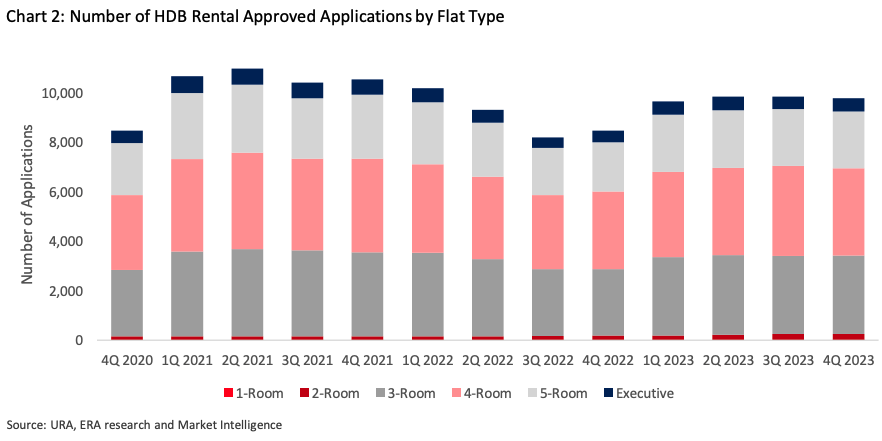

HDB rental approved applications saw a decline for the first time since the start of 2023, falling 0.7% q -o-q to 9,787 applications in 4Q 2023. Despite the quarterly dip, the y-o-y comparison painted a more optimistic picture, showcasing a substantial 15.5% y-o-y increase in HDB rentals compared to 4Q 2022.

The overall annual figures revealed a positive trajectory in the demand for HDB rental with a total of 39,138 rental approvals lodged in 2023, an 8.2% increase from the 36,166 rental approvals lodged in 2022.

Temporary Relaxation of Rental Cap

The recent announcement by HDB and URA in the 4th quarter of 2023 regarding the temporary relaxation of the occupancy cap allows for eight unrelated persons to rent a property, up from the previous cap of six. The move aims to alleviate rising rental demand and support households intending to rent larger residential units. This is as long as the conditions are met for the unit to be 90 square meters and above for private residential properties or 4-room or larger for HDB flats and equivalent HDB commercial properties.

Tenants will be able to share rent among a larger group of tenants, potentially reducing rental costs. Larger families (e.g. multi-generation families) that may not have been able to rent the same unit previously, are now able to do so.

Landlords, who rent out individual rooms, stand to benefit from increased rental income by optimizing tenant occupancy. It cushions them against a softer rental market and higher property taxes in 2024. This adjustment may lead to a shift in rental dynamics in favour of tenants in the coming year. Increased housing supply, coupled with the relaxation of the occupancy cap, is expected to alleviate rental prices. Tenants are likely to enjoy greater negotiating power enabling them to secure more favourable lease terms. The rapid run up in rents in 2021 and 2022 has driven tenants to move further to the outskirts of the city to take advantage of the lower prices.

Rental Market to Turn in Favour of Tenants in 2024

ERA predicts a potential easing of private residential rental prices by up to 5% in 2024, with the number of rental contracts ranging between 75,000 and 80,000. Some 20,000 private residential units (excluding EC) were completed in 2023, marking the highest annual supply of completions since 2016. Another 10,000 units are scheduled for completion in 2024. More rental inventory will come onstream with the slew of new home completions.

On the contrary, the HDB market can expect to see higher rental growth driven by a shortage of rental inventory. HDB rental market will stay fairly resilient, with average rental prices to grow by up to 10% in 2024.