Private home prices

According to URA, the All Residential Price Index expanded 2.8% quarter-on-quarter (q-o-q) in 4Q 2023 to 201.5, registering a faster pace of q-o-q growth compared to 3Q 2023. For the whole of 2023, the All Residential Price Index rose 6.8% on the back of higher new home prices. This was the second year of moderation in price momentum.

Non-landed property prices in OCR reported the fastest pace of growth among the three regions, expanding by 4.5% q-o-q and 13.7% year-on-year (y-o-y) with the launch of J’den and Hilllock Green. J’den achieved a benchmark median price of $2,577 per square foot (psf) in December 2023, while Hillock Green’s median selling price was $2,112 (as of November 2023).

Correspondingly, non-landed home prices at CCR were lifted 3.9% q-o-q with the launch of Watten House which reached a median price of $3,258 psf. In contrast, non-landed new home prices in RCR slipped 0.8% q-o-q on the back of no new home launches.

Landed property prices grew 4.6% q-o-q in 4Q, reversing the 3.6% q-o-q decline in 3Q due to higher landed home prices and a lack of inventory. Landed home owners, who have stronger holding power and face higher costs of replacement homes, are inclined to set higher prices and show little urgency to sell. Demand, on the other hand, has remained fairly resilient.

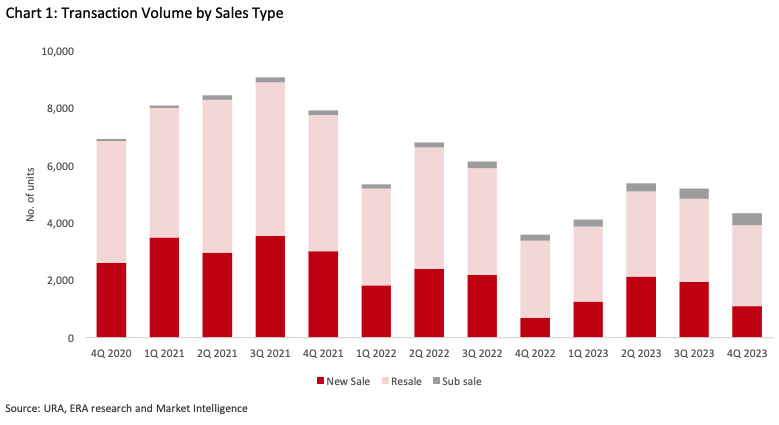

Transaction Volume

New sale volume fell by 43.9% q-o-q, from 1,946 in 3Q to 1,092 in 4Q. Developers only launched 1,060 units (excluding ECs) in 4Q. This was 62.2% lower than in 3Q, leading to fewer new sale transactions.

Resale volume fell by a more marginal 2.4% q-o-q, from 2,900 in 3Q 2023 to 2,831 in 4Q 2023.. Sub-sale transactions increased 15.8% q-o-q to 411, due to more projects attaining Temporary Occupation Permit (TOP) status in the preceding months.

Newly completed homes, given their pristine condition and readiness for immediate occupancy, continue to be popular among buyers These newly completed homes offer a strong value proposition for buyers who seek to take immediate possession of the units. There are a few mega-developments (more than 1,000 units) that attained TOP in 2023, including Parc Clematis (1,468 units), Affinity at Serangoon (1,012 units) and Riverfront Residences (1,451 units).

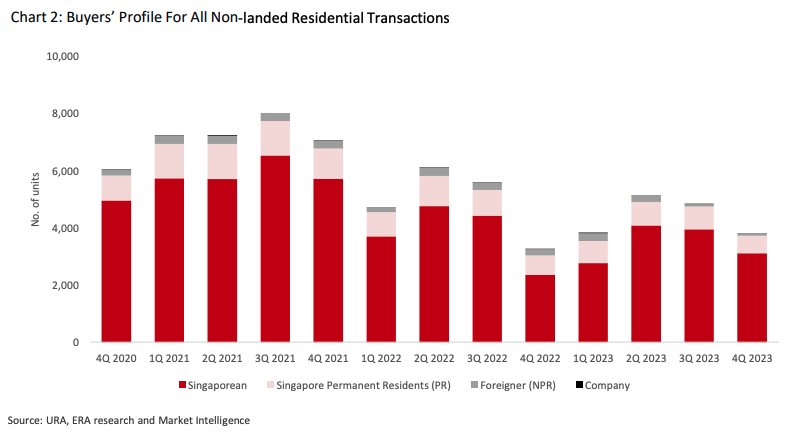

Dwindling interest from foreign buyers and companies

The number of foreign buyers and companies purchasing non-landed residential properties has dwindled since 2Q 2023 after the hike in ABSD introduced in April 2023.

While the April ABSD hike was a curveball for the real estate sector in 2023, the residential sector may have found its footing with the gradual return of local buyers in 4Q and could forge ahead towards a more promising outlook.

Outlook

Buyers can expect more home options with some 32 new home launches and one Executive Condominium launch scheduled for 2024. Beyond this, those with immediate housing needs could look to the resale market with the slew of new home completions.

The upcoming launches will have something for every buyer, from prime locations to the city fringe to suburban locations. Prices of new homes will continue inching upwards as developers endeavour to price at the sweet spot price range while being constrained by rising land, construction and interest costs. Even though home buyers remain fairly cautious and price sensitive amid elevated interest rates, home-buying interest could return with the projected interest rate cut in the second half of 2024.

With another 4,085 private residential units (including ECs) being completed in 4Q, this brings the total home completions in 2023 to 21,284. This was the highest annual completions since 2016. Another 11,793 units are expected to be completed in 2024. This could further regulate the pace of non-landed resale price growth and drive transaction volume. Non-landed resale prices could increase by up to 6% y-o-y in 2024, with total resale and sub-sale transactions ranging between 12,000 and 13,000 units in 2024.