HDB Resale Price Index

HDB resale prices experienced a modest uptick of 1.1% q-o-q in 4Q, bringing 2023’s full year growth to 4.9%. This is the second year of price growth moderation following 12.7% and 10.4% y-o-y growth in 2021 and 2022 respectively.

Nevertheless, 1.1% q-o-q growth in 4Q remained below the average quarterly increase of 2.5% observed in 2022 and around 3.1% in 2021, indicating a moderation in HDB resale prices since the implementation of cooling measures in September 2022 and April 2023.

HDB Resale Transaction

A total of 6,547 HDB resale transactions were recorded in 4Q, marking a 2.2 % q-o-q decline and 0.8% y-o-y decline. For the whole 2023, there were some 26,735 HDB resale transactions, 4.2% lower than 27,896 transactions in 2022.

Record number of million-dollar flats transacted in 2023

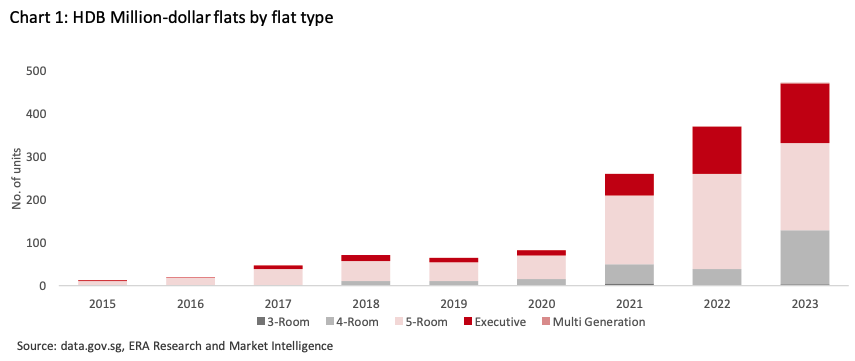

HDB flats surpassing the million-dollar mark are becoming common. There were 470 HDB million-dollar flat transactions in 2023, an increase of 27.4% compared to 369 in 2022.

Majority of these HDB million-dollar flat transactions are within mature estates such as Bukit Merah (62 units), Toa Payoh (57 units) and Kallang/Whampoa (54 units). Likewise, non-mature estates have seen more HDB million-dollar flat transactions. Most notably, Woodlands saw 14 HDB million-dollar flat transactions in 2023. Many of these HDB million-dollar flats possess similar qualities that buyers value, such as a longer remaining lease, larger floor area and are located near transport nodes or amenities.

The highest price of HDB flat sold in Q4 2023 was three 5-room flats in Bukit Merah. All three flats were located at Henderson Road and were sold at $1.45 million each.

The HDB resale market set to see muted price growth despite demand holding firm

HDB resale markets could see moderate price growth in 2024. This is in anticipation of a moderate supply of resale units being offered for sale with the diminishing supply of MOP units. Additionally, the elevated interest rate situation and higher cost of replacement homes may have delayed some HDB owners’ upgrading plans.

Even as HDB ramps up BTO supply in 2024, it has been proven difficult for second-timer families to secure new flats, and with that we expect these buyers to turn to the resale market.

Hence, demand for HDB flats is expected to hold firm, particularly for HDB flats located in proximity to amenities and transport nodes. Existing resale flats, which are not affected by the more stringent resale conditions set for the upcoming Prime and Plus flats, will also be popular among buyers.

Supported by firm resale demand, ERA projects the total resale transaction volume to reach between 26,000 and 27,000 units by end-2024, with resale prices rising by a more muted 3% to 5% range by end-2024.